The US Presidential Election is around the corner while global central banks continue to monitor key inflation indicators. We delve into policy implications if Trump is elected, and the economic outlook as local inflation accelerates again.

Market Recap

Global equity markets continued to perform strongly over the past quarter, reaching new highs in the US and Australia as rate cut expectations were affirmed by cautiously dovish comments from the Federal Reserve Chairman, Jerome Powell. Consumer sentiment improved with the disinflationary trend in US CPI continuing in June as headline CPI fell to 3% year-over-year, from 3.3% in May. BCA’s US Bond strategists expect that the Federal Reserve will begin to cut rates in September, which is in line with market consensus, however they note it is equally important that policymakers also focus on long term inflation expectations as they remain somewhat elevated. Cutting rates too soon or too severely still presents risks for a rebound in inflation which can have trickle down effects on the rest of the world.

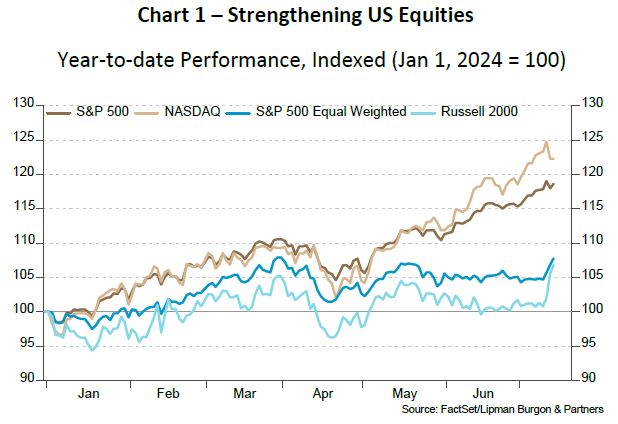

US equity performance was largely driven by gains in big tech as the NASDAQ was up almost 9% last quarter (Chart 1) led by electric vehicle and software companies. Richly priced tech firms like Nvidia may see more volatility as Deutsche Bank recently issued a warning on signs of over-exuberance about the stock. The ‘Magnificent Seven’ are up about 57% in the past year which is more than double the 25% return of the S&P 500 and a sign of very high concentration in the index. US small cap stocks soared as investors turned to look for bargains in other areas of the market pushing the Russell 2000 index up 6% last week, outpacing the S&P 500 by the widest margin since November 2021.

US Treasuries have reversed this year’s declines as cooling inflation has investors betting on a September Federal Reserve interest rate cut. Global 10 year bond yields have all declined in the last month on this data (Chart 2), however, investors have tended to react to the prospect of a Trump win by pushing Treasury yields higher. This is in part on the assumption that Trump’s economic policies would add to inflation and debt given proposals to levy tariffs on imports which would push prices higher while reducing consumer spending power. If after Trump’s assassination attempt, his election odds are assessed to have further improved, there may be a steepening of the US Treasuries curve and a stronger US Dollar. We delve into the US election next.

The US Presidential Election

An assassination attempt on Donald Trump has sent shockwaves through the US and speaks to the amplified danger that political polarisation can bring. The most recent polls conducted after President Joe Biden’s poor debate performance, place Biden behind the former President by three points. The assassination attempt which saw the suspected shooter killed, is likely to add to Trump’s popularity. Additionally, almost 80% of all voters reported having concerns about Biden’s mental and physical fitness and 60% of Democrats said they would prefer someone else as the party’s presidential nominee. Trump’s betting odds have increased to 67% as Judge Aileen Cannon dismissed the criminal case for allegedly stealing sensitive government documents and storing

them, illegally.

Should Trump be re-elected, there are a few key policy implications to keep in mind. Namely the continued shift away from globalisation with more protectionist policies around foreign relations including restrictions on immigration and increased tariffs on imports to support local manufacturing. The higher tariffs may push up consumer prices and therefore reduce real wages (though Trump also intends to further lower corporate and personal taxes). Most Chinese imports are actually produced by US companies with manufacturing facilities in China leading to reduced profit margins and increased prices which may temporarily increase inflation. Over the long term, protectionism will curb economic growth and if the 60% tariff on Chinese imports is implemented (with another 10% on all other imports), it will weigh on China’s exports which may have negative implications for Australia.

