The June quarter CPI figures surprised investors to the downside, with annual inflation now slowing to 6.0%, while unemployment remained at a record low of 3.5%. Australian equity markets responded positively to the lower inflation and despite softer growth, the economic growth rate is running at 2.3%. The Reserve Bank of Australia (RBA) left the cash rate on hold in early August, as it continues to monitor the evolving landscape. Meanwhile, markets welcomed the news that Michele Bullock was appointed as Governor of the RBA, commencing a seven-year term on 18 September 2023. These factors combined to push the ASX 200 2.88% higher in July, in line with global developed markets (Chart 1), with Energy posting the strongest return at 8.8% on rebounding oil prices, followed by Financials and IT.

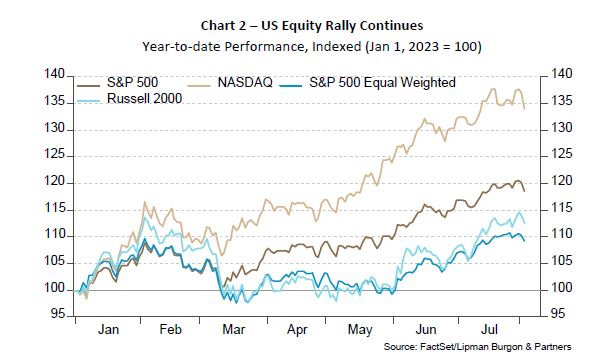

US equity markets continued their rally through July, led by technology-heavy NASDAQ amid an Artificial Intelligence-fuelled boom and CPI slowing down to a two-year low of 3% in June (Chart 2). The drop in inflation is largely attributed to a 16.7% fall in energy prices which rose significantly in 2022 after Russia’s invasion of Ukraine. Despite the fall in US inflation, further rate hikes have not been ruled out as figures are still above the 2% target, confirmed in July with the decision to raise the benchmark overnight interest rate by 25 basis points to 5.5%.

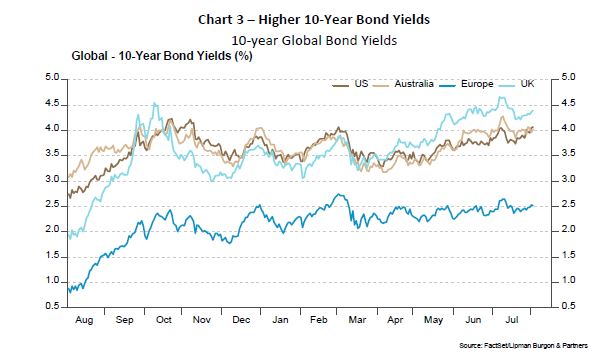

Repricing of the rates outlook to higher for longer has led to an increase in the global 10-year bond yields, with Australia up 3 basis points to 4.05% while the US was up 14 basis points to 3.95% last month (Chart 3). The RBA has reinforced that further rate hikes are likely as services and wage growth inflation continue to contribute to sticky prices. Global credit markets are concerned about tighter lending conditions due to US regional banking turmoil and more recently, Fitch Ratings lowering its sovereign credit rating on the US to AA+ from AAA. The tighter lending conditions may increase yields on shorter-term debt which presents an opportunity for investors.

What Does it Mean for Australian Investors?

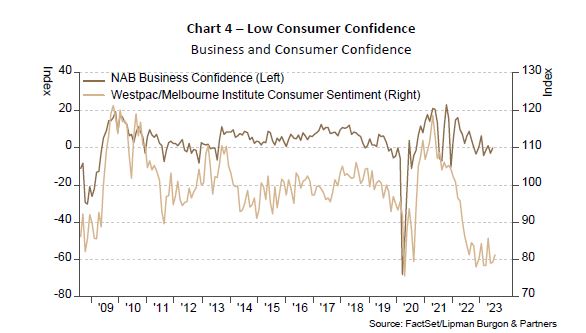

Australia’s cash rate has not quite reached levels seen in the US for one key reason – variable rate mortgages. In the US, over 70% of households are on long-term fixed rate mortgages which means the cash rate hikes are not impacting mortgage repayments to a large degree. In Australia however, over 50% of mortgage holders are on a variable rate loan, with more households set to roll off low fixed rates, and onto much higher rates. Australia’s household debt level also exceeds 100% of GDP so the RBA must walk a very fine line to reduce inflation while avoiding a recession and mortgage stress. Consumer confidence has fallen to Covid lows (Chart 4), and AMP chief economist Shane Oliver puts the probability of a recession starting late this year or early next year at about 50%.

This means a 50% chance of a soft landing which is still on the cards as banking executives at a Senate parliamentary committee recently noted that consumers are largely managing to stay on top of their mortgage repayments. This is likely due to the $300 billion in excess savings accumulated since the onset of the pandemic which is helping to cushion the blow. Even if a recession does occur, there is an opportunity set in private credit and listed fixed income markets, which are often seen as the ‘ballast’ of portfolios. Strict lending standards and covenant heavy private debt funds provide investors with an extra layer of protection against default, and given higher yields, this asset class remains attractive.

Portfolio Positioning

Despite market optimism of a soft landing, this requires near perfect calibration of monetary policy which is a difficult task for the RBA and other central banks to achieve, particularly given the lag in effect to trickle down to the economy. Equities generally peak about six months prior to a recession and the LBP view is to consider reviewing tactical allocation towards the end of this calendar year to be more defensive, rather than continue chasing the equity rally.

We have positioned ourselves slightly underweight equities and have modestly increased allocation to private debt. Given the structural seniority of debt relative to equity, and higher yields post consecutive cash rate hikes across the globe, investors can benefit from greater insulation from market volatility.

While inflation still remains elevated, we maintain our allocation to real assets such as infrastructure, real estate, and transport as these can improve portfolio diversification and provide a degree of inflation protection. Despite some short term volatility and high CBD office vacancy rates, Australia remains one of the preferred real estate markets in the world, consistently ranking in the top three APAC investment destinations.

Alternative investments can also be another portfolio diversifier, providing a source of strong returns that are uncorrelated to major equity and bond markets. LBP continues to stress the importance of maintaining a robust investment framework and remaining invested through the cycle. Time has shown that the greatest threat to real wealth tends to come from being underinvested in the long term rather than remaining invested through short-term volatility as it is incredibly difficult to ‘time’ the market.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.