Gold price upside

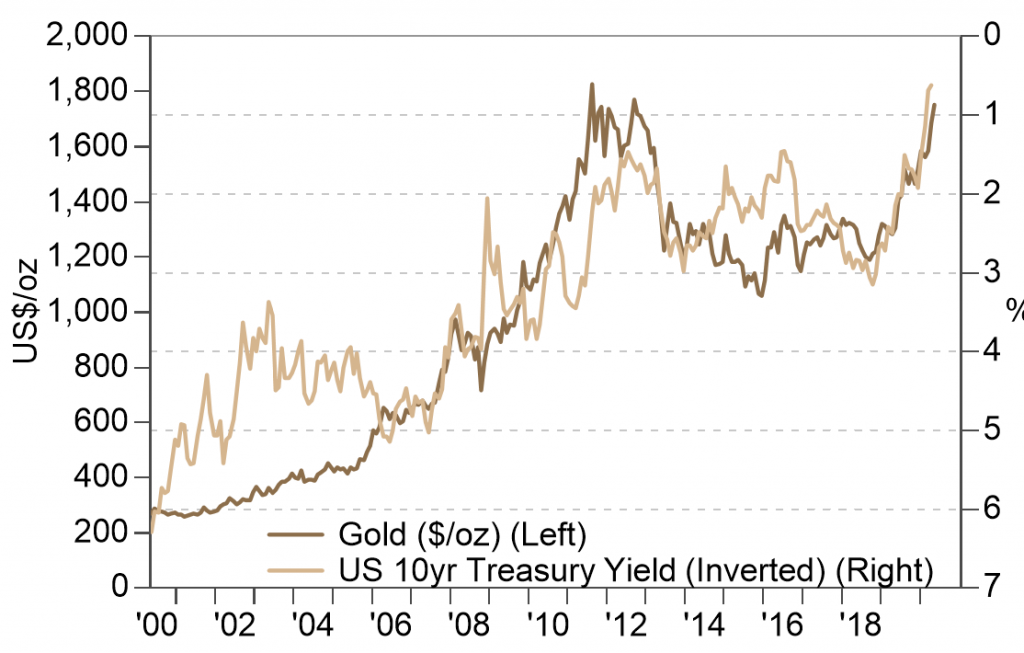

Gold has performed well recently, up 15.4% this calendar year. Gold tends to benefit from economic stimulus because it is widely viewed as a hedge against inflation and currency debasement. It is also widely viewed as a hedge to serious economic, financial, and geopolitical risks in the global economy. The post GFC quantitative easing programs helped drive long term interest rates lower and gold higher, leading to a gold price of over $1,800 in late 2011 – an all-time high.

Currently, policymakers are moving towards a whatever it takes mentality to reviving inflation. As such, real interest rates should remain low (or negative) as quantitative easing continues to depress bond yields and inflation starts to move higher. That environment would be very supportive for gold prices, and as such, we believe there may be further upside.

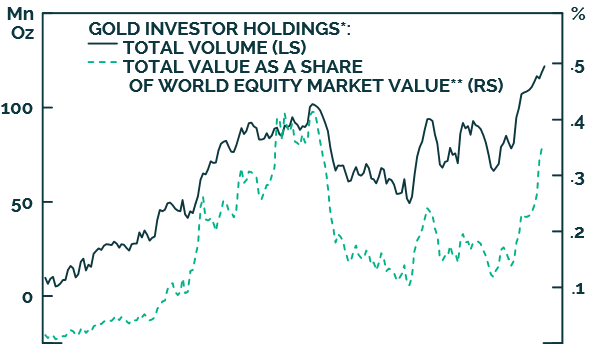

BCA Research, our key partner for macro-economic analysis, last week raised their view on gold to “a strategic holding”. On top of the above rationale for owning gold, BCA note that in the long term, gold prices could also benefit from stimulative policies to boost EM income growth and the reversal in globalisation and demographic trends that will become inflationary rather than deflationary. BCA note that investors have already increased their gold holdings, although as a proportion of equity market value, investor holdings in gold remain below the previous peak.

Recent investor purchases have driven gold to a level that may be over bought in the short term, and as such, BCA state they would look to build a long term position on weakness rather than conducting large amounts of buying at today’s prices.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.