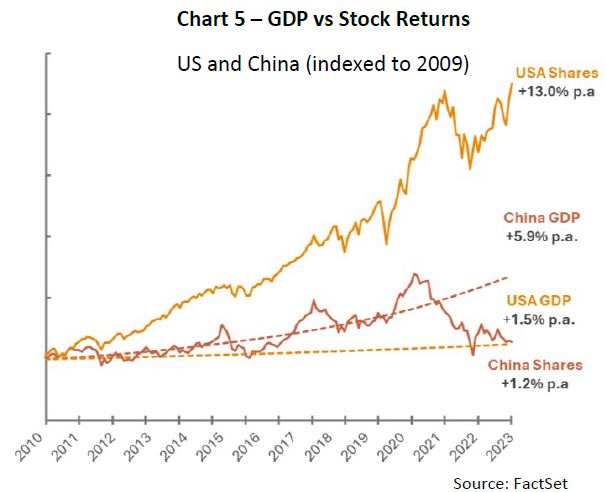

Though there may be some concerns, it is important to note that markets have rewarded long-term investors under both Democratic and Republic US Presidents (Chart 3). Empirical records show no relationship between the elected party and the performance of equity markets, particularly as there is a weak link between economic growth (affected by policy) and equity market performance.

Australian Dollar Strengthens as Inflation Ticks Up Again

Domestic inflation accelerated more than forecast in May, rising to 4%, up from 3.6% in the prior month, while the Australian Dollar (AUD) strengthened to US68 cents. The Reserve Bank of Australia (RBA) kept the cash rate unchanged at the last meeting and will use the official quarterly index to guide its decision about whether to increase interest rates at the next meeting. The Australian Financial Review’s economist survey showed a median forecast that underlying inflation would not return to the 2-3% target range until June 2025 and several economists are forecasting the RBA will hike the cash rate in August.

This outlook, against the continuing disinflationary trend in the US is likely to help support the AUD for the rest of 2024 as the Federal Reserve is more likely to start cutting rates ahead of the RBA. The price of iron ore continues to dip (Chart 4) on the back of falling demand from China as real GDP growth decelerated to 4.7% year-on-year in Q2, down from 5.3% in the previous quarter. An OECD study showed that Australia could suffer a 1.2% reduction in GDP due to a 10% reduction in global trade between major OECD countries. This could occur if Trump wins the election with his protectionist policies. China’s real estate sector has continued to contract, and its economic outlook looks bleak which poses risks for the Australian economy.

Economic Outlook

And thus, we arrive at the economic outlook going forward. First, it is important to highlight that the outlook for the US is going to be quite different to Australia. The US has been experiencing a disinflationary trend consistently and the Federal Reserve is forecast to begin dropping interest rates from September this year. Australia on the other hand has seen an acceleration in monthly CPI and a more hawkish tone from the central bank who must balance the urgency of getting inflation back down to the 2-3% target and its mandate of full employment. The interest rate differential between the USA and Australia is slowly narrowing as local inflation remains sticky and this will likely be a positive for the AUD, though the marked slowdown in the Chinese economy and potential for lowered commodity demand may prove to be a countervailing force on our currency. Recession risks for Australia have moderately increased in 2024 as the economy cools while inflation still runs hot. This may be a particularly challenging situation for the RBA as stubborn inflation may preclude them from cutting rates in response to an economic downturn. We discuss portfolio positioning next.

Portfolio Positioning

So, this quarter we reviewed key market moves, a US election around the corner with two polarising candidates, local inflation accelerating and the risks to economic growth. It is important to be aware of current affairs and the trends in data

but also to acknowledge the limitations in forecasting the future. The consensus view of economists in 2023 was for a global recession and major share market correction and it never occurred. Those warnings are now being broadcast again and investors are questioning should they be paying attention? The answer is yes and no.

