Climbing a wall of worry

Despite weak economic fundamentals and geopolitical risks, rising global equity markets have been strong since bottoming in late March. The ASX200 has risen 27% from its trough and the S&P500 gained 36%.

This rise has been driven by huge central bank liquidity injections, government fiscal stimulus, falling new COVID-19 case numbers in many developed countries, and some medical progress in the development of both treatments and a vaccine. Markets are forward looking, and while many issues of concern remain, most of these are now less feared now than two months ago.

Central bank policy action also shouldn’t be underestimated as a driving force in markets. As world renowned investor and hedge fund manager Stanley Druckenmiller recently said, “Earnings don’t move the overall market; it’s the Federal Reserve Board…. focus on the central banks and focus on the movement of liquidity… most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.”

The big squeeze

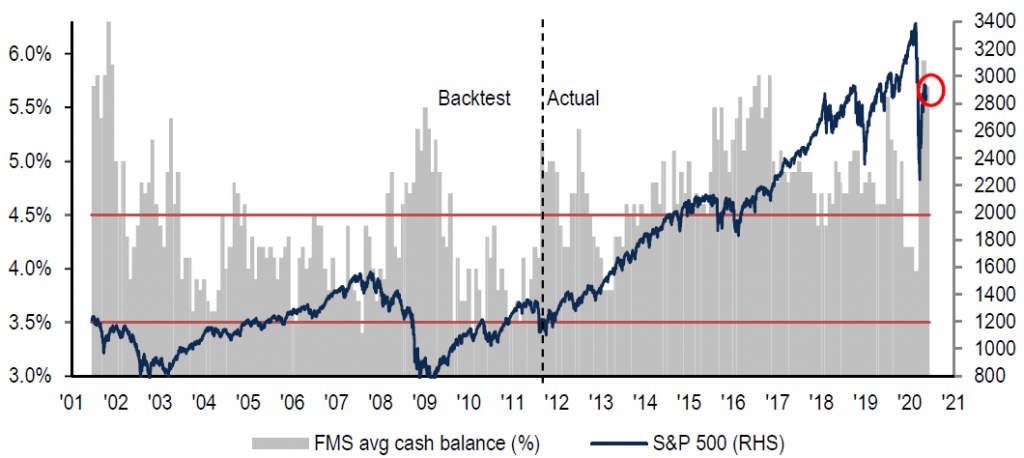

As it became clear in February and March that COVID-19 would have a huge economic impact, most fund managers around the world quickly adopted defensive portfolio positioning. That re-positioning has seen many fund managers under-perform the rally over the last two months. Markets often move in the opposite direction to crowded positioning. When there is a crowded short, or underweight positions in the market, there is little selling left to be done and small amounts of buying can see the market move higher. As this continues, fund managers that are short or underweight can be squeezed into the market, no longer being able to withstand the pain of underperforming a rising market. This phenomenon has been evident in the market in the last two months. The Bank of America Global Fund Manager Survey shows that fund manager positioning is still defensive (cash levels elevated). In the past, cash levels greater than 5%, as they are now, have led to subsequent market rallies. As such the survey suggests this squeeze could continue.

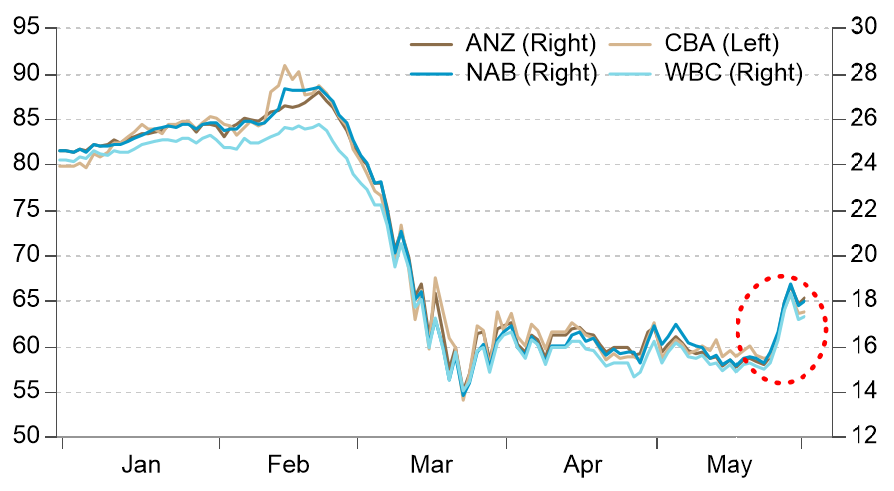

Growth stocks and defensive stocks have significantly outperformed value and cyclical stocks this year and over a longer time horizon. Last week, there was a sharp rotation into cyclical and value stocks which is typical of a late stages rally as the economic outlook improves.

The rotation saw the four Australian major banks rally by 20% in a week. This sort of sharp rotation is also a typical characteristic of a market “squeeze”.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.