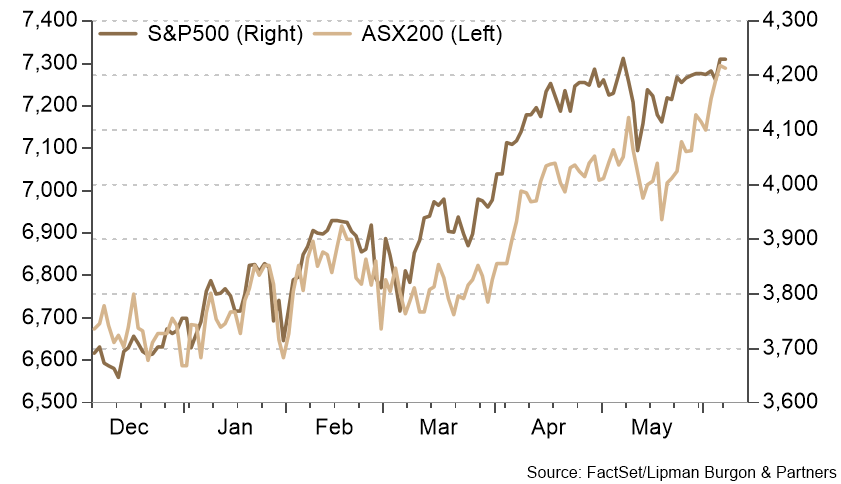

Global equity markets edged higher in May, with the MSCI World Index rising 1.1%. In the US, S&P500 companies reported strong Q1 earnings growth of 47% year-on-year, well beyond the consensus estimates of 20%. However, despite the robust earnings data, the S&P500 climbed only a modest 0.7% as inflation numbers outpaced expectations spurring talks of Fed tapering. The Australian market outperformed global equities, with solid gains among the banks driving the ASX200 2.4% higher. European equities also outperformed, with the MSCI Europe rising 2.5% after a ramp-up in vaccination rates and positive eurozone PMIs for May provided a much-needed boost to confidence.

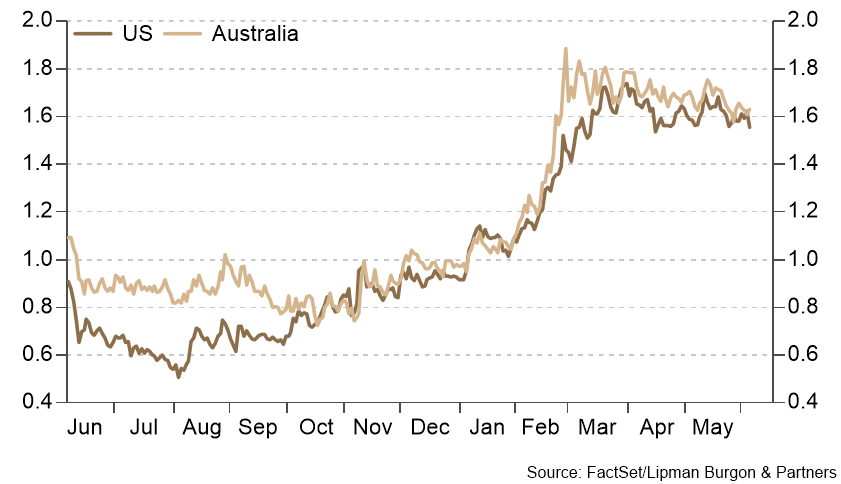

Global bond yields have continued to moderate, with the US 10-year Treasury bond yield falling 5 bps to 1.58% and Australian 10-year yields down 3 bps to 1.66%. Commodity markets continued their upward momentum, rising across the board in May. Iron ore was the standout performer, up 14.5% to $206/tonne. The price of gold also strengthened 7.5% amid concerns over higher inflation.

