Risk assets were robust over August, with all major equity indices posting positive gains. In developed markets, the MSCI World Index rose 2.7%. This was led by the US market, with the S&P 500 rising 3.0% and the Nasdaq jumping a strong 4.1%. Emerging markets experienced similar increases after a meagre July, with the MSCI Emerging Markets Index climbing 2.3%. In Australia, the falling iron ore price weighed on the resources sector; however, substantial gains in technology stocks helped push the ASX 200 2.5% higher.

In fixed income markets, US 10-Year Treasury yields rose a modest six basis points to 1.30%. In Australia, 10-Year Government bond yields remained steady at 1.16%. The fallout in Afghanistan caused the US Dollar to strengthen as investors flocked to the ‘safe haven’ currency. This saw the Australian Dollar depreciate relative to the greenback, which currently buys US 73c, 0.6% lower than in July.

Commodity markets were lower over the month amid concerns of weakening demand from China. Iron Ore was the most impacted, falling a steep 24.9% to $US159/t. Brent Oil was also down sharply, falling 6.1% to $US73/bbl. Gold was modestly lower, falling 0.6% to $US1,814.90/oz.

Looking through lockdown anxiety

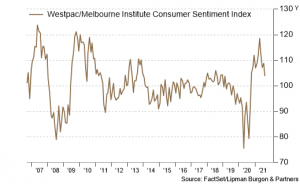

The spread of the coronavirus delta variant continues to roll through Australia and the rest of the world. New South Wales on Saturday recorded 1,533 new covid cases, the highest on record. At the same time, Victoria also registered 190 new cases. The protracted lockdowns designed to stem the escalating case numbers are also featuring in key indicators of economic health. The Westpac/Melbourne Institute Consumer Sentiment Index fell 4.4% to 104.1 in August, the lowest point in over a year, as fears around the economy grew.

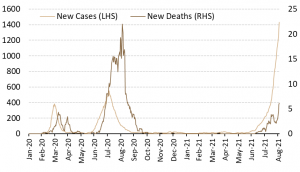

Contrary to what headlines suggest, the underlying picture may be somewhat more optimistic. Although case numbers have risen considerably in Australia, new deaths have not seen the same aggressive growth (Chart 3). The same dynamic can also be seen in many other economies such as the US and UK. This would suggest that the current suite of available vaccines offers substantial protection from the delta strain. Given this and rising vaccination rates in many developed economies, we currently see COVID-19 as only a moderate risk to global markets.

Will the Fed raise rates?

While COVID-19 continues to occupy mainstream media headlines, the number one topic the market is concerned with continues to be inflation, or more specifically, whether central banks will raise policy rates in response to inflation. Recent messages from the Jackson Hole symposium from Fed Chair Jerome Powell indicated that if conditions evolved broadly as anticipated, it could be appropriate to start tapering bond purchases by the end of the year. However, investors were largely unphased by the remarks, with 10-Year Treasury yields even falling four basis points on Friday and since holding relatively steady (Chart 4). The subdued response suggests that investors are already prepared for a tapering announcement by year’s end.

Although we will likely see a tapering announcement at some point this year, it is unlikely we will see the Fed raising its policy rate for a little while still. The New York Fed’s Survey of Market Participants showed that investors do not expect a rate hike in 2022. The risk for markets would be an earlier-than-expected rate hike; however, we feel the Fed is likely to favour a cautious approach.

Earnings solid despite lockdowns

Despite market uncertainty due to the recent lockdowns across Australia, the latest reporting season was fairly strong. According to FNArena’s Corporate Results Monitor, 78.2% of the 345 companies that reported either outperformed or were in-line with consensus expectations. Aggregate profits were up almost 76% year-on-year, albeit from a lower base given the COVID-19-led events weighing more heavily on earnings in 2020.

Capital management activity was also elevated, with many companies in a strong position to return cash to shareholders. Aggregate dividends rose 70% to almost $41bn with 60% of companies increasing their dividend. In addition, special dividends and buybacks were a key feature, with an extra $15bn of capital returned to shareholders through these mechanisms.

The current outlook is constructive. Over the coming months, the state governments will look to begin reopening the economy and winding back restrictions as the vaccination rate ticks over the 70-80% threshold.

Outlook

We remain positive on equities in the medium-term, primarily driven by availability and adoption of vaccines allowing for global economic re-opening, further supported by accommodative fiscal and monetary policy. This will lead to above-trend growth, driving strong medium-term earnings growth pushing equities higher.

However, we feel portfolios need protection from the threat of long-term inflation, which can be gained through holdings in property, infrastructure, and gold.

We see high-quality bonds are largely un-investable and prefer various alternative investments that add diversification to portfolios whilst also helping to achieve income and growth targets.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.