Not-For-Profit and For-Purpose Organisations

Helping to maximise your organisations social impact.

Lipman Burgon & Partners is focused on providing tailored investment solutions to organisations seeking to advance their purpose and make a positive impact.

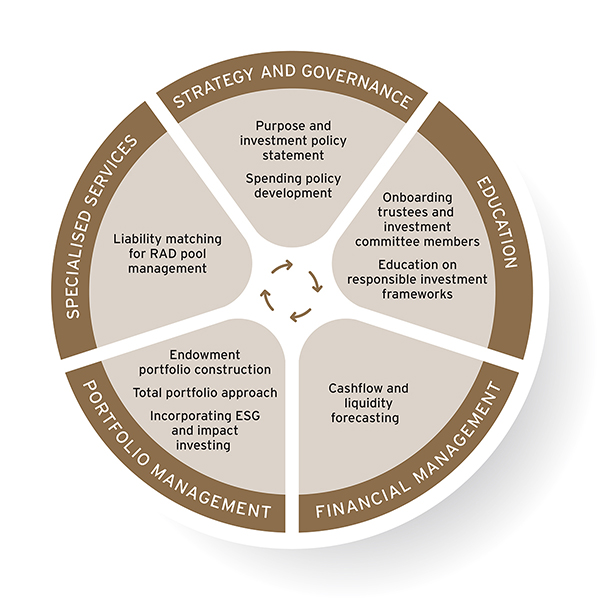

Our dedicated team of experts provide support at every stage of the investment lifecycle. We have a long-standing history of helping clients to develop investment and spending policies, strengthen financial governance and position portfolios to enhance returns and impact.

Who we work with

Medical, Healthcare and Aged-Care Associations

Clubs and Community Groups

Colleges and Universities

Private Ancillary Funds

Our services

Endowment purpose and investment policy statement design

Developing a robust investment policy statement ensures that the right investment and governance framework is in place to support an organisation’s vision and fiduciary requirements.

Read more in our whitepaper:

Good governance, better investment outcomes

Spending policy development and forecasting

The sustainable funding of withdrawals for operational and capital expenditure relies on a tailored spending policy. With expenditure analysis, forecasting and budgeting, an organisation’s short-term needs and long-term goals can be met.

Cash flow and liquidity management

Projecting cash flow and setting liquidity parameters are crucial to ensuring an organisation has the cash reserves to advance its mission. Related to the spending policy, predicting future cash flow can inform portfolio rebalancing and asset allocation.

Endowment portfolio construction

Lipman Burgon & Partners takes a portfolio management approach where each investment decision is evaluated on its risk and reward merits which allows greater flexibility in tactical asset allocation. This Total Portfolio Approach (TPA) can help drive diversification and manage risk, as well as introduce alternative asset classes to deliver better outcomes. In order to optimise the risk/return outcomes our portfolio construction methodology also considers your organisation’s tax status and foreign exchange considerations.

Read more in our whitepapers:

Total Portfolio Approach

Alternatives – A tool for the times

Navigating Environmental Social & Governance factors and responsible investing

As a member of the Responsible Investment Association of Australasia and with our investment team having pioneered responsible investment frameworks during the market’s more nascent stages, we help clients navigate the complex ESG investing landscape and invest to maximise both impact and return.

Read more in our whitepaper:

Navigating the complexities of ESG investing

Preparing key decision-makers

The onboarding of new trustees and investment committee members can be a process of education on the policies, governance and investment approach that has been developed. We advise individuals on their responsibilities to help embed our competencies within the organisation.

Liability matching for RAD pool management

For independent aged care operators, adopting a best practice approach to managing the pool of Refundable Accommodation Deposits (RAD) can help maintain liquidity, match assets with liabilities, and deliver better investment returns for capital invested.

Your specialist team

Heath Ueckermann

Heath has 15 years of experience as a wealth advisor and Chartered Accountant, specialising in advising for-purpose organisations, boards, and investment committees. Heath has a particular focus on the healthcare sector, clubs and community groups, assisting them to effectively manage their investment corpus to further their purpose and meet their portfolio objectives.

