Market commentary and investment outlook

Equity markets staged a recovery in the fourth quarter of 2023 as bond yields fell, and investors become increasingly encouraged by signs of an economic soft landing. So, how should you position your portfolio?

IS A SOFT LANDING BACK ON THE CARDS?

During the fourth quarter of 2023, prevailing market themes revolved around the US Federal Reserve’s (Fed) notable dovish (expansionary monetary policy) pivot, as signs emerged that the aggressive tightening cycle in previous months may end. This came as Chairman Jerome Powell’s commentary suggested the Fed may be close to finishing the series of rate increases following a lower inflation print.

The quarter began with a bumpy ride for investors as geopolitical tensions rose significantly following the Hamas terrorist attack on Israel on October 7th. Both bond yields and oil prices rose sharply amid investor concerns of a higher for longer interest rate environment. However, a reversal of that sentiment sent global and domestic equities higher in the last two months of 2024. It also highlighted the fickle nature of markets during uncertain macroeconomic environments. The S&P/ASX200 surged 8.40% last quarter on the back of a strengthening currency, recouping its earlier losses to end the year up 12.42%. The MSCI World Index (in AUD terms) also climbed last quarter, ending the year up 23.75% (Chart 1).

Firms with exposure to artificial intelligence soared over 2023, finding strong investor support for the technology’s transformative potential on productivity and efficiency. This underpinned a significant uplift for the NASDAQ, taking its one-year gain to 44.64%. Since hitting a peak in September, oil prices and have now slumped, falling about $20USD over the last quarter despite the prospect of ongoing production cuts in the new year. This again presents a marked turnaround of investor sentiment since October as concerns about monetary policy dragging on global demand and non OPEC production oversupply took hold. This puts downward pressure on prices making the oil price outlook difficult for traders to determine, particularly in light of continuing geopolitical uncertainty. Meanwhile, the soft landing narrative continues to be debated, as recent US inflation data exceeded expectations, rising from 3.1% to 3.4% in December. Housing costs were responsible for more than half the headline increase with energy another large contributor (though this component is volatile and excluded from core CPI; the more valuable metric to follow).

Nonetheless, the generally positive outlook for 2024 and downward trending inflation have supported a fixed income market rally in Q4, with long term bond yields rapidly falling (Chart 2). US treasuries declined 69 basis points over the quarter to 3.88%, while Australia’s 10 year yield has fallen to 3.96% – a considerable decrease from peaks of up to 5% in the second half of 2023. Investors are hopeful of interest rate cuts in 2024 and the VIX (Chicago Board Options Exchange Volatility Index) has ended the year at 12.45 – near its lowest level since the pandemic.

THE AUSTRALIAN DOLLAR RALLIES

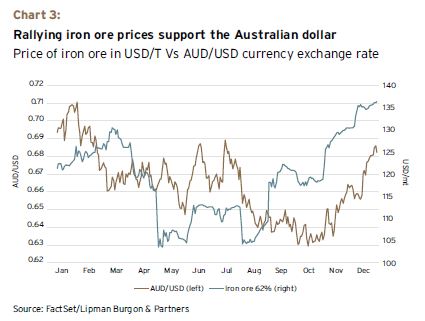

The Australian Dollar (AUD) has rebounded from lows of US63¢ in October to US68¢ by the end of December spurred by rallying iron ore prices (Chart 3) and expectations of US rate cuts. Iron ore hit $144.81 USD/ Tonne; a 35% gain from October lows bolstered by strength in the Chinese economy (the world’s largest importer of iron ore). China’s factory activity expanded at a quicker pace in December, with PMI (global manufacturing purchasing managers’ index) rising to 50.8 in December from 50.7 in November and marking the fastest expansion in seven months. Soni Kumari, a commodities strategist at ANZ, said that the increase was “momentum driven” by a series of stimulus announcements by Beijing to support its economy. The price rise has led to renewed interest in smaller iron projects across Australia that in turn, could continue supporting a strengthened AUD. However, weakness in the Chinese economy or risks of a recession in 2024 could see the price of commodities (including iron ore, copper, and lithium) fall with a resultant decline in the value of the AUD. LBP manages currency risks by maintaining a considered hedging ratio in its international exposure.

The strengthened exchange rate reduces the risk of import inflation, which was a concern for the Reserve Bank of Australia (RBA) while inflation remained sticky. CPI has now eased more than forecast to a two-year low of 4.3%, sparking hope for variable rate mortgage holders and signalling another interest rate rise may be off the table. A statement by Michele Bullock following the December Reserve Bank Boad Meeting highlighted its decision to hold the cash rate at 4.35%, which was driven by the economic performance broadly tracking to expectations. ‘’Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and evolving assessment of risks’’, the statement said. Given that the CPI was 0.1% below expectations, the market has put the likelihood of an interest rate rise in February at only 3%.