We should monitor key economic data as it can be beneficial to keep on top of what economists are expecting and how irrational investors might behave. However, we should not be making drastic portfolio changes in response to any of these given how quickly investor sentiment and polls can change. Markets are quite efficient in the short term, meaning they can capture information in stock prices faster than the average investor can act on any perceived arbitrage opportunity. Additionally, economist predictions are grounded in macroeconomics and expectations for GDP and inflation, and how they might affect asset performance. The relationship is not always clear though, and this data should not drive investment decisions. Chart 5 shows the performance of US and Chinese shares against very different GDP trendlines as the perfect example for why we do not rely on economic predictions to make portfolio changes.

Instead, we prefer to take a longer-term view when it comes to asset allocation and portfolio construction decisions. It is the preservation of capital by maintaining a multi-asset class portfolio that is sufficiently diversified across all regions, sectors, asset classes and fund managers that remains our key objective. We seek to construct a portfolio that derives its return from various factors (equity, currency, momentum, value, growth, and interest rates, etc.) as it will deliver more consistent performance across a range of economic environments, whether they be in periods of economic strength or weakness.

Our recent whitepaper ‘Ten Principles for a New Investing Paradigm’ highlights the importance of separating behavioural alpha, signals and noise. Economists have recognised that natural cognitive biases such as loss aversion, herding and

confirmation bias, can exert a pervasive influence on investment decisions which more often than not, leads to less-than-optimal outcomes. Extensive research has shown that most active, tactical investors tend to underperform the market which highlights the significance of managing behavioural biases. To protect against behavioural errors, it is essential to have a robust investment framework, and a well thought-out portfolio whose allocations are designed to interact with each other to achieve the best outcomes.

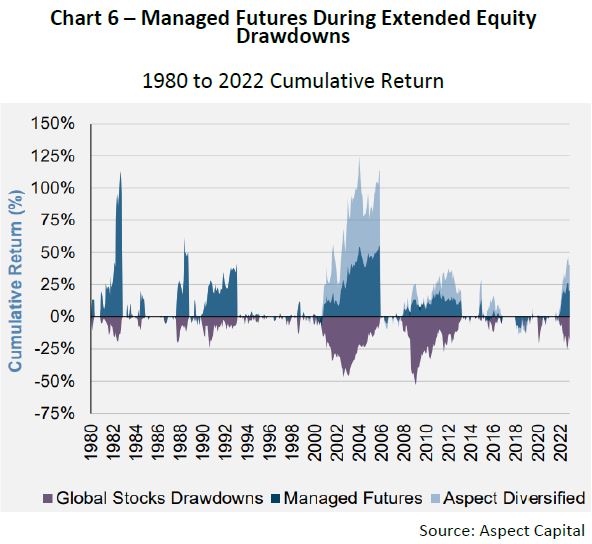

What better way to demonstrate this than with an example? When we review our allocation to alternative asset classes, we consider their portfolio role and what kind of ‘protection’ they can provide investors when other areas experience market stress. An excellent example of this is in trend following or managed futures strategies. These strategies use quantitative models to follow trends (up or down) across all asset classes (commodities, equities, currencies, interest rates, etc.) to add alpha through different factors. They complement a bond and equities portfolio exceptionally well as they have a positive return skew that can add substantial portfolio returns during sustained market drawdowns (as this is a downward trend they can exploit via futures and other derivative securities). Chart 6 shows how managed futures (Aspect Capital) can provide portfolio protection when global stocks fall.

At LBP, our primary goal is to construct and manage a diverse multi-asset class portfolio that derives its return from various factors and can perform well through the cycle. Time has shown that the greatest threat to real wealth comes from being underinvested, often due to attempting to time the market; something even the best economists consistently get wrong.

Recent Comments