Heath has worked with a range of for-purpose organisations and endowments to develop their purpose and investment policy statements, manage cash reserves and liquidity, advise on endowment portfolio design and the integration of ESG investment approaches.

Heath supports existing and incoming investment committee and board members, providing education and advice on investment governance frameworks, financial markets, and portfolio construction.

Paul Burgon

Paul Burgon has supported for-purpose organisations for more than 15 years. He has worked alongside early pioneers of Private Ancillary Funds in Australia and advised many families and boards on the establishment of policies and governance frameworks for the prudent management of investment capital.

Paul is passionate about social impact and in addition to advising boards in a professional capacity, is as a director and responsible manager for a number of Private Ancillary Funds.

In addition to holding a Masters in Applied Finance and the Certified Financial Planner (CFP) designation, Paul has completed the certification to be qualified as a Certified Investment Management Analyst (CIMA). CIMA certification is the peak, international technical portfolio construction certification program designed for investment management analysts who service family offices, endowments, and institutions.

Paul has ranked among Australia’s Top 25 Financial Advisers by US financial investment publication Barron’s for three consecutive years.

Paul Selikman

Paul has extensive experience advising individuals and organisations that are seeking to align their investment management strategies with impact outcomes. Throughout his time at Lipman Burgon & Partners, Paul has regularly assisted clients to construct portfolios that have a focus on ESG principles.

Previously, Paul spent six years working in the investment team of one of Australia’s largest family offices, the Lowy Family Group (LFG). In this role, Paul worked directly with the Lowy Medical Research Institute, a NFP dedicated to preventing vision loss in people with macular telangiectasia type 2 (MacTel).

Paul is a Certified Practising Accountant (CPA), Certified Financial Planner (CFP) and holds both a Bachelor of Business Administration and a Bachelor of Commerce Accounting.

Frequently asked questions

What steps are involved in an ongoing engagement with our firm?

Our engagement with your organisation typically begins with preliminary discussions with your organisation’s CEO, Trustee/s, Director/s or leadership group. These discussions allow us to establish the objectives and cash flows needs of your organisation and the purpose of your investment corpus. Understanding the current governance structures and decision-making processes are also important.

These preliminary discussions enable us to submit a proposal to your leadership group and field questions. If our firm is engaged, we would then, work with your organisation to develop or refine an investment policy statement (IPS). Once the IPS and investment mandate are agreed we will commence the implementation and ongoing management of the portfolio.

We conduct quarterly meetings with the investment committee, Board or Trustees. This meeting will provide an update on investment markets, a performance review and a series of investment recommendations. We may also be called on to assist the finance team with budgeting and forecasting exercises and answer queries from auditors or internal and external stakeholders.

Who do we work with in your organisation?

Ahead of a formal engagement, discussions are typically held with leaders from your organisation. Based on experience, the best results are achieved by forming a small group of three to four decision-makers that form an investment committee. The committee is mandated to review and approve recommendations put forward by Lipman Burgon & Partners and report to the Board or Trustee group on a regular basis. For smaller organisations a dedicated investment committee may not be needed, as the Board or Trustees can approve investment decisions directly.

We also regularly engage with CFOs or the finance team during the annual or semi-annual budgeting and forecasting process. We provide information related to predicted cash flows and matching these to anticipated liabilities.

How will you determine what portfolio is right for us?

Portfolio design is a specialist capability of our firm. Constructing customised portfolios starts with a collaborative process to understand the objectives of your organisation, cash flow and liquidity requirements, risk appetite, and considerations relating to responsible investing. All recommended investments have been researched by our investment team during their due diligence process and formally approved by our investment committee. We have a very strong governance process and our investment committee meet formally on a monthly basis.

What is an investment policy statement?

An investment policy statement (IPS) is a governance document used to provide guidelines for the management of funds held by your organisation.

The policy will:

- Establish reasonable expectations, objectives and guidelines for the management and investment of your assets.

- Encourage effective communication between the Board of Directors/Trustees, Board Finance Audit and Risk Committee (BFARC) and the Investment Committee.

- Create the framework for a diversified asset mix that can be expected to generate acceptable long term returns at a level of risk suitable to your organisation.