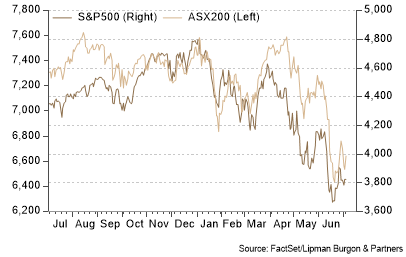

The sell-off in equities markets continued in June, as persistently high inflation and ongoing uncertainty around the economic outlook eroded consumer and investor confidence. Most global equity indices posted negative returns during the month, with the MSCI World Index declining 7.7%. In the US, the S&P 500 retracted 8.3%, closing the first half of the year 20% lower and concluding the worst first-half return since 1970. Australian equities posted similar declines, with the ASX 200 falling 8.8%.

Emerging markets outperformed developed markets, as sentiment towards China improved after quarantine requirements were removed for international travellers. The MSCI Emerging Markets Index fell 4.5% over the month.

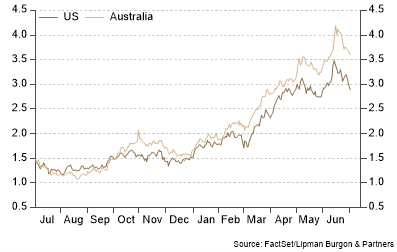

Bond yields have continued to trend higher. However, they have retraced somewhat from their intra-month peak due to a pessimistic outlook for growth which has led to a flattening yield curve. The US 10-Year Treasury Bond yield rose 13bps over June to 2.98%, while the Australian 10-Year Government bond yield rose an outsized 32bps to 3.66%.

Commodity markets were also broadly lower in June, driven by recession worries. The price of Brent Crude slumped 8.5% to $114/bbl. Ongoing weakness in China’s property market weighed on the price of Iron Ore, which fell 2.6% over the month to $130/t. In currency markets, the ‘safe-haven’ US dollar strengthened against major crosses. The Australian Dollar, on the other hand, was broadly lower, declining 4.1% to 69 US cents.

Is the global economy heading for a recession?

The second quarter of 2022 was characterised by increased and persistent volatility across rates, commodities, equities, and credit. The recession narrative replaced the inflation one as the central story driving markets. The increased focus on the likelihood of a recession is influenced by recent economic releases. Consumer confidence collapsed around the globe as high inflation and uncertainty weighed heavily on households’ attitudes. Expectedly, the shock to confidence is most significant among European nations, given the economic impacts of Russia’s invasion of Ukraine. Returning home, confidence in Australia has also plummeted. Still, unlike in other countries, consumers have managed to reduce the impact of surging inflation on purchasing power by drawing down on their savings.

Not surprisingly, most investors are focused on US data, given its influential role in global markets. The economic activity there is likely to drift lower as demand is hit by fiscal drag, a high USD, rising mortgage rates and lower consumer confidence. Nonetheless, demand is not expected to collapse at least in the second half of this year. In fact, there appears to be strong pent-up demand for vehicles, houses and consumer products that have been in short supply throughout the pandemic. Spending should also be buoyed by demand for travel, leisure, and entertainment. Furthermore, US household balance sheets are in reasonably good shape. It is estimated that households are sitting on $2.2 trillion in excess savings and the ratio of household debt-to-disposable income in the US is down by a third since its peak in 2008.

While the unemployment rate remains historically low, the slowing economic momentum will likely reduce labour demand in the months ahead. This coupled with transitory inflationary forces waning, such as high energy prices, the semiconductor shortage and government aid, would likely see inflation starting to roll over in the second half of the year. While the Fed would prefer inflation to come down quickly, it is aware of the significant tightening being applied to the economy. Because of the economic risks and the long-term forces that should reduce inflation in the years ahead, we expect the Fed’s rhetoric to turn less hawkish in the months ahead. Overall, given the mix of the above data and expectations, the US economy may still avoid a recession; and if a recession does occur, it is likely to be mild.

