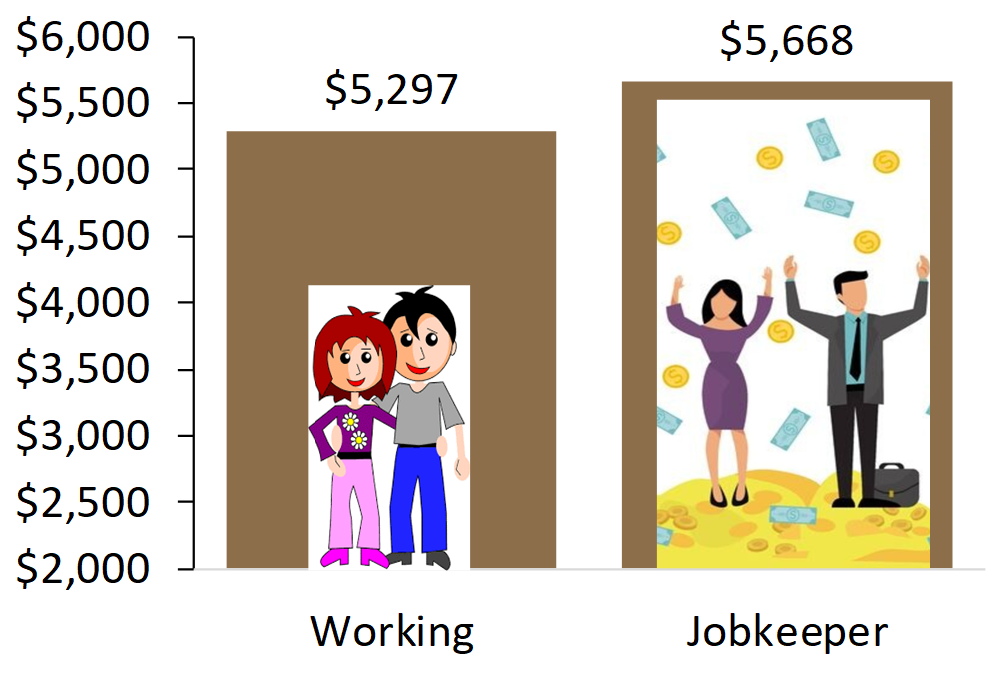

Cash rich JobKeepers (temporarily)

Government support measures in Australia and the US are seeing disposable income rise for some people who have lost their jobs or are on the JobKeeper or equivalent. Chart 1 illustrates the situation in Australia. A working couple in Australia on combined average monthly after-tax earnings of $8,779 prior to COVID-19 had a monthly disposable income of $5,297 after servicing their $800,000 principle and interest mortgage. That same couple now on JobKeeper is receiving $5,668 after tax. To help with cashflow they have deferred their mortgage payments, along with almost 500,000 other mortgage holders in Australia, meaning that all of the $5,668 they are receiving from JobKeeper after tax is effectively disposable income. As such, their “disposable income” has increased 7% (at least temporarily) and this is before accounting for those that accessed early release superannuation. It’s no wonder we saw strong retail sales numbers for May, up 4% on pre COVID levels, and consumer confidence has bounced back to pre-pandemic levels.

In the US, the situation is even more pronounced. In the past three months, personal income excluding government transfers has plunged at nearly a 30% annual rate in real terms. This is unprecedented and almost double the worst decline in the GFC. However, after including government transfers, total personal income has risen by almost 10%. The average worker in more than half of US states is collecting more from unemployment than their job. Many are collecting as much as US$50,000-55.000 on an annual basis.

COVID-19 related top-ups to government unemployment benefits that have led to this situation are intended to be temporary. We certainly view the current situation as artificially inflated, however, it is much easier to instate these measures than remove them. We think it is likely that many of these measures are extended, particularly while the underlying economic situation remains fragile. As such, concerns about a fiscal cliff (withdrawal of fiscal stimulus) we think are overdone and premature. This situation also highlights the magnitude of the current economic stimulus.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.