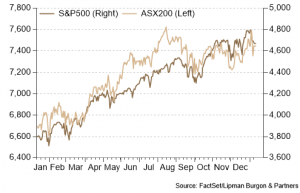

Equity markets closed out 2021 on a positive note, with most major global indices rising in December. In developed markets, the MSCI World Index rose 4.0%. European equities led global share market gains with the MSCI Europe Index returning 5.2%. Emerging markets however were relative laggards, with the MSCI EM index climbing 1.5%. In Australia, the ASX 200 posted a solid 2.7% uplift.

US Equities were mixed, while the S&P 500 rose 4.5% to close out the year, the tech-heavy NASDAQ was only 0.7% higher, as stretched valuations of growth stocks have come back into the spotlight of investor focus.

A flurry of central bank activity saw a broad sell – off across government bond markets causing yields to rise. The Fed announced it would accelerate the tapering timeline, which will conclude in March, the Bank of England lifted interest rates by 15 bps, and the ECB announced it will begin tapering asset purchases. This saw the US 10-Yr Treasury yield jump 8bps to 1.51%.

The yield on the UK 10-Yr Gilt jumped 18bps to 0.97%. Australia, being somewhat insulated, saw the yield on the 10-Yr Government bond moderate by 3 bps to 1.67%.

The Australian dollar strengthened 2.5% to 73 US cents. Commodities strengthened over the month. A shift in policy stance from the PBOC and expectations of further Chinese stimulus in early 2022 saw the price of Iron Ore rebound, rising 18.5% to $112/t. Brent Crude also strengthened 8.9% as restricted supply has kept prices elevated.

2021 – a year in review

Despite the initial concerns that the emergence of a new Covid-19 variant in late 2021 could disrupt the economic recovery, most global share markets closed out the year with a solid performance. While there were some brief sell offs, the S&P 500 recorded 70 all-time highs in 2021, a record that is second only to 1995.

Overall, investors continued to brush away any concerns that could have derailed the performance of equities. From the contested presidential election in the US, escalation of geopolitical concerns, supply chain disruptions and the re-emergence of historically high inflation followed by many global central banks turning more hawkish, to Delta and Omicron variants of Covid-19 – none of these events stopped stocks from notching higher. The year also saw very strong inflows from retail investors and emergence of a new type of day traders, who often utilised social media to fuel speculation and boost share prices of companies that many professional investors were shorting. While speculation was an important feature, it was a mixture of economic recovery, improving macroeconomic fundamentals and robust corporate earnings that fuelled the bull market. According to FactSet data, the estimated (year-over-year) annual growth rate for US companies is expected to reach 45%, well above the trailing 10-year average, while European companies are expected to grow top line revenues by 16%. This is a dramatic turnaround compared to 2020.

Across private markets deal activity rebounded significantly in 2021. Specifically, venture capital total deal value more than doubled 2020 activity. Fund managers continued to raise capital and launched more funds, as investors increased allocations towards private markets strategies during the year.

2022 – setting the scene

Despite some covid – related setbacks, 2021 was a year of strong returns driven by economic growth and a powerful rebound in corporate earnings. While the rate of growth may moderate in 2022, it is still expected to remain above-trend providing a relatively positive backdrop for risk assets.

Inflation, which became one of the most discussed themes of 2021, is likely to remain elevated in early 2022. However, supply chain issues that fuelled goods inflation, are likely to dissipate in the first half of the year. At the same time, the recent step-up in wages could see an increased labour participation rates, such that the rise in labour costs is unlikely to be a persistent trend. Should both of those dynamics happen as anticipated, some of the inflationary pressures seen in the second half of 2021 will be reduced. Nonetheless long-term inflation is likely to be higher over the cycle, and the labour market continues its normalisation path to maximum employment. As a result, monetary policy is on a tightening path. The market currently expects three rate hikes to come out of the Fed in 2022. If inflation pressures ease by mid-2022, the pace of rate hikes currently priced in may turn out to be too aggressive.

Other trends that are likely to persist in 2022 include strong household balance sheets, re-emergence of corporate capex and productivity. Although the fiscal spending that supported the global economy over the past two years is coming to an end, most economists believe that private sector demand will be sufficient to keep the economy growing well above trend.

While the path of the pandemic remains uncertain, improving vaccination rates and the new variant’s apparent dip in virulence are reasons for optimism. Furthermore, with each virus round, the economy is adapting more quickly and bouncing back faster.

Portfolio positioning

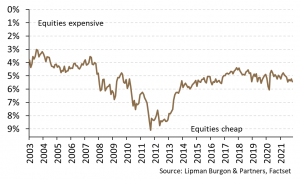

While valuation multiples are elevated, we remain constructive on equities over the medium-term. Equity risk premia remain attractive relative to bonds (Chart 3) and shares are likely to continue generating positive returns in 2022, albeit below those seen in the past.

Given the pathway for interest rates is skewed to the upside, we see relative value in markets outside the US which are more attractively priced and less sensitive to changes in interest rates.

Structurally higher inflation over the long term continues to present a long-term risk to portfolios. Therefore, we continue to advocate for allocations to property, infrastructure, Gold, and other commodities to maintain inflation hedging and portfolio diversification.

Government bonds remain expensive and exposures to interest rate duration during the period of rate hikes should be minimised. While spreads are also relatively unattractive, corporate debt is likely to outperform government bonds. We continue to prefer various alternative investments as well as private market opportunities that add some downside protection to portfolios whilst also helping achieve income and growth targets.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.