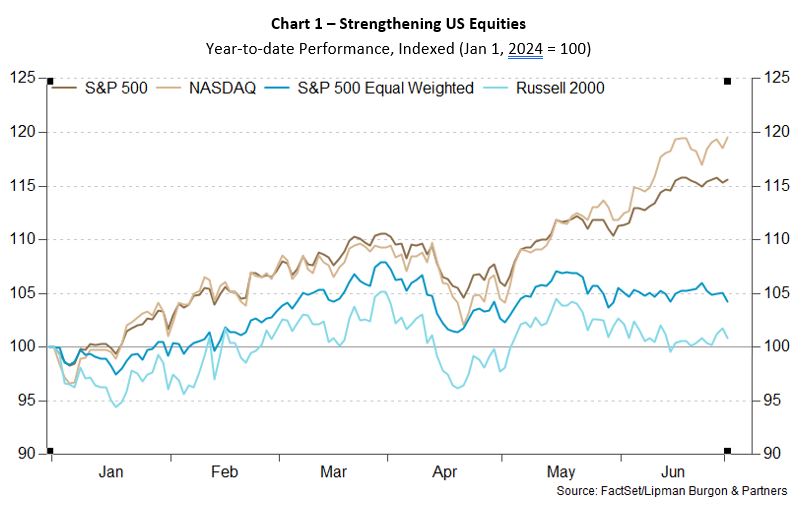

US equities continued higher in June, largely driven by gains in big tech as the NASDAQ was up 6% (Chart 1). Outperformers included electric vehicles and software; however, this momentum is concerning investors who believe richly priced stocks like Nvidia will see more frequent pullbacks. The mania surrounding artificial intelligence has propelled the US share market to record levels as the ten largest companies account for over a third of the S&P 500. The ‘’Magnificent Seven” are up about 57% in the past year, which is more than double the 25% return of the whole market-cap weighted index. Goldman Sach’s head of global equity research, Jim Covello, likened Nvidia’s situation last week (which saw a 13% pullback) to the dot com bubble in the early 2000’s. “The bursting of today’s AI bubble may not prove as problematic as the bursting of the dot-com bubble simply because many companies spending money today are better capitalised than the companies spending money back then. But, if AI technology ends up having fewer use cases and lower adoption than consensus currently expects, it’s hard to imagine it won’t be problematic for many companies spending on the technology today” he said. Deutsche Bank also issued a warning on signs of over-exuberance about the stock.

