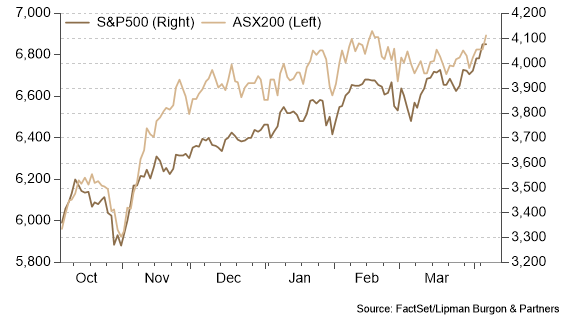

Equity markets strengthened in March, supported by central bank commentary that calmed concerns over rising bond yields. Geographically, almost all equity indices posted positive returns, with Chinese equities being the exception. The US and UK, driven by their leading vaccine rollout were strong gainers, with the S&P 500 and FTSE 100 rising 4.4% and 4.2% respectively. In Australia, the ASX 200 was 2.4% higher driven by strengthening domestic conditions.

In fixed income markets, the US 10-year Treasury bond yield rose a further 28 bps to 1.74%, following a sharp increase in February. Australian government bond yields fell 10 bps in March to 1.79% having over shot in Feb. The A$ declined 1.6% in March driven by the weakness in Australian bond yields relative to the US. The A$ decline marks a noticeable pause in the recent A$ strength. Commodity markets were mostly softer in March with Crude Oil, Copper and Gold all falling ~3%, although for Oil and Copper the softness follows a very strong period since the COVID depths.

Central banks calm markets….again

March began with fear of how high interest rates could rise in the near term after a tumultuous February in fixed income markets saw a big jump in 10yr bond yields in Australia and the US (79bps and 37bps respectively). The RBA responded with action, doubling the size of its daily QE bond purchases on Monday 1st March to $4bn. This was followed by comments from Governor Philip Lowe at the meeting on 2 March that the Board does not expect the conditions to raise rates to be met until 2024 at the earliest, leading to some reversal of the higher rates that had been priced in. The US Federal Reserve didn’t change it’s script with Jerome Powell saying on March 4 “We’re still a long way from our goals of maximum employment and inflation averaging 2% over time”. The reassuring statements (and action from the RBA) removed the fears about tighter financial conditions and allowed equity markets to continue the journey to new record highs.

Positive surprise on economic data

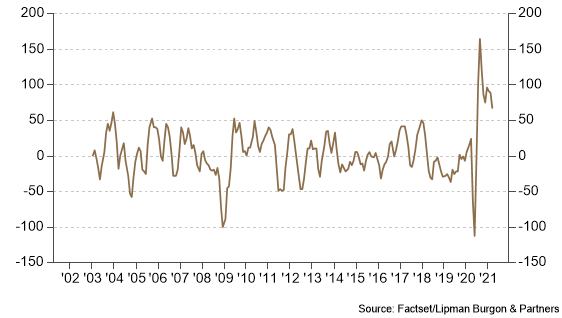

Positive surprise from economic data (relative to expectations) has been a big factor supporting the recent strength in equity markets. The Citigroup Economic Surprise Index measures this, which shows that EVERY month since July 2020 economic data in Developed Markets has broken the pre-COVID record for positive surprise (Chart 4). Macro-economic forecasts as a result have continually been upgraded. Stronger than expected economic activity has led to the US having three very strong quarterly company reporting seasons in a row (measured by earnings beating expectation). The February reporting season in Australia was the strongest relative to expectation in over 20 years.

Outlook

The medium term outlook for equities remains positive, primarily driven by the prospect of economic re-opening and sustained accommodative fiscal and monetary policy. The excess earnings yield of stocks over bonds in the US currently stands at 2.8%, still substantially higher than pre-GFC levels of ~2% (i.e. equities are cheap compared to bonds). Additional optimism towards the economic growth outlook could compress that spread further towards pre-GFC levels, driving equities higher. As a result of these factors and other variables:

- We are positively disposed to cyclical and value stocks.

- We feel that portfolios need protection from the threat of long term inflation, which can be gained through holdings in equities, property, infrastructure and gold.

- We continue to see government bonds as un-investable and prefer various alternative investments that add diversification to portfolios whilst also helping to achieve income and growth targets.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.