Global equity markets continued to strengthen in April, with the MSCI World Index rising 4.1%. In the US, the S&P 500 gained 5.3% amid a strong reporting season, while in Australia, strong gains in the banks and miners pushed the ASX 200 3.5% higher. Fixed income markets continued to moderate with both the US 10-year Treasury bond yield and Australian 10-year government bond yield falling 10bps to 1.63% and 1.69% respectively.

Lower bond yields drove a reversal in recent equity market performance leadership between growth and cyclical stocks, with growth stocks significantly outperforming cyclical names. Higher commodity prices drove a strengthening A$, with the AUDUSD rising 1.4% to 77c. Commodity markets were stronger across the board as demand for base metals continues to strengthen. The price of Iron Ore rose to an all-time high following a booming steel market, finishing the month 7.6% higher to $179/t. Copper however was the standout performer of the month, rising 12.4%.The price of Gold also strengthened, rising 4.5% to US$1,767/oz.

Strong US reporting season

More than 50% of S&P 500 constituents have already reported March quarter financial results, recording a blended EPS growth rate of ~44%. The proportion of companies beating analyst earnings expectations is well above historical averages. Corporate commentary is generally positive, with companies impacted by COVID-19 indicating an improvement in earnings guidance. Notwithstanding, the reaction from the market on the day of EPS results has variously been subdued, suggesting that the strong results have been largely priced in.

All eyes on inflation and bond yields

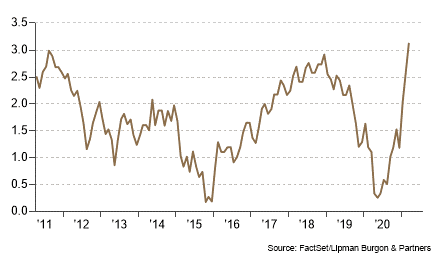

Inflation is arguably the most significant thematic flowing from reporting season with companies citing supply chain constraints, input cost pressures and price increases. Mentions of inflation from companies have increased threefold, the biggest jump since 2004. Bank of America economists have highlighted the high correlation this metric has with inflation data one quarter later. In March, producer price increases (ex food and energy) saw the biggest increase in over 10 years. US 10-year bond yields have risen slightly in the past week, partly induced by company comments. After a period of consolidation, we expect that long-dated bond yields will continue the path higher.

Outlook

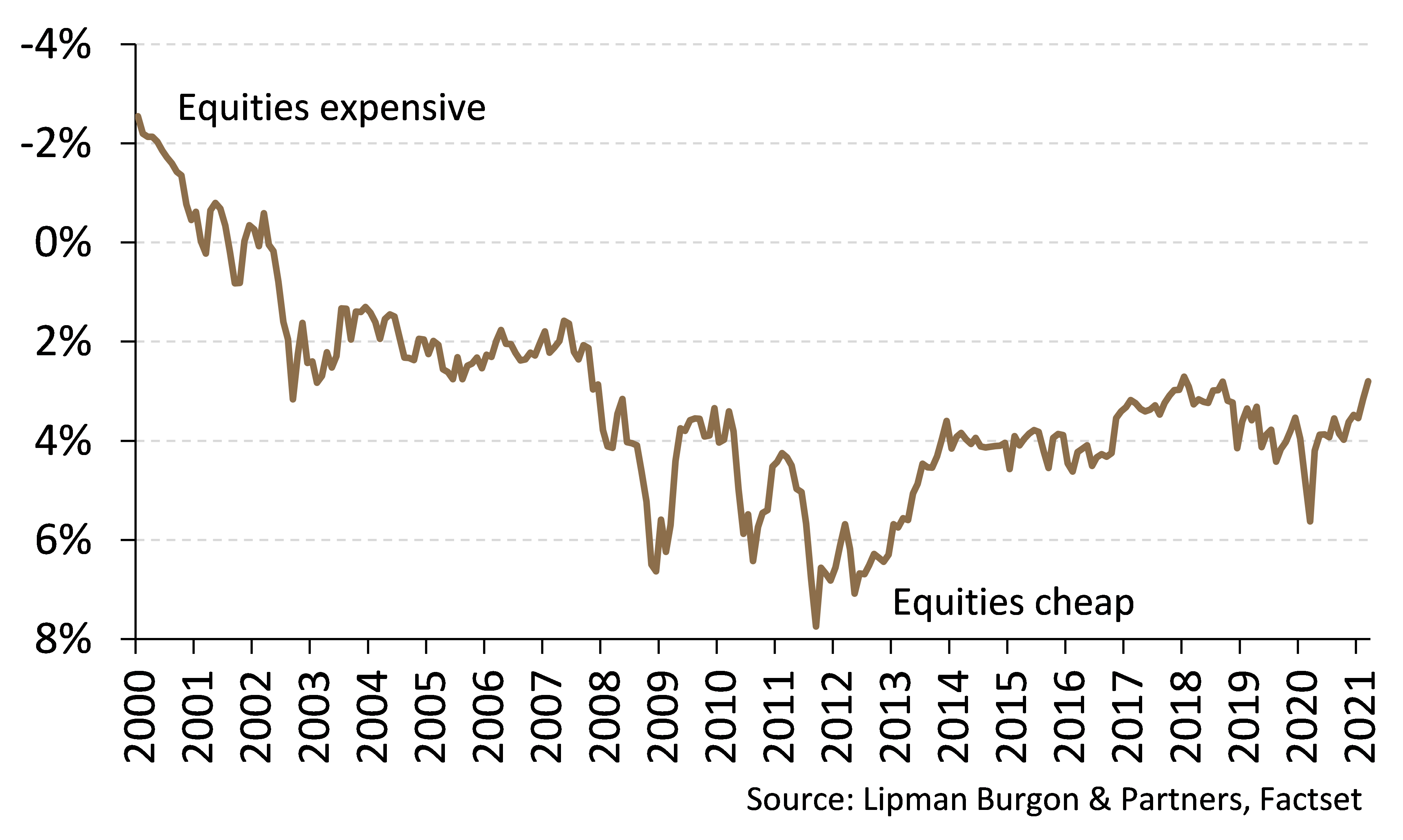

The medium-term outlook for equities remains positive, primarily driven by the prospect of economic re-opening and sustained accommodative fiscal and monetary policy. The excess earnings yield of stocks over bonds in the US currently stands at 2.9%, still substantially higher than pre-GFC levels of ~2% (i.e. equities are cheap compared to bonds). Additional optimism towards the economic growth outlook could compress that spread further towards pre-GFC levels, driving equities higher. As a result of these factors and other variables:

- We are positively disposed to cyclical and value stocks.

- We feel that portfolios need protection from the threat of long term inflation, which can be gained through holdings in equities, property, infrastructure and gold.

- We continue to see government bonds as un-investable and prefer various alternative investments that add diversification to portfolios whilst also helping to achieve income and growth targets.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.