Dealing with a difficult market

Our strategic recommendations to deal with a difficult market:

- Do not panic sell. Focus on the long term prospects of your equity investments and their recovery post COVID-19. Utilise your cash reserves to fund your living expenditure and avoid selling into the weakness. Be comforted that markets almost always rebound after significant bouts of volatility.

- Be prepared that markets may fall further. Market bottoms often occur when we reach the point of maximum fear. COVID-19 is likely to lead to an almost total shutdown of the world economy in the short term and many thousands of fatalities. There is unprecedented support from central banks and governments to support the economy. Anti-viral medications and trials for a vaccine will be expedited. Markets will rebound before the economy.

- Spread out buying in tranches. The most attractive buying opportunities become available during times of pessimism. Make investments with a long term view and never leave yourself short of liquidity. Sensible buying into weakness over time is the best way to drive long term value. Timing the bottom is all but impossible.

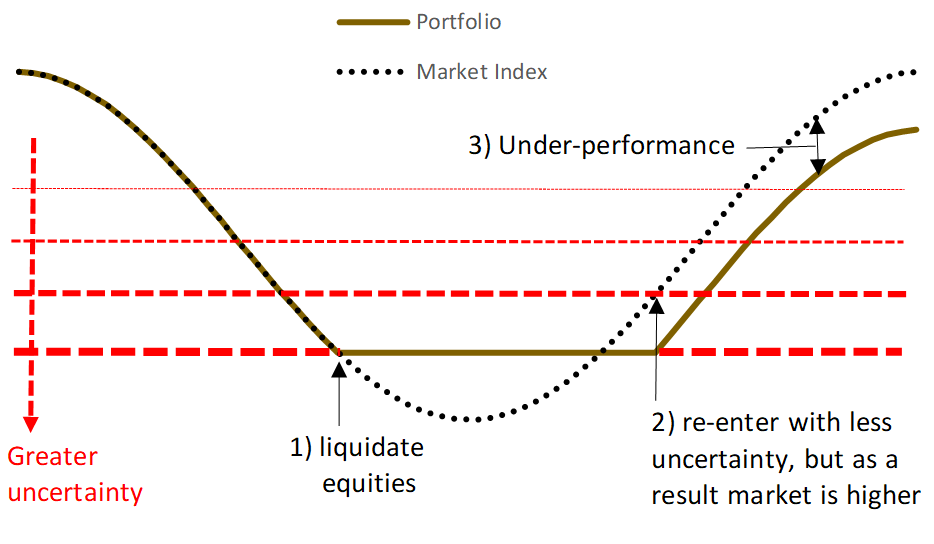

Panic selling locks in losses

It is natural to fear the current uncertainty and want to reduce your portfolio exposure. The ASX200 is now down almost 40%. History suggests that the better strategy is buying into weakness of this magnitude. Buying in the GFC when markets were down this much lost money in the short term, but made money within twelve months, and made significant money on a medium and long term basis. Chart 3 highlights why panic selling into weak markets is likely to result in under-performance. Markets are already pricing the current economic uncertainty, and all else being equal, as uncertainty subsides the market will be higher. Buying back in at that higher point (point 2 on chart 3) results in locking in under-performance.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.