Integrated wealth solutions that build and sustain family legacies

Institutional-grade portfolio management

Specialised investment

sourcing

Multi-asset administration

& reporting

Family governance and

succession

Purpose and impact-driven

giving

Family planning and advisory services

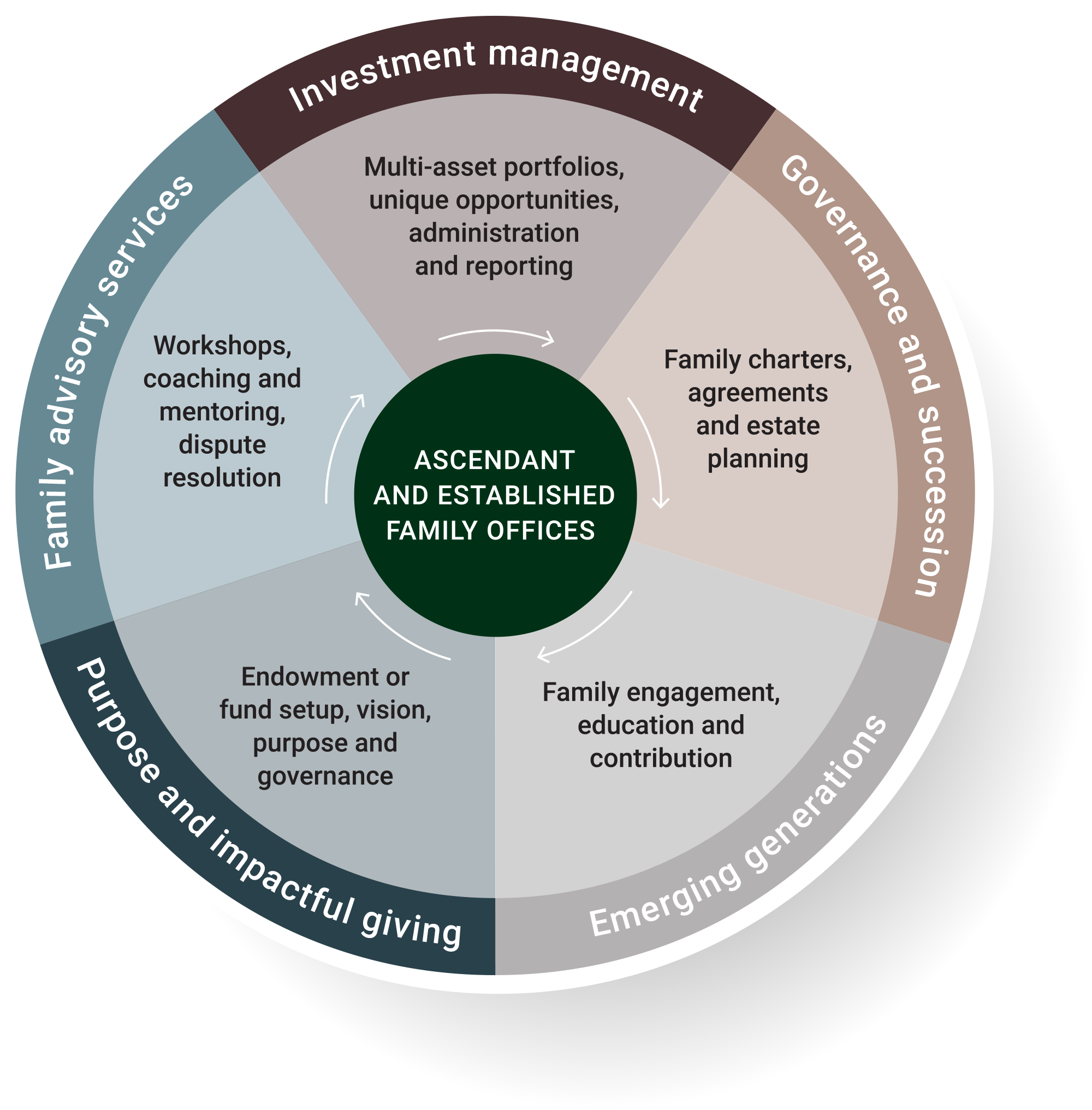

The Lipman Burgon & Partners Private Office (LBPO) supports families and family offices that are custodians of generational wealth. We work with established and ascendant family offices through an integrated approach to enhancing investment outcomes, strengthening governance, and amplifying family values and purpose.

