After selling off in January and February, equity markets staged a rebound in March, all the while the US Federal Reserve (Fed) approved a 0.25% rate hike, the first since December 2018. A resurgence in covid cases and lockdowns in China saw emerging market indices underperform developed markets with the MSCI EM Index returning -2.0%, lagging the MSCI World index return of 3.2%. Regionally, European and UK markets underperformed with a lower degree of separation from the still uncertain Ukraine war. The Australian market led global share gains, with the ASX 200 jumping 6.9%. US Equities also performed strongly, with the S&P 500 gaining 3.7%.

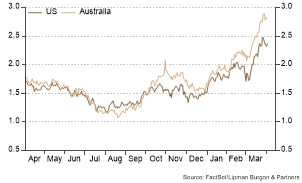

During the month, the Fed approved a 0.25% rate hike, the first since December 2018. Markets have begun pricing in an increasingly aggressive hiking cycle, which has resulted in bond yields significantly increasing and the yield curve flattening considerably, and in some parts, inverting. Australian 10-Year Government Bond yields rose 69 basis points (bps) over the month to 2.83%, while the US 10-Year Treasury yield rose 49 bps to 2.32%.

Similar increases occurred across Europe and the UK. Short-dated yields increased even further, with the Australian 2-Year Government Bond yield jumping 70 bps to 1.80% and the US 2-Year Treasury yield rising 86 bps to 2.29%.

A continuation of the still uncertain backdrop of the Ukraine war saw commodities prices benefit. The price of Iron Ore rose 6.2% over the month and is now back over $150/t. Nickel and Zinc were standout performers, rising 32.3% and 15.0%, respectively. Brent Crude was 4.7% higher at $104/bbl, although substantially down from its intra-month highs of ~$133/bbl. Gold also solidified 1.7% to $1,942/oz.

In currency markets, the Australian dollar strengthened on major crosses, supported by higher commodity prices and attractive interest rate differentials. Relative to the USD, the AUD appreciated 3.5% to 75 US cents.

Spotlight on US Treasuries

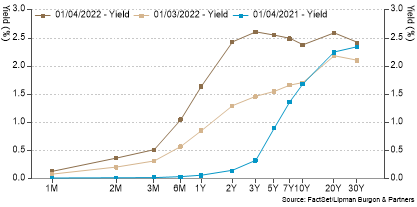

Following the much-expected interest rate hike from the Fed on 16 March 2022, the path towards interest rate normalisation can only be described as ‘turbulent’, with US Treasuries experiencing their worst drawdown in nearly 50 years. Many investors now wonder whether yields are likely to continue their sharp rise and what it would take for central banks to adjust their hawkish stance.

Many investment commentators argue that the escalation in geopolitical risks prevented the Fed from an initial rate hike of 50 bps, however an increase of that magnitude may still be on the table. Given the expectations, the US yield curve continued to flatten in March with the difference between 2-year and 10-year Treasury yields, often described as an indicator of recession risks, inverting and becoming slightly negative before returning into positive territory.

According to Bloomberg data, as of the 29th of March, the market was pricing in 90 bps of hikes in the next two Fed meetings and 206 bps – more than eight 25 bps hikes – in total for 2022. As a result, US 2-year Treasury yields have risen by 161 bps year to date, up 73 bps in March alone. Overall, while there is scope for yields to continue rising, most economists agree that those are likely to occur at a slower pace, especially given the moves that have already occurred.

It seems that inflation remains the main driver of central bank hawkishness. The war in Ukraine is putting upside pressure on inflation expectations, specifically through increases in food and energy prices. The Fed has been cognisant of these risks and noted that the central bank may deviate from the more typical slow and gradual interest rate increases in favour of more aggressive tightening. Other central banks are also becoming increasingly hawkish. The Bank of England (BoE) has raised interest rates to 0.5%, up from 0.25% in February, the Reserve Bank of NZ has recently sharply increased its projected tightening path, while the Bank of Canada has indicated the possibility of a 50 bps hike, if necessary. What, if anything, could cause central banks to change their hawkish stance?

Economists generally agree that significant tightening in financial conditions, decrease in inflation (particularly in the more persistent components, such as wages or housing), or substantial weakening of growth would likely slow down rate increases. At the moment, financial conditions remain easy, and inflation has continued to rise. In terms of growth, historically the Fed has tended to stop raising rates when the forward one-year recession probability reached 30%-40%. Currently, JP Morgan’s assessment of economic data is signalling less than a 10% chance of recession. While central banks are likely to retain their hawkish narrative in the near term, any change to economic data, in particular inflation, could impact that and allow for a pause in tightening.

What is in store for the world economy?

Many economists expected global growth to return to pre-pandemic trend in 2023. However, those expectations are now being challenged. Firstly, events in Ukraine present a downside risk to that view. The direct effect of the war on global economy is likely to be limited with Russia and Ukraine relatively small in terms of their economic output (3.5% of global GDP) and most corporations having only limited exposure to Russia.

It is arguably the indirect impact that is more important, given that both countries are significant producers and exporters of many commodities. Russia produces 12% of global oil, one-third of the world’s palladium, and 40% of potash (used in fertilizers). Meanwhile, Ukraine is a major producer of some auto parts, used by many European car manufacturers. The conflict has put further pressures on already stressed global supply chains, causing a surge in many commodity prices.

As a result of higher commodity prices, OECD estimates that the global economic growth this year could be up to 1% lower.

However, it is worth noting that food and energy prices are now much smaller parts of the consumption basket, and consumers continue to hold large amounts of excess savings, which should help absorb some of the impacts of price increases. Furthermore, increased supply of oil from OPEC members is expected to put downward pressure on the Brent prices by the year end, further reducing near-term stagflation risks for the global economy.

Secondly, a potential slowdown in China is worrying investors. While the Chinese government has been easing fiscal and monetary policy, the effectiveness of the measures is yet to be seen. The pickup in credit growth has so far been limited, and the private sector’s appetite to borrow remains low.

Thirdly, global financial conditions started to tighten given higher long-term rates. While they remain easy relative to previous cycles, further tightening is likely to be indicative of lower future growth.

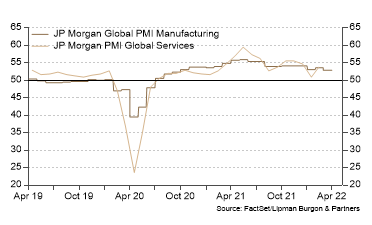

While some of the above risks have already started to impact economic data, with consumer confidence recently collapsing, economic activity indicators such as the manufacturing ISM remain elevated.

Portfolio positioning

The first quarter of 2022 delivered a significant change in monetary policy and shocking developments in geopolitics. Unsurprisingly, asset markets are taking time to recalibrate and volatility is likely to persist for a while. However, despite the high probability of significant monetary tightening, the geopolitical risks, and the ongoing disruption to commodity markets, most global economists do not forecast an imminent recession. While some caution is warranted, there is scope for improving returns over the second part of the year. Keeping the above in mind, we make no changes to current portfolio positioning, retaining our relative preference of equities compared to bonds.

Global equities continue to be more attractively valued today than a year ago, with non-US equities preferred on valuation metrics. However, the recent geopolitical tensions and war in Ukraine continue to moderate our preference for non-US equities over the near term, given the latter continues to be seen as a safe haven investment during risk-off periods.

Allocations to property, infrastructure, Gold, and other commodities should be maintained for inflation hedging and portfolio diversification. We also remain positive on various alternative investments as well as private market opportunities for downside protection and diversification of return streams in portfolios.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.