A combination of geopolitical turmoil between Russia and Ukraine, and the imminent start to the rate hiking cycle, supported continued market volatility in February. However, expectations that the conflict may not spread more broadly and its implications for the policy normalisation pathway for central banks have largely limited its impact on broader equity markets for now. European markets were most affected, with the German DAX Index falling 6.5% and the Euro STOXX 600 declining 3.2%. More exposed to rising interest rates, US equities were also relative underperformers, with the tech-heavy Nasdaq falling 3.3% and the S&P 500 trailing 3.0%. Australian equities, supported by a relatively robust earnings season, were relative outperformers, with the ASX 200 climbing 2.1% over the month.

Fixed Income markets continue to grapple with the prospect of a hawkish Federal Reserve and speed of policy normalisation. This dynamic has resulted in the US Treasury yield curve flattening as investors express concern for the growth outlook if the Fed is forced to stamp out inflation. Long-dated sovereign yields continued to trend upwards in most markets. However, a risk-off move late in the month pushed prices for sovereign bonds higher, compressing yields somewhat. The Australian 10-Year Government Bond yield rose 25bps over the month to 2.13%, while the US 10-Year Treasury bond yield rose 5bps to 1.84%.

As the invasion of Ukraine induced global risk-off sentiment, there was a flight to safety among investors benefitting perceived ‘safe-haven’ assets over the month. The US dollar strengthened on most major crosses, and the price of Gold rallied 6.4% to US$1,909/oz.

Other commodities were also generally stronger. Expectations that energy supply bottlenecks would continue in the wake of the Russian invasion saw energy markets strengthen. The price of Brent Crude briefly touched over $100/bbl before settling at $97.90/bbl, representing a 6.0% gain. Continued expectations of increased infrastructure spending in China saw the price of Iron Ore gain 8.1% to $142/t.

Spotlight on the Russia-Ukraine Conflict

In less than a week, what was earlier described as “geopolitical tensions between Russia and Ukraine” escalated into an invasion and a war on Ukraine’s soil. President Putin likely assumed Ukraine’s forces would be quick to fall and that he would succeed in potentially installing a pro-Russian government with the rest of the world having to eventually accept the outcome.

At the time of writing, this hasn’t eventuated. Not only have Russian troops been met with strong resistance, but Russia has also faced a number of global sanctions, including the removal of Russian banks from the SWIFT international payments system. With billions of dollars in Russian reserves at risk of being trapped and capital controls in place, limiting money flows, Russian stocks have plunged and have become essentially uninvestable.

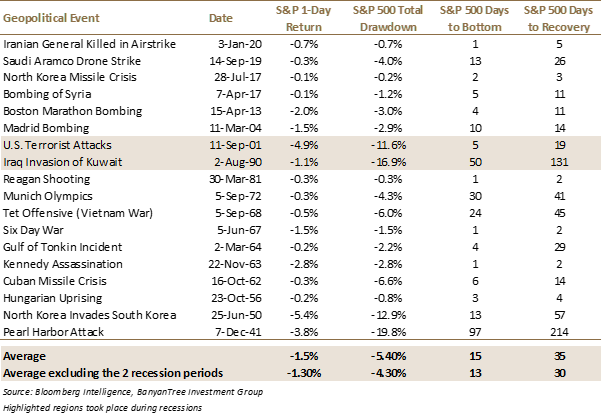

Markets are likely to remain volatile over the coming months as events unfold. However, history shows that most conflicts typically have only limited impacts on asset performance.

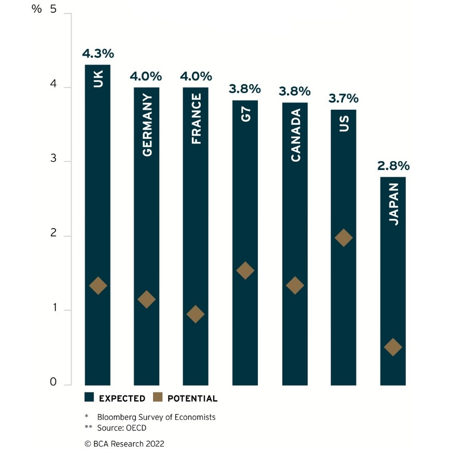

In fact, according to BCA Research, global growth is still likely to remain above trend this year.

The only exception would be if the oil prices remained at above $100 a barrel, as some are forecasting. BCA’s Energy strategists expect that the oil-producing and exporting countries (excluding Russia) would step up to provide additional oil supply, bringing Brent crude back to $85 by the second half of this year. Furthermore, it is important to note that more negative sentiment towards equities that started in January was predominantly prompted by the hawkish Fed and expectations of rapid interest rate hikes. Given the current events, we believe that central banks would prioritise growth and therefore would normalise policy more gradually as they acknowledge the downside risks from higher commodity prices.

According to Bloomberg, market pricing for a 50-basis-point hike from the Fed and the Bank of England (BoE) at their next meeting has fallen to 20%, whereas in previous weeks, it had been as high as 80%. Market pricing for policy rates by the end of the year has also fallen. This is likely to be supportive of risk assets. In the absence of additional economic shocks, our market outlook for 2022 set out in January remains unchanged. While the economic and geopolitical situation is still developing, it is premature to make any long-term forecasts. However, the implications of protracted conflict in Ukraine, a higher number of refugees and any change to the world order will likely cause an increase in global military spending, higher long-term inflation and tightening of business conditions, to name a few.

Global energy prices spike. Is this the first step towards a recession?

Russia controls 13% of global oil production and 17% of global natural gas production. While the US is somewhat insulated, the European Union’s (EU’s) reliance on Russian energy supply is sizeable. Around a quarter of EU crude oil imports and 40% of natural gas imports come from Russia. Sanctions to date have been designed to minimise the impact on energy supply. Nonetheless, energy prices will remain highly sensitive to further developments. Energy prices would likely decline over time if the situation deescalates, but supply imbalances would keep prices at relatively elevated levels. Other possible sources of supply may help restore demand and supply balance in the long run. These include sanctions against Iran being lifted, the release of global reserves, and increased production capacity by other oil-producing countries, including the US. Still, this would take time.

Given the above, the elevated oil prices are likely to persist for some time yet. Would this lead to a recession? Most market commentators believe the likelihood is currently low. The middle- to upper-income consumers have sufficient savings post-Covid lockdowns to support spending increases. At the same time, government subsidies could be brought back to support lower-income earners. In addition, although inflation is high, low unemployment is prompting an increase in wages, with low-wage earners seeing the most substantial gains. Overall, given the likelihood of elevated energy prices, global governments may need to step up fiscal support, including fuel tax cuts or energy subsidies, to offset higher spending on these necessities and protect discretionary spending. This would prevent any imminent recession or, at a minimum, delay it. Over the long term, we are likely to see an acceleration in the transition towards renewables, as higher energy prices and fears of energy security add to existing climate concerns.

Portfolio positioning

Despite a broad-based market sell-off in January and ongoing market volatility seen in February, we don’t believe the medium-term outlook for risk assets has changed.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.