Financial markets experienced bouts of volatility in January as investors grappled with looming rate hikes, a backup in bond yields and escalating geopolitical tensions between Russia and Ukraine. Most equity markets experienced negative returns during the month. The tech-heavy Nasdaq led global losses, declining -9.0% over the month. In domestic markets, steep drops in Healthcare and Technology stocks weighed on the ASX200, which contracted 6.4%.

Emerging Markets were more resilient than Developed Markets, with the MSCI EM Index declining a modest 1.1% relative to the MSCI World Index, which fell 4.9%. UK Equities were one of the only markets to end the month higher, with the FTSE100 rising 1.1%.

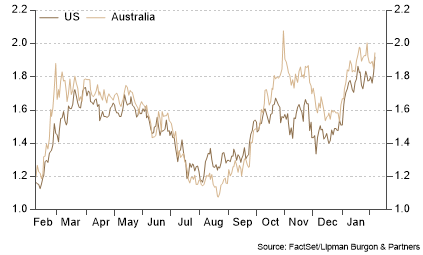

A major re-pricing of sovereign bond markets following the Fed’s hawkish pivot saw Government bonds sell off sharply, and consequently, bond yields increased significantly. The US 10-Year Treasury Bond yield rose 27bps to 1.78%. The Australian 10-Year Government Bond yield similarly climbed 22bps to 1.89%.

Commodity markets were mostly higher over January. Shifting sentiment towards China amid growing expectations of further fiscal stimulus provided a positive backdrop for Iron Ore, which gained 16.6% over the month to US$131/t. Continuing demand and supply imbalances and concerns around the growing tension between Russia and Ukraine maintained elevated oil prices, with Brent Crude gaining 19.6% to US$92/bbl.

The global risk-off move resulted in a flight of capital to the ‘safe-haven’ US dollar, which strengthened over the month. This resulted in the Australian Dollar’s relative depreciation of 3.1%, buying 70 US cents.

A correction or the start of a bear market?

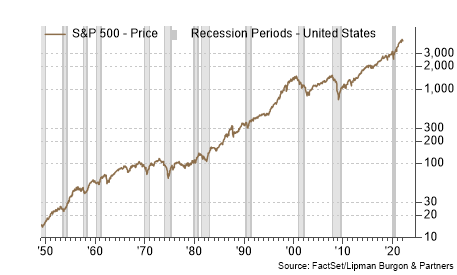

In January, a sudden reversal in market momentum saw most global equity indices decline. Our mid-January Market Insights note noted that there were several explanations for the recent market moves. Those include the expectations that the US Federal Reserve may accelerate its rate tightening cycle, the escalation of the conflict between Russia and Ukraine, and a shift in some short-term technical signals that added to selling pressures. Despite negative market commentary from a range of market pundits, including speculation that equities markets could decline by up to 50% from current levels, we believe the recent sell-off is a long-overdue correction following a sustained increase rather than the start of the bear market.

While corrections can occur outside of recessionary periods, equity bear markets tend to coincide with recessions.

For stocks to decline over the long term, corporate earnings need to fall which is very rare in the absence of a major economic downturn. We expect that strong household balance sheets, re-emergence of corporate CAPEX and productivity, as well as private sector demand, should keep the economy growing well above trend over the next 12 months. Therefore, an imminent growth slowdown is unlikely. In terms of corporate earnings, we are currently only several weeks into the earnings season, so it might be too premature to comment. However, according to Bloomberg, 79% of the companies that have reported so far have beat analyst expectations. Apart from several technology companies, earnings declines have been driven by higher operating costs and pandemic-related disruptions rather than lower sales. While earnings might be normalising and valuations remain elevated, predominantly in the US, it is important to note that the business cycle rather than valuations are likely to have a more pronounced impact on stocks over the medium-term horizon. As such, we believe this cycle has some time to run yet.

Debt – the growing risk?

Several macroeconomic factors often predetermine recessions. One of those is debt. While household debt levels remained anchored in most developed economies, they have risen across emerging markets. Corporate debt generally increased globally, mainly to finance the booming buyback and M&A cycle. Public debt has also reached new heights globally, as governments provided unprecedented fiscal support measures during the Covid pandemic.

For many economists and investors, China’s debt burden is especially worrying. This is not surprising, given China’s significant influence on the global economy. According to BCA Research, total private and public debt was 285% of GDP in 2021, nearly double what it was in 2008. China is currently facing a difficult trade-off as any effort to reduce debt is likely to cause nominal GDP to decline. If GDP decline is significant, this will result in the debt-to-GDP ratio increasing, making the situation worse. Presently, the only feasible option seems to be allowing the economy to run hot by maintaining highly accommodative monetary policies.

This could prove to be a favourable outcome for global investors in the near term. However, it may lead to economic stagflation in the future, which would pose a significant risk to global equities and other risk assets.

Portfolio positioning

Despite broad-based market sell off in January, we expect financial markets to moderate. Global growth is slowing, but it is likely to remain above trend, which is supportive of growth assets. While bond yields are rising, we expect the pace of increase to be moderate and thus not constraining for the economy. Given the above, we believe investors should stay overweight stocks relative to bonds over a 12-month horizon.

While global equities markets look more attractively valued today than a year ago, equity valuations are elevated. However, not all stocks are expensive. According to BCA Research, non-US stocks trade at 14.1 times forward earnings compared to US markets trading on a 20.8x multiple. This differential underpins our preference for non-US equities.

In terms of equity styles, both small caps and value stocks trade at a substantial discount to large caps and growth stocks.

We continue to advocate for allocations to property, infrastructure, Gold, and other commodities to maintain inflation hedging and portfolio diversification. We also prefer various alternative investments as well as private market opportunities for downside protection and diversification of return streams in the portfolios.

In times of share market volatility, it is important to have a robust investment framework and focus on the long-term objectives while preserving some cash to be invested in opportunities that may present themselves after market dissolutions.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.