Global equity markets climbed higher over June, with the MSCI World Index rising 2.4%. In the US, strong gains among tech stocks saw the NASDAQ post a 5.5% increase, with the S&P500 rising 2.3%. The Australian market finished its best financial year on record, with the ASX200 up 24% in the past 12 months and 2.3% in June. This was despite intermittent lockdowns around the country.

European equities were also higher, with the MSCI Europe rising 1.6%. A hawkish (or less dovish) stance from the Fed caused the yield curve to flatten, with the US 10-year Treasury bond yield falling 13 bps to 1.45% and Australian 10-year Treasury bond yield down 12 bps to 1.53%. Commodity markets were mixed. While the price of Iron Ore and Brent Oil continued to strengthen, reaching US$214/t and US$74.8/bbl respectively, Copper experienced a 7.6% pullback. Gold was also weaker amid rising equities and a stronger dollar, falling 7.2% to US$1,763/oz. The Australian Dollar was weaker, falling to US 75c.

Connecting the dots at the Fed

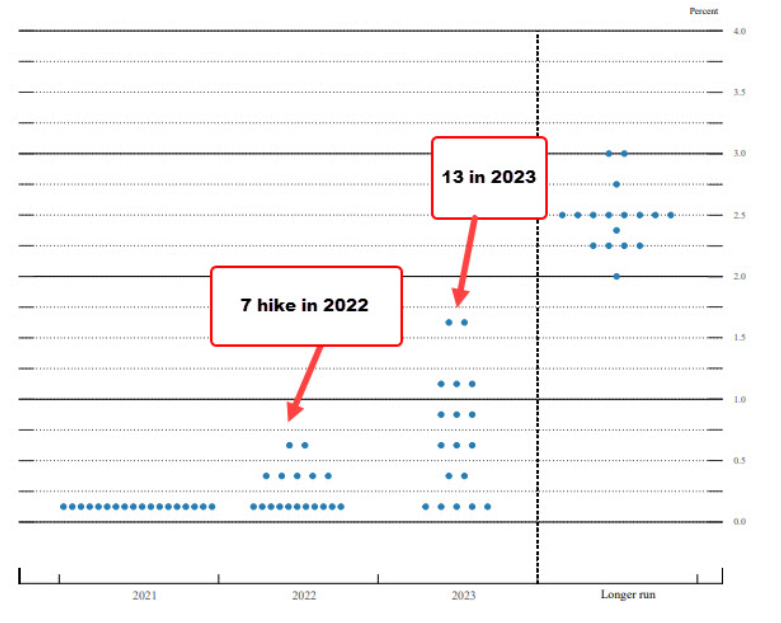

The Fed recently jolted markets after the Federal Open Market Committee (FOMC) signalled it might raise rates twice in 2023 (in March, the Fed projected no rate hikes until 2024). According to the Fed’s dot-plot, which represents individual committee members’ views on future Fed Fund rates, 13 members expected the Fed to start raising rates in 2023, up from 7 previously.

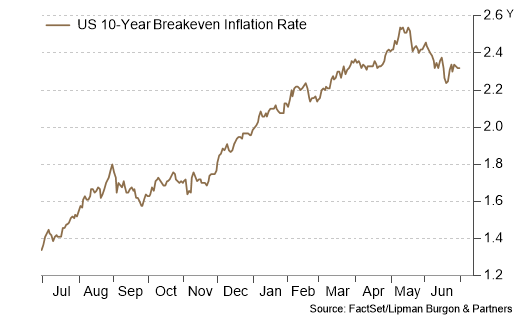

The projection for headline PCE inflation in 2021 was also revised upward to 3.4% from 2.4% in March. Chair Powell also stated that “there is a possibility that inflation could turn out to be higher and more persistent than we expect”, noting that the committee “would be prepared to adjust the stance of monetary policy” in response to stronger inflation. This hawkish surprise saw the 10-Year Treasury yields jump 8 bps to 1.57%; however, the market seems to be buying into the narrative that the current inflationary pressures are indeed “transitory”. The US 10-Year breakeven level of inflation peaked in May at just over 2.50% and even fell after the hawkish comments from some of the Fed speakers.

Reflation trade on pause

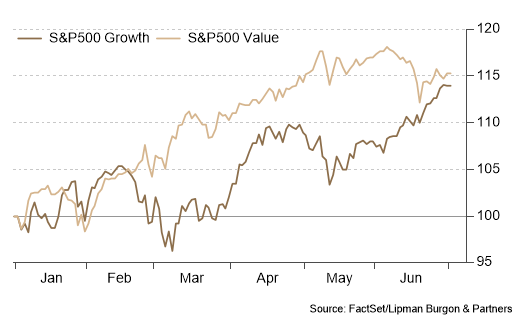

The ‘reflation trade’, a term that describes the strong performance of economically sensitive and value stocks should inflationary pressures emerge, seems to have been put on pause. Despite strong outperformance of value stocks in the early months of the year, increasing concerns surrounding the ‘delta’ variant of COVID-19 have weighed on this thematic, with growing case numbers and lockdowns around the world slowing the pace of economic re-opening. This has seen the performance of growth stocks pick up while value stocks have drifted sideways.

Once the vaccine rollout has advanced and economies approach herd immunity, we expect reflation to return.

Outlook

Despite rising concerns surrounding the COVID-19 ‘delta’ variant, we remain positive on equities in the medium-term, primarily driven by the prospect of global economic re-opening and sustained accommodative fiscal and monetary policy. The excess earnings yield of stocks over bonds in the US currently stands at 3.2%, still substantially higher than pre-GFC levels of ~2% (i.e. equities are cheap compared to bonds). Our base case is that accelerating economic growth drives strong medium-term earnings growth, pushing equities higher. As a result of these and other factors:

- We are positively disposed to cyclical and value stocks.

- We believe that portfolios require protection from the threat of long-term inflation, which can be achieved through holding equities, property, infrastructure and gold.

- We continue to see high-grade bonds as largely uninvestable and prefer various alternative investments that add diversification to portfolios whilst also supporting income and growth targets.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.