Elsewhere, the Eurozone remains resilient, but the deterioration in both consumer and business confidence, on the back of a crisis in Ukraine, may be enough to see Europe experience a recession later this year. The outcome is very much dependent on energy price pressures and whether the European Union can transition away from Russian fossil fuels. Should energy prices stabilise, price pressures may peak mid-year, while confidence could improve and activity remain resilient.

Another economy that is crucial to consider is China. The economy continues to suffer from the renewed Covid lockdowns, a shift of global demand away from manufacturing towards services, and dislocations in the property market. While economic activity remains robust and, in fact, improved in June (Chart 3), the sustainability of the Chinese economy would depend on the implementation of a pandemic strategy, policy stimulus to counteract the drop in demand, and increased clarity and predictability around the regulatory cycle. If realised, this should give companies the confidence to expand, and the outlook for the economy should remain favourable.

Overall, recessionary fears have risen worldwide over the first half of the year. The recent report published by BCA Research noted that the odds of a recession in the next 12 months have soared to 40%, up from 20% a month ago. Nonetheless, many global economies remain well-positioned and are likely to avoid a hard landing, provided some conditions are met.

The importance of profit growth in a rising rate environment

Markets have been under pressure since the start of 2022 as elevated inflation, a more hawkish Fed, slower growth, and geopolitical tensions have all weighed on both valuations and investor sentiment. In fact, according to JP Morgan estimates, the S&P 500’s forward price-to-earnings (P/E) ratio has declined to 15.8 from a peak of 20.9 in early 2022 and now sits below its 25-year average.

With the Fed set to continue normalising monetary policy, equity market volatility will likely persist, and valuations are expected to remain under pressure. This leaves corporate profits as the primary driver of returns. Although first quarter 2022 earnings were better than expected, the outlook for profits depends on companies’ ability to defend margins.

Broadly, there are three strategies that companies can implement to offset margin pressure: reduce costs, pass costs onto consumers by increasing prices or focus on automation and efficiency. So far, we have seen a combination of all three measures. Hiring freezes and layoffs are picking up in sectors like technology, whereas costs are likely to be passed on in the industrial, energy, materials, and consumer staples sectors. Across the board, we expect a greater focus on productivity, which could be supported by some degree of investment spending. Many research analysts expect to see margins decline from their 2021 highs, but stabilising in the mid-12% range, provided a more significant economic downturn is avoided.

This year’s sell-off can be explained by rising rates and recessionary fears, while profit growth is yet to start moderating. The next reporting season, therefore, might see additional pressure on equities, should downgrades be significant. Investors should focus on those sectors and industries that can continue growing profits in the slower macroeconomic growth environment while remaining mindful of valuations given elevated inflation and hawkish central banks.

Portfolio positioning

We make no changes to our portfolio positioning views. We believe a cautious approach with a neutral weight to global equities is currently warranted. Nevertheless, it is essential to note that global equities continue to be more attractively valued today than a year ago, with non-US equities preferred on valuation metrics. However, the recent geopolitical tensions and the ongoing war in Ukraine continue to moderate our preference for non-US equities over the near term. The latter is likely to outperform in the second half of the year, and we would look to add exposure once there is more certainty over the outcomes for the European economies, as headwinds from geopolitics, higher bond yields, elevated inflation, and recessionary fears continue to weigh on the market.

For inflation hedging and portfolio diversification, allocations to property, infrastructure, gold, and other commodities should be maintained. Core real assets, such as real estate, infrastructure, timberland and transportation, have historically provided investors with inflation protection and income. We also remain positive on various alternative investments and private market opportunities for downside protection and diversification of return streams in portfolios.

We continue to recommend that clients remain invested yet maintain some cash outside the portfolio, giving them dry powder when a better entry-point into risk assets presents itself. In times of market volatility, it is important to have a robust investment framework and focus on long-term investment objectives.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.