August once again lives up to its dismal reputation for stocks as both domestic and global equity markets finished lower, with a final rally towards the backend of the month that helped reduce the severity of the decline. The S&P/ASX200 fell a moderate 0.73% compared to a steeper drop for the S&P500 and NASDAQ of 1.59% and 2.05%, respectively (Chart 1). This fall may be attributable to market jitters over the possibility that the Federal Reserve may have to keep rates higher for longer following reports that the US economy remains resilient. This coincided with yields for US 10-year Treasuries rising 14 basis points to 4.09%.

So, what has driven market declines in August after a strong rally this year? As always, there is a myriad of reasons that all come together to pull the markets into bearish territory. One key driver is inflation, and the corresponding contractionary monetary policy global central banks have employed to control it. Long term bond yields rose again in August, with the 10-year US treasury reaching its highest level in 2023 (Chart 2). This resulted in lower equity market valuations (as we saw in 2022). Yield curves remain inverted indicating a slowdown in activity ahead. However, the narrative for a soft landing continues to be supported by falling inflation and resilient US retail sales with a strong 0.7% increase in July. This demand in the US is underpinned by strong real wage gains from a tight labour market and excess savings built up during Covid. China’s faltering economy was reflected by a substantial 8.23% fall in the Hong Kong Hang Seng index led by deflation, a falling yuan, and a high youth unemployment rate. This further dampened sentiment and global equity market returns this month.

What Happened to the Aussie Dollar?

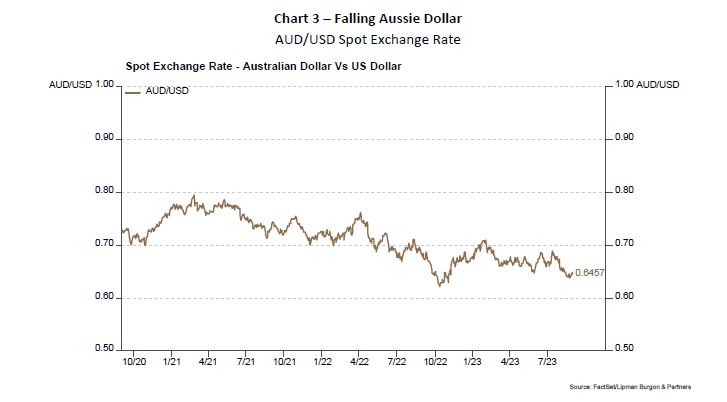

The Australian Dollar (AUD) hit a nine-month low against the US dollar, depreciating to US64¢ in late August from almost US69¢ in July. This decline was fuelled by growing concern about the strength of the Chinese economy and the US Federal Reserve raising rates more aggressively than the Reserve Bank of Australia (Chart 3). The weaker exchange rate makes foreign goods more expensive and if sustained for long periods, may increase imported inflation, making the RBA’s task even more challenging. This has contributed to petrol prices spiking to above $2 a litre and may be a factor in subdued consumer confidence which remains at Covid lows.

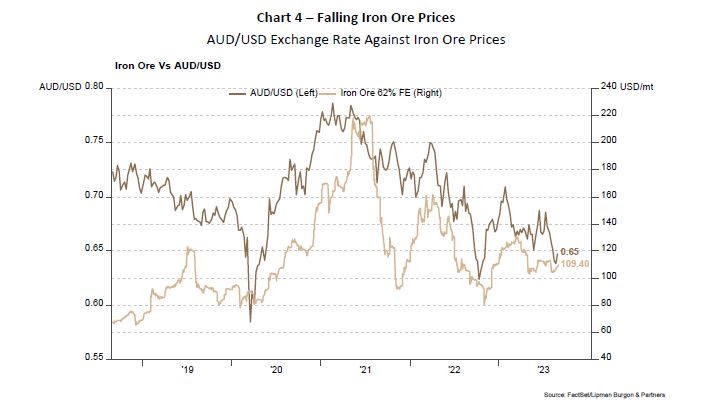

China is Australia’s largest export market and a major buyer of iron ore, gas, and coal, so the health of the Chinese economy directly impacts domestic markets and our currency exchange rate. The country’s once booming real estate sector has stalled and China has slipped into deflation. Major developers are faltering as they face massive losses, struggle with high levels of debt and have unpaid bills to the estimated total of $390 billion. China’s property sector accounts for about 40% of the country’s demand for steel and falling property values have been followed by a major slump in iron ore prices (Chart 4). ANZ warned that iron ore prices face an imminent pullback as falling steel production in China coincides with easing supply disruptions that negatively impact Australia’s exports. Consumer prices in China fell in July for the first time in two years while foreign investment into the country dropped more than 80% in the second quarter from the previous year. A sharp downturn in China will depress economic growth in Australia through both lower exports and tourism, with an immediate impact on commodity prices given their outsized role as a buyer.

The significance of China’s faltering economy spiralling into deflation is such that it can have a domino effect whereby the Australian Dollar continues to fall and therefore leads to sustained levels of high inflation (there is an inverse relationship between exchange rates and inflation). This will force the RBA to become more hawkish and can challenge the narrative of a soft landing for the domestic economy. It is unlikely, however, that we will see further rate hikes as our household sector has been significantly impacted by mortgage hikes, far greater than American households. This means the RBA cash rate will remain below the US Fed’s for the foreseeable future, maintaining a weaker currency which has its own benefits – provided it does not dip to dangerously low levels.

Portfolio Positioning

To summarise the reasons for the weaking of the Australian Dollar and what it means for your portfolio; a dovish monetary policy stance relative to the US central bank, falling iron ore prices, and China’s deflation have caused the AUD to become undervalued. Despite the current macroeconomic conditions, this can create portfolio opportunities for informed investors. Rob Rennie, head of commodity and carbon research at Westpac, was not surprised by the Australian dollar’s weakness and believes that “ultimately, the $A is a buy on the dips”. However, he does note that it hinges on more positive developments in China and is not convinced of that just yet. This can be an opportunity to increase AUD hedging in your portfolio.

We have positioned ourselves slightly underweight equities rather than continue chasing the equity rally and have modestly increased allocation to private debt. Given the structural seniority of debt relative to equity, and higher yields following consecutive cash rate hikes across the globe, investors can benefit from greater insulation from market volatility. Given the current favourable yields and elevated economic uncertainty, we also feel comfortable allocating to traditional duration in portfolios in the form of fixed income.

While inflation remains elevated, we maintain our allocation to growth assets including real assets such as infrastructure and transport, as these can improve portfolio diversification and provide a degree of inflation protection. Alternative investments including hedge funds can also be another portfolio diversifier, providing a source of strong returns that are uncorrelated to major equity and bond markets.

LBP continues to stress the importance of maintaining a robust investment framework and remaining invested through the cycle. Time has shown that the greatest threat to real wealth tends to come from being underinvested in the long term rather than remaining invested through short-term volatility as it is incredibly difficult to ‘time’ the market. As such, the main focus should be on long-term objectives and capital preservation, while maintaining some dry powder to dynamically allocate to attractive opportunities as they arise.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.