We assist clients in building early foundations to expand wealth, impact, and legacy through to those striving to optimise and streamline existing family office functions. In all cases, we bring institutional rigour to multi-asset portfolio management, governance, and administration.

We recognise wealth preservation and growth is rarely the only goal for families and family offices. We focus on ensuring family principles and ethos span generations, building long-term relationships with clients, future generations, and other professional advisory teams.

Our clients

Ascendant families

Families with $30m to $100m in investable assets seeking access to family office services that provide the structures, vehicles and processes that can drive enduring wealth.

Established family offices

New and existing family offices with $100m to $250m in investable assets seeking trusted investment partners to uplift capabilities and rigour and bring focus to their affairs.

Our focus

Multi-asset portfolio management

Lipman Burgon & Partners has a long history of managing significant and complex portfolios for successful families and family offices.

We develop customised investment programs that benefit from an institutional approach to due diligence and manager selection and contemporary asset allocation models.

Our multi-asset custody and reporting capabilities ensure the visibility and security of distributed portfolios.

Family succession and governance

Managing substantial family wealth across generations requires a clear, shared vision.

We help clients establish robust governance to guide capital to what matters most. That includes family and investment charters and policies.

This extends to engaging and educating the next generation and family stakeholders to enable stewardship and to help navigate challenging situations.

Our services

Our capabilities

Investment program development

Lipman Burgon & Partners specialises in multi-asset portfolio design and construction using evidence-based asset allocation approaches that aid diversification and risk-adjusted returns.

Outsourced investment management or CIO

Family offices need disciplined investment management for efficient, sustainable portfolios. Independent investment partners can help enhance allocation strategies and portfolio outcomes.

Read our latest research on the advantages of partnering with investment experts.

Sourcing unique opportunities

With deep networks and private markets expertise, we can originate unique investment opportunities. We can also conduct due diligence on client-sourced opportunities.

Administration and reporting

We partner with leading global providers of portfolio administration platforms which allows us to integrate and report on custodial and non-custodial assets.

Family governance and planning

Development of the charters, agreements and policies that enshrine a family or family offices’ investment, intergenerational wealth transfer and broader, long-term vision.

Family engagement and education

We proactively engage with the next generation of family members to equip them with the confidence to make informed and effective decisions.

Responsible investing and philanthropic giving

Whether through responsible and sustainable portfolios or finding the right structures to optimise philanthropic or charitable giving, we support families seeking to make a positive impact.

Family advisory services

We offer a holistic range of services that can further support families, whether related to technical aspects of tax or assisting with navigating family disputes.

Trusted network of specialists

Gain access to our long-standing relationships with a range of leading professional advisers and specialists. It’s more than just a referral, as we often work together as one team.

Your specialist team

Paul Burgon, CFP, CIMA

Managing Partner and Chief Investment officer

Paul leads Lipman Burgon & Partners’ investment and advisory teams, acting as Lead Adviser to family offices. He specialises in tailoring investment programs, developing governance frameworks, and succession management. Drawing on decades of experience working with leading investment and private banks, he has extensive experience serving the needs of wealthy families. Paul is an expert in multi-asset portfolio construction and allocation across public and private market assets and has been recognised among Australia’s top Financial Advisers for multiple consecutive years. Paul has a tertiary qualification in applied finance and is a Certified Financial Planner (CFP) and a Certified Investment Management Analyst (CIMA).

Heath Ueckermann, CA, CFP

Partner

As a leader and private wealth adviser, Heath specialises in supporting families and for-purpose organisations. As a chartered accountant and having worked for leading investment banks and top-tier accounting and advisory firms, Heath brings an institutional lens and technical expertise to advisory services and portfolio structuring. His knowledge and experience inform a passion for family charter, investment policy and governance development and education for emerging generations. Heath is also a Certified Financial Planner (CFP).

Paul Selikman, CPA, CFP

Partner

Paul has longstanding experience providing wealth advisory and investment management services to some of Australia’s most prominent families. Supported by a team of advisers, Paul currently works with many of the firm’s family offices, using unique insights gained from many years in the investment team at Australia’s Lowy Family Group. Paul is a Chartered Practicing Accountant (CPA) and Certified Financial Planner (CFP) specialising in managing complex investment portfolios, multi-generational wealth preservation, risk management, succession planning, and educating the next generation.

Jason Rademan, CFP, TEP

Partner