No more positive data surprise

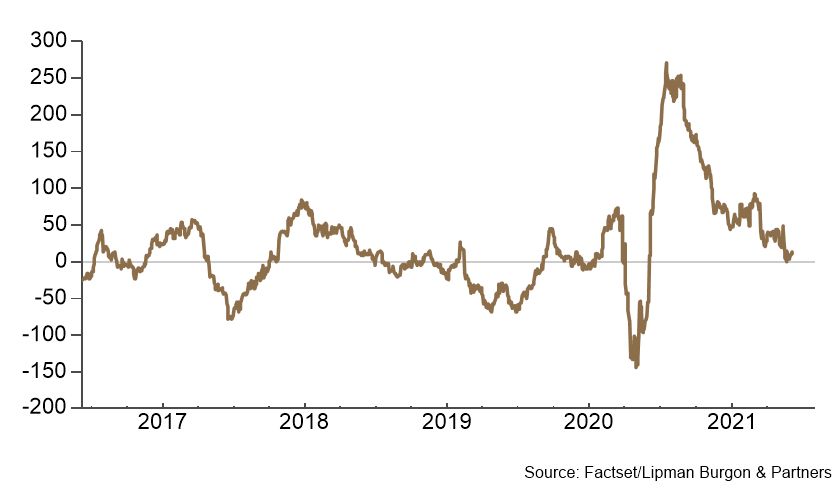

May marked a significant change to a key driver of post-COVID-19 financial market strength – economic data is no longer surprising on the upside. Better than expected economic data and positive market reaction from mid-2020 (when it was ‘off the charts’) lasted until last month.

This also contributed to company results consistently beating expectations over the past twelve months. Of course, the positive surprise has been driven by performance being not as bad as feared rather than the actual strength of economic performance. Nonetheless, this has provided significant tailwinds for global equity markets. S&P500 earnings in the next twelve months are now expected to be 11% higher than the pre-pandemic forward estimates.

In other words, earnings expectations in the US have already returned to trend. Genuinely strong economic growth will be required to achieve further positive surprise dynamics from here. Thankfully, that is precisely what central banks intend to achieve.

Beware the Taper Tantrum?

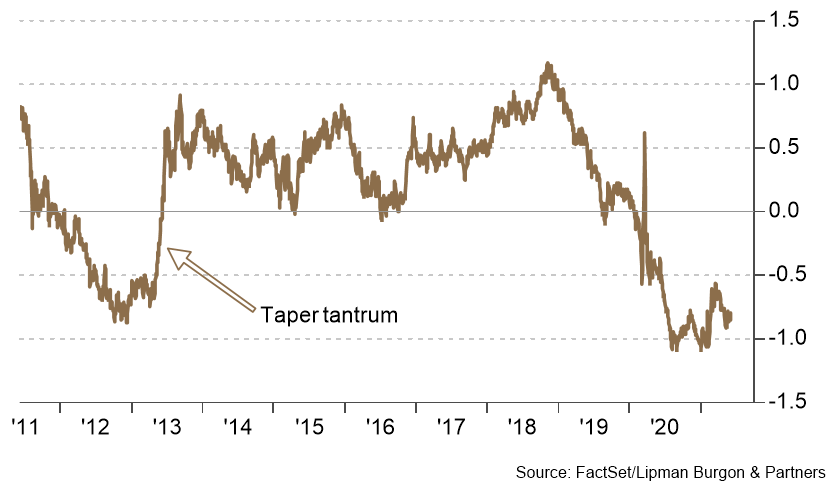

The prospect of central banks slowing their quantitative easing (QE) bond purchases (known as “tapering”) is seen by many as a potential concern for markets. We have a different view. We expect that tapering will only occur when economies have reached ‘escape velocity’, and that tapering will simply be a marker along the journey to economic recovery. When the Fed announced tapering of its QE bond purchases in 2013, the resulting surge in treasury yields became known as the ‘taper tantrum’ (10-year real yields moved from -0.5% to +0.5% in the space of two months). At that time, there were significant concerns that equity markets would crumble upon withdrawal of central bank support. However, after a short wobble, market strength resumed, with the S&P500 posting a 30% gain for calendar 2013. We think concerns over a ‘taper tantrum’ may be similarly overdone this time.

Outlook

The medium-term outlook for equities remains positive, primarily driven by the prospect of global economic re-opening and sustained accommodative fiscal and monetary policy. The excess earnings yield of stocks over bonds in the US currently stands at 3.1%, still substantially higher than pre-GFC levels of ~2% (i.e., equities are cheap compared to bonds). Our base case is that accelerating economic growth drives strong medium-term earnings growth, pushing equities higher. As a result of this and other factors:

- We are positively disposed to cyclical and value stocks.

- We believe that portfolios require protection from the threat of long-term inflation, which can be achieved through holding equities, property, infrastructure and gold.

- We see high-grade bonds as largely uninvestable and prefer various alternative investments that add diversification to portfolios whilst helping to achieve income and growth targets.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.