OUTLOOK FOR 2024

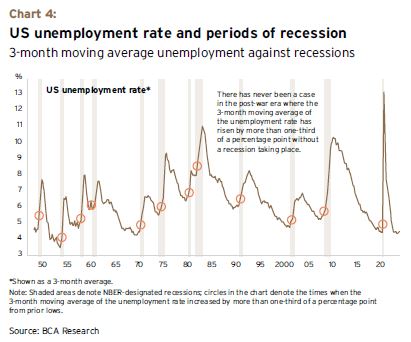

Although 2023 ended on a positive note for investors with the return of the soft landing narrative, Shane Oliver, Chief Economist at AMP, has warned that the risk of a recession in Australia is around 40%. These high risks are due to the lagged impact of interest rate hikes as the economy continues to slow down. The good news is that we know monetary policy is still effective, however the prospect of a soft landing (in any economy) rests on the timing of the central bank in relaxing its policy and reducing rates before unemployment rises too far. Because history has shown when unemployment starts rising, it usually keeps rising. The US has never avoided a recession when the 3-month average of the unemployment rate has increased by more than one-third of a percentage point (Chart 4).

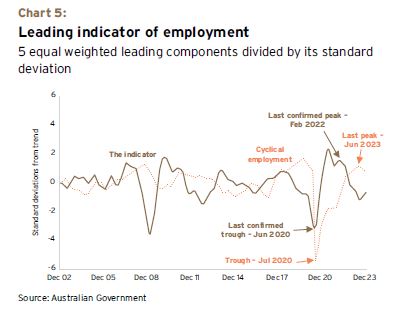

The unemployment rate needs to be carefully monitored from here as US job openings are trending lower and wage growth has slowed – these are lagging indicators that coincide with rising unemployment. In Australia, the Monthly Leading Indicator of Employment has risen for the fourth consecutive month in December, driven by improving consumer sentiment. However, further consecutive monthly increases are required to confirm a turning point in cyclical employment (Chart 5).

According to BCA Research, a soft landing can be achieved however, they do not believe it can be maintained for long because it requires the perfect calibration of monetary policy – an exacting task. To achieve full employment, the central bank needs to cut rates fast enough to keep unemployment at NAIRU (the non-accelerating inflation rate of unemployment which is the lowest rate that can be sustained without causing wage growth and inflation to rise) or else it will increase. However, if it cuts rates too fast, a second wave of inflation may occur and reset the tightening cycle. It is plausible that a global recession may begin in the second half of 2024, just when investors believe a soft landing has been achieved.

PORTFOLIO POSITIONING

So, will we get that soft landing? Truth be told, it is incredibly difficult for even the most seasoned economists to forecast the macroeconomic environment, therefore, we turn our attention to portfolio positioning to achieve long term capital appreciation and wealth preservation. Taking a total portfolio approach, LBP considers the relative attractiveness of opportunities across asset classes.

For example, in the current environment, private debt is offering equity-like returns with a reduced risk profile. As such our resulting asset allocation is overweight private debt and fixed income, while maintaining a meaningful (though underweight) exposure to equities, as well as cash for dry powder to deploy into attractive opportunities. The resultant portfolio is therefore positioned somewhat defensively for the first quarter of 2024.

Within individual asset classes, LBP emphasises the importance of investment selection. In the case of our overweighting to private debt, LBP has allocated to managers who focus on strong covenants, careful evaluation of default risks, and have a strong track record of return and minimal losses. LBP continues to maintain its allocation to equities and other growth assets while its defensive positioning provides strong sources of income through higher yields that will continue to support overall portfolio returns if capital gains fall.

Currently, we see significant opportunities in alternatives to improve diversification in multi-asset class portfolios. A key benefit of alternatives is their ability to produce return streams that are uncorrelated to traditional asset classes – the benefits of which were clear in 2022 when both equities and bonds posted negative returns. Alternatives may therefore reduce portfolio risk and serve as a ballast when other assets face downward pressure.

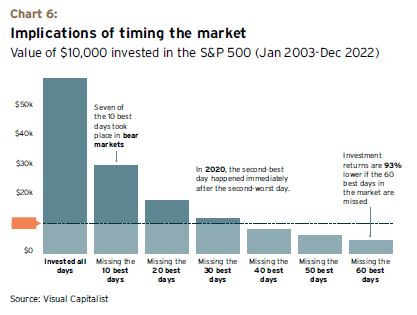

LBP continues to emphasise that timing the markets can be a costly exercise in the long run (Chart 6). As we move into 2024, we highlight how critical it is to maintain a robust investment framework and remain invested through the cycle as the greatest threat to real wealth comes from being underinvested in the long term.