Global equity markets experienced lift-off in November. Promising vaccine trial results and a benign US election outcome led to improved sentiment and expectations of economic re-opening gathered pace. All major share markets posted double digit gains, with the MSCI World Index finishing November 12% higher. European and US markets rose 12.7% and 10.9% respectively. The Australian market climbed 10.2%, driven in part by the four major banks that were up an average of 18% over the month.

In Australia, 10-year government bond yields rose in November and are now rising in the US, reflecting growing optimism of an economic recovery.

Commodity markets also jumped sharply in November. Crude oil was up a staggering 28.9%, and Copper rose 14.6%. Iron Ore posted a modest 3.7% gain in November and has now gained 10% in the first week of December. Gold prices fell 6.3% in November, exhibiting a negative correlation to equities. The Australian dollar continued to strengthen against the US dollar, rising 4.9% to 74c – its highest level since 2018.

Market rotation set to continue

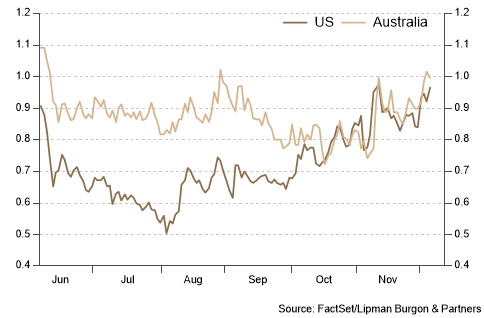

Economically sensitive cyclical and value companies rallied strongly in November. These companies were supported by the improved sentiment towards economic re-opening, with value stocks outperforming growth stocks in the US by 3.5%. Before this move, growth stocks had outperformed value by 35% this year, and as such, there is significant scope for value stocks to continue the catch up in coming months.

The valuation conundrum

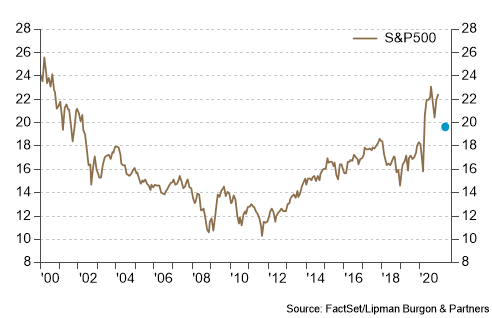

Depending on the measure used, equity markets can appear anything from very expensive to quite cheap. The straight forward price/earnings ratio sees the market looking expensive with the S&P500 forward P/E currently sitting at 22x versus its 20-year average of 15.7x. Even “normalising” the earnings number by +15% (to its pre-pandemic trajectory) still sees the P/E at an elevated 19.5x. However, all assets are priced relative to the risk-free government bond yield, which, despite a recent increase, is still extraordinarily low at less than 1% in the US.

The Equity Risk Premium (ERP), or return premium to be earned from shares over government bonds, currently stands at 3.5% which is broadly in line with its 5-year average and well above pre-GFC levels (the higher the ERP, the cheaper equities are relative to government bonds). Overall, we feel that in the near term, equity valuations can continue to rise as improving market sentiment sees more cash being moved into risk assets.

Outlook

The prospect of sustained policy accommodation (both monetary and fiscal) sees us remaining constructive on equities despite current economic uncertainties. US politics may continue to create instability in the short term, particularly if the election result is contested. We think any significant market correction (a further 5% – 10% from here) would be a good buying opportunity for long term investors. The prospect of enduring negative real interest rates sees us positively disposed to inflation-protected assets like property, infrastructure and gold over the medium to long term. We also remain positive on various alternative investments to help achieve income and growth targets for portfolios, whilst also adding to diversification.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.