One characteristic of the current crisis is the acceleration of many trends that were already underway. This is very important in terms of the investment implications of the crisis. Below we discuss three global themes that have been expedited by COVID-19. For some time investors that have underappreciated the growth potential in new world businesses have claimed that valuations in technology and e-commerce were too high. The last few months in the market have been a strong reminder that it is dangerous to bet against strong and enduring themes.

Digital adoption

Since the onset of COVID-19, the digital economy has seen a huge increase as organisations fast-tracked digital transformation programs and consumers gravitated online. This has come in many forms including e-commerce (online purchasing), payments (collapse in cash usage) and video conferencing to name a few.

As a result, the crisis has accelerated the market share gains of many technology related companies, and has simultaneously boosted valuations – Amazon is up 56% in the year to date versus the S&P500 that is down 2%.

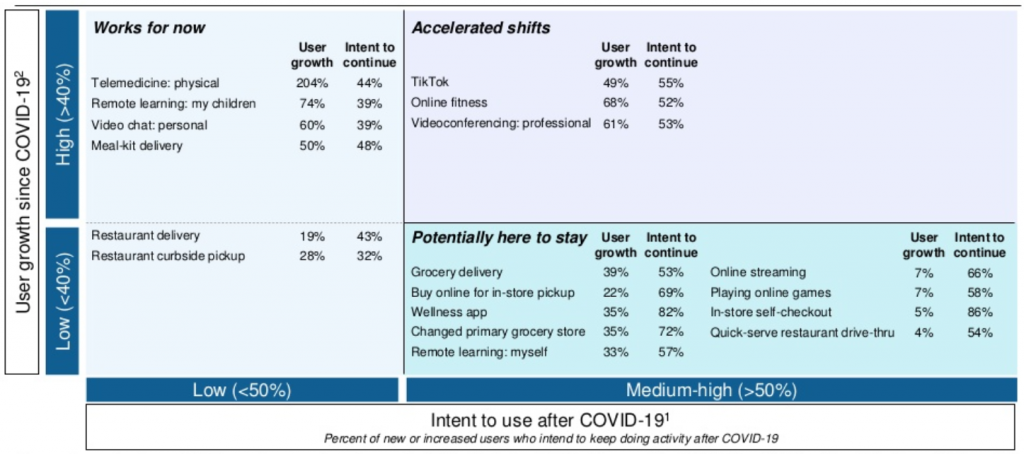

A survey of consumers by McKinsey & Company showed greater than 30% user growth across many digital services including grocery purchasing, remote learning and wellness. Video conferencing has seen >60% user growth. In many cases, more than 50% of new users intend to continue to use these digital services. Chart 4 shows the intent of consumers to continue to make purchases online after COVID-19 has subsided. Acceleration of digital adoption has not only benefitted online retailers like Amazon, but many other e-commerce related businesses from Alphabet and Apple to Zoom. Bricks and mortar retail, including REITs, have struggled.

Working from home has transitioned to the mainstream. Previously, for many, there was a stigma attached to working from home. With so many workers being forced to adopt this practice over the past four months, its acceptance has leapt to the point where it is now being seen by some as a productivity enhancer. This has important implications for urbanisation and gender workplace equality, amongst other things.

Consumer Survey

Rising inequality

Rising wealth inequality is not a new problem, however, it has been exacerbated by recent recessions. The chart below displays the income growth gap that has opened since the 1980’s. The chart clearly shows the larger dips in income for low and median income earners during the recessions of the early 1980’s, 1990’s, 2000’s and the GFC in 2008/9. The experience during COVID-19 is the same, with low income earners being disproportionately represented amongst those that have lost their jobs. Further, accommodative monetary policy fuels asset prices to the benefit of asset owners (the wealthy). Arguably, the recent extensive global protests under the banner Black lives matter are also, in part, related to the frustration caused by rising wealth inequality. There are significant political implications, with a rise in populist politics being seen in many parts of the world. Fiscal austerity has tended to hamper rectification of this situation, and the recent death of austerity (even the EU are agreeing spending measures!) is likely, at least in part, to be a response to rising inequality and the need to address it.

De-globalisation

Rising wealth inequality in the US arguably helped President Trump rally support among some voters when espousing populist anti-China rhetoric to protect American jobs. It is natural to see social unrest lead to policy change, and that movement had started well before COVID-19. World trade as a proportion of global output had peaked pre-GFC.

An additional driver amplified by the COVID-19 crisis is to improve supply chain diversification, including increasing self-sufficiency. Countries such as Australia, the US and the UK have outsourced so much in terms of manufacturing and supply chain that we are now considering bringing some of that back on-shore. Do we need to bring things back to our economies because we can’t rely on the supply of some of the essential manufactures from places like China if they shut down?

Alex Joiner, chief economist at IFM investors recently commented “It’s key high-tech, medical, manufacturing – those sorts of things – that we might need to be more self-sufficient in going forward and that will have implications. Take the Australian example: we no longer produce motor vehicles in this country at all.…. The argument then becomes, to make these goods in Australia we would have to subsidise the industries that produce them, and that’s always been the issue. How much government subsidy should an industry get?” Greater social unrest around inequality, as well as concerns about supply chain disruptions, will likely encourage many governments to protect domestic industries where they may have not in the past.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.