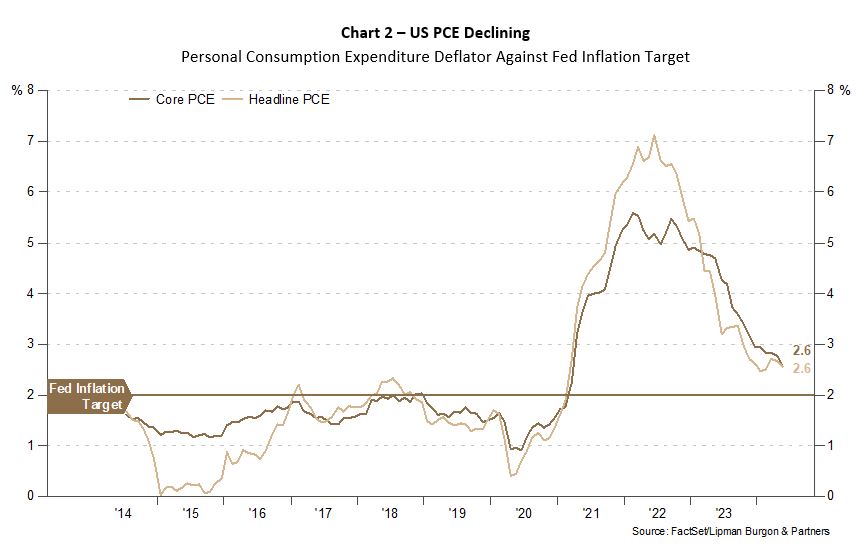

The ASX 200 ended the month mostly flat as consumers eagerly await the RBA Minutes to get a gauge on the central bank’s next cash rate move given the unfavourable changes in CPI. Meanwhile, the long term bond yield gap between Australia and the US narrows as core PCE inflation slows in the latter, confirming that the disinflationary trend that stalled earlier this year, has resumed (Chart 2). BCA’s US Bond strategists expect that the Federal Reserve (Fed) will begin to cut rates in September. The University of Michigan survey of consumers was recently released and showed an improvement in the sentiment measure as consumers have reduced short term inflation expectations. Policymakers will need to focus on the long term expectations however as they remain somewhat elevated. It will be crucial for the Fed to not cut rate too soon or too severely as risks to an uptick in inflation still remain prevalent.

Australia’s Inflation Ticks Up Again – Are Rate Rises on the Horizon?

The Reserve Bank of Australia (RBA) kept the cash rate unchanged at the last meeting, and the Minutes have just been released to provide more guidance as a key measure of inflation has jumped again. In May, the Bureau of Statistics monthly consumer price indicator produced an annual inflation rate of 4%, up from 3.6% in the prior month. The most significant contributors to the annual increase were housing, food and non-alcoholic beverages, transport, and alcohol and tobacco. Underlying inflation (which excludes volatile components) remains above 4% (and well above the RBA Inflation Target) which is concerning. Financial Review’s economist survey showed a median forecast that underlying inflation would not return to the 2-3% target range until June 2025 and more economists expect the RBA to hike the cash rate in August. They will have the official quarterly index that will guide its decision about whether or not to increase interest rates.

Chart 3 shows the number of dwelling approvals and commencements declining to record low levels that is set to continue putting upward pressure on house prices and therefore housing-induced inflation. The slowdown in new construction projects comes as a result of rising construction costs and planning delays that does not bode well for first home buyers trying to get their foot in the property market. The Board Meeting Minutes did highlight that growth in GDP had been weak, reflecting the subdued activity in the more interest rate-sensitive parts of the economy, such as retail spending and housing construction. The labour market was still assessed as tight relative to full employment though conditions had continued to ease gradually in recent months as expected, and wages growth had likely passed their peak for the current cycle.

Ultimately, it was concluded that the RBA would need to remain alert to upside risks to inflation and that the extent of uncertainty at present meant it was difficult either to rule in or rule out future changes in the cash rate target. Returning inflation to target remains the Board’s highest priority and it will do what is necessary to achieve that outcome. This may increase the chances of an August rate hike if the June quarterly CPI figures show that inflation is returning to target slower than anticipated.

Portfolio Positioning

The outlook for Australia is quite different to the US, with the interest rate differential slowly narrowing as local inflation remains sticky and has climbed above expectations. This may be a positive for the Australian Dollar, as a few more rate rises may be necessary to achieve the RBA Target while the Fed may be cutting rates later this year. With US equities heading into overvalued territory, the inflation outlook becoming uncertain, and the possibility of a global recession looming, it becomes increasingly important to maintain a portfolio that derives its growth from factors outside of equities.

The preservation of capital by maintaining a multi-asset class portfolio that is sufficiently diversified across all asset classes, regions, sectors, and fund managers remains our key objective at LBP. We seek to construct a portfolio that derives its return from various factors (equity, currency, momentum, value, growth, and interest rates) as it will perform more robustly during periods of economic recession and heightened volatility. This means diversifying exposure across asset classes within alternatives like trend following, real assets such as transport and infrastructure, and natural capital like water entitlements and farmland.

LBP continues to stress that a robust investment framework, and remaining invested through the cycle is integral to preserving wealth, and that investors should emphasise long-term goals over short-term market movements. Time has shown that the greatest threat to real wealth comes from being underinvested, often due to attempting to time the market; something even the best economists cannot consistently get right.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.

Recent Comments