Global equity markets were mixed over July. Developed markets were higher, with the MSCI World Index rising 1.7%. However, scrutiny from Chinese regulators weighed on market sentiment toward emerging market equities, resulting in a 5% decline in the MSCI Emerging Markets Index. In the US, strong earnings results saw the S&P500 climb 2.4%. In Australia, gains in materials and resources companies saw the ASX200 post a modest 1.1% gain (Chart 1). Encouraging signals regarding eurozone growth have driven European equities higher, with the MSCI Europe gaining 1.5%.

Yield curves continue to flatten, with the US 10-year Treasury yield falling 22bps to 1.23% and the Australian 10-year Government bond yield similarly falling 35bps to 1.18%. The Australian dollar was weaker, driven by market expectations that the Fed will begin dialling back bond purchases early next year. The AUD currently buys US 74c, 2.1% lower over the month.

Commodities were mostly higher with copper jumping 3.9% to $9,747/t and nickel rising 7.8% to $19,892/t. The gold price was moderately higher off the back of higher-than-expected inflation figures in the US, rising 3.6% to $1,826/oz. Iron ore slumped, however, falling 1.2% to $212/t, buckling from China’s move to slow steel output.

De-mystifying the bond market

Yield curves have flattened considerably in major economies. Since reaching highs of 1.70% and 1.80% in February, US and Australian 10-year yields have fallen to 1.23% and 1.18%, respectively.

Slowing growth, expectations of Fed tapering, and a variety of technical factors have been discussed as the factors supporting bond prices (and hence compressing yields). At the same time, inflation expectations have picked up. Real yields, measured by the US 10-Year TIPS yield, have dropped to record lows, currently at -1.16%.

These factors suggest that investors are concerned about the growth outlook particularly given the uncertainties created by the Delta variant of COVID-19. However, our base case view is that the continued vaccine rollout and economic reopening will drive growth and put upward pressure on both real and nominal yields.

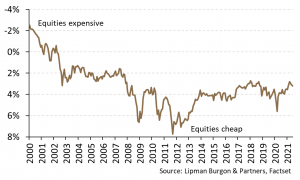

A record US earnings season

To date, approximately 59% of S&P500 constituents have reported their Q2 earnings results. According to FactSet consensus, 88% of companies have reported a positive EPS surprise and the blended growth rate for the S&P500 is 85.1% which, if sustained, will be the highest earnings growth rate reported since 2009. As a result of earnings uplift, valuation multiples are beginning to contract, and the excess earnings yield of stocks over bonds in the US has increased to 3.5%, substantially higher than pre-GFC levels.

Outlook

Despite rising concerns surrounding the Delta variant of COVID-19, we remain positive on equities in the medium-term. This is primarily driven by the prospect of global economic reopening and sustained accommodative fiscal and monetary policy. Equities remain attractively priced compared to bonds. Our base case is that accelerating economic growth drives strong medium-term earnings uplift, pushing equities higher. As a result of these and other factors:

- We are positively disposed to cyclical and value stocks.

- We believe that portfolios require protection from the threat of long-term inflation, which can be achieved through holding equities, property, infrastructure and gold.

- We continue to see high-grade bonds as largely uninvestable and prefer various alternative investments that add diversification to portfolios whilst also supporting income and growth targets.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.