Share markets experienced substantial volatility throughout the month, ultimately closing on a positive note. The period began with a contraction in early August, followed by a robust recovery. In the sections below, we delve into the “tale of two halves”, as well as provide a snapshot of the Australian equities reporting season.

Early August Drawdown

During the first five days of August, listed equity markets (ASX 200, MSCI World, and S&P 500) saw drawdowns of between 5% to 7%, with Japanese equities (Nikkei) experiencing a particularly steep decline of nearly 20%. These movements are illustrated in Chart 1. These declines were driven by several factors:

- Unwinding of Carry Trades: A key contributor to the market volatility was the unwinding of carry trades, particularly those involving the Japanese Yen. A carry trade is a strategy where investors borrow in a low-interest-rate currency (such as the Yen) to invest in higher-yielding assets, like US Treasuries or Australian government bonds. When the Bank of Japan (BOJ) unexpectedly adjusted its yield curve control policy, the Yen appreciated sharply. This sudden strengthening prompted investors to exit their carry trades to minimise losses, leading to a sell-off in global bond markets. The resulting liquidity crunch and selling pressure caused sharp declines across major equity indices.

- US Recession Fears: Concerns about a potential US recession grew as economic indicators suggested a slowdown. The US labor market report for July, released on August 2nd, fell short of expectations, with the unemployment rate rising to 4.3% from 4.1% in June. This triggered the “Sahm Rule,” a recession indicator devised by former Federal Reserve economist Claudia Sahm, that suggests a recession is underway when the three-month average unemployment rate rises by 0.50% or more from its 12-month low.

Market Recovery

Despite the early August drawdown, markets recovered all losses as shown in Chart 1, and closed the month higher, driven by several factors:

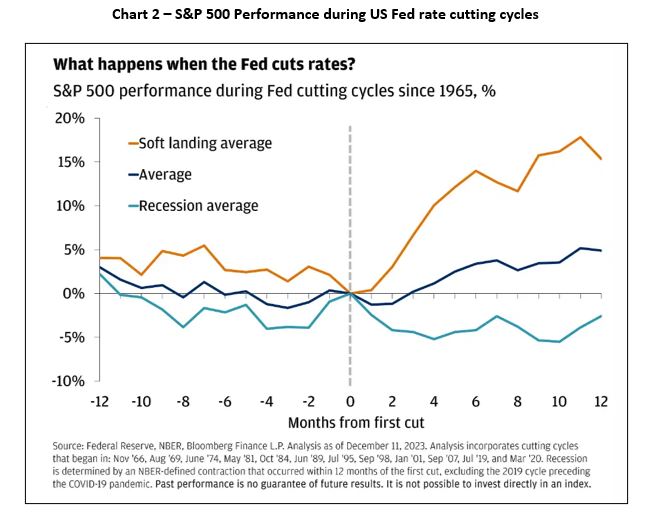

- Federal Reserve’s Rate Cut Plans: The Fed signalled that it may consider rate cuts in the near future that buoyed market sentiment. At the Jackson Hole symposium on August 23rd, Federal Reserve Chair Jerome Powell stated, “The time has come for policy to adjust.” Investors grew more optimistic, anticipating a shift towards a more accommodative monetary policy, which could ease the pressure on economic growth. Chart 2 highlights that the historical experience of Fed rate cycles has tended to be accretive to share market performance over the near-term.

- Resilience in Economic Indicators: Positive signs emerged from the US economy, as indicated by better-than-expected retail sales data and a slight rebound in consumer confidence, which helped to alleviate concerns about a recession.

- Retail Sales: US retail sales showed surprising strength, rising 0.6% month-over-month, exceeding analysts’ expectations of a 0.3% increase. This was driven primarily by robust consumer spending in key sectors such as automotive sales, online retail, and consumer electronics.

- Consumer Confidence: The Conference Board’s Consumer Confidence Index rose to 108.5 in August, up from 106.0 in July.

Australian Equities Reporting Season

The August 2024 earnings season in Australia was mixed across sectors and companies. We have outlined a snapshot of the key results across sectors and companies below:

- The technology sector emerged as the standout performer, with WiseTech (WTC) reporting strong revenue and earnings growth forecasts, leading to a stock rally of over 25%. Other technology firms such as HUB24 and Block also benefited from continued demand for innovative fintech solutions.

- The retail and consumer sector experienced varying results over earnings season. While JB Hi-Fi surprised the market with accelerated sales growth, Harvey Norman reported a significant drop in profits.

- The mining and energy sectors struggled, with giants like BHP, Rio Tinto, and Fortescue experiencing declines due to weak commodity prices and a subdued outlook for the Chinese steel market. Despite some improvements in cost control, companies like Mineral Resources faced significant challenges, including the decision to forgo dividends for the first time in over a decade.

Portfolio Positioning

This report underscores the importance of staying invested during periods of market volatility. While markets may experience irrational selloffs, as seen in early August, it is crucial to not be influenced by short-term sentiment and news flow. For example, if you had invested $100 in the MSCI World Index but panicked and exited your position after the first five days of August, and then chose not to re-enter the market for the rest of the month due to fears of further drawdowns, you would have ended up with $93.60. Conversely, if you had stayed invested throughout the month, your investment would have grown to $101.90.

LBP continues to stress that a robust investment framework and remaining invested through the cycle are integral to preserving wealth, and that investors should emphasise the long-term goals of income generation and capital appreciation. Maintaining a multi-asset class portfolio diversified across all asset classes, regions, sectors, and fund managers is imperative for achieving optimal long-term outcomes.

During the short-term volatility experienced in early August, exposure to asset classes such as multi-strategy hedge funds and private debt provided crucial protection for the portfolio. Multi-strategy hedge funds aim to deliver absolute returns regardless of market direction, employing strategies like long/short equity, global macro, and fixed income arbitrage, which typically exhibit low correlation with equity and credit markets. Similarly, private debt funds are less affected by short-term fluctuations in listed markets, as they invest in debt backed by private companies with strong fundamentals and low default rates.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.

Recent Comments