Central banks are winning the battle against inflation while global equities continue to show strength. The RBA remains cautious while China’s stimulus measures should support commodity prices and the Australian economy.

Central Banks Easing as Inflation Cools

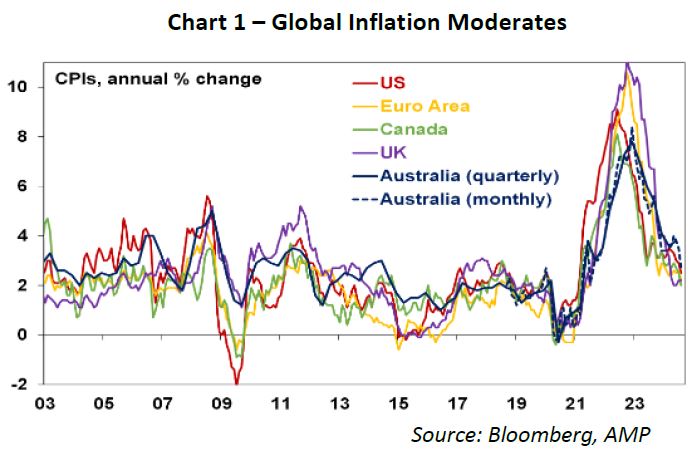

Global equities had a strong quarter broadly as central banks eased montetary policy in response to abating inflation. US stocks leaped to new record highs after the Federal Reserve (Fed) delivered a higher-than-expected interest rate cut of 50 basis points to 4.75-5.0% at the September FOMC meeting. Economists predict the European Central Bank will cut the key interest rate by 25 basis points to 3.25% at the October meeting, marking the third rate cut this cycle. Many major developed countries have shown a steady fall in inflation which is very positive to begin the easing cycle and encourage economic activity (Chart 1). This has shifted the focus away from an inflation-dominated framework and toward economic growth and the health of the labour market.

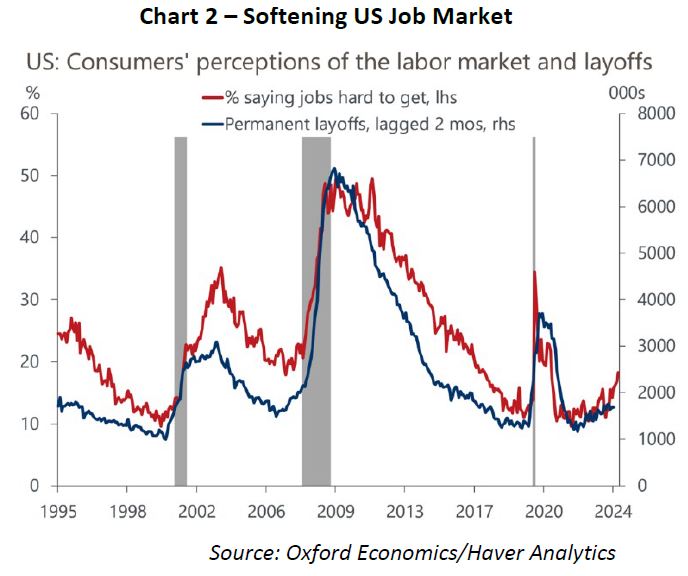

Signalling the beginning of a new monetary easing cycle against the current disinflationary backdrop, the US S&P 500 ended almost 6% higher in the September quarter. Core US inflation was revised downward by 0.2% this year to 2.6% and continues to taper to 2% by 2026. J.P. Morgan Research expects the Fed to cut rates by another 50 basis points at its next meeting in early November, though this is contingent on further softening in the two jobs reports between now and then. Chart 2 shows this softening through 2022 onwards and layoffs have started to inch higher, prompting the Fed to act now to preserve a strong labour market and help the economy return to a favourable place over time. Layoffs are still quite low by historic standards though this metric should continue to be closely monitored.

Signalling the beginning of a new monetary easing cycle against the current disinflationary backdrop, the US S&P 500 ended almost 6% higher in the September quarter. Core US inflation was revised downward by 0.2% this year to 2.6% and continues to taper to 2% by 2026. J.P. Morgan Research expects the Fed to cut rates by another 50 basis points at its next meeting in early November, though this is contingent on further softening in the two jobs reports between now and then. Chart 2 shows this softening through 2022 onwards and layoffs have started to inch higher, prompting the Fed to act now to preserve a strong labour market and help the economy return to a favourable place over time. Layoffs are still quite low by historic standards though this metric should continue to be closely monitored.

While other global central banks including the Swiss National Bank and Bank of Canada are easing their monetary stance, the Reserve Bank of Australia (RBA) held the cash rate steady at 4.35%, maintaining a hawkish stance. Governor Michele Bullock said the board did not actively consider raising rates but did discuss whether or not its hawkish messaging should change at the September meeting. She reiterated policy would have to be sufficiently restrictive to ensure inflation returns to target and does not bounce in and out of the 2-3% range but remains firmly in the band. However, sentiment was still up amid a dovish global tone, pushing the ASX 200 up almost 8% over the last quarter while the Australian Dollar strengthened to US69c.

While other global central banks including the Swiss National Bank and Bank of Canada are easing their monetary stance, the Reserve Bank of Australia (RBA) held the cash rate steady at 4.35%, maintaining a hawkish stance. Governor Michele Bullock said the board did not actively consider raising rates but did discuss whether or not its hawkish messaging should change at the September meeting. She reiterated policy would have to be sufficiently restrictive to ensure inflation returns to target and does not bounce in and out of the 2-3% range but remains firmly in the band. However, sentiment was still up amid a dovish global tone, pushing the ASX 200 up almost 8% over the last quarter while the Australian Dollar strengthened to US69c.

Turning to commodities, the price of brent crude oil fell almost 18% over the last 3 months on expectations of oversupply, weakening global demand on OPEC’s forecasts, and heightened geopolitical risk in the Middle East. Iron ore also saw a 12% price decline over the same period as weak demand in China triggered the sharp sell-off as the nation’s deteriorating property sector weighs on steel prices. Commodity strategists are hopeful that Chinese policymakers will step in and defend the country’s economic growth target of around 5% which could help stabilise iron ore prices.

China’s Stimulus to Revive Growth

Despite the lifting of COVID-19 restrictions at the end of 2022, China’s economy has remained sluggish with a prolonged downturn in the property market that has deflated consumer confidence and curbed spending. The China Shanghai Composite equity index has yet to reach its previous high from December 2021 and the country has been battling with deflationary pressures which increased in September. The weak consumption and investment demand has led to businesses slashing wages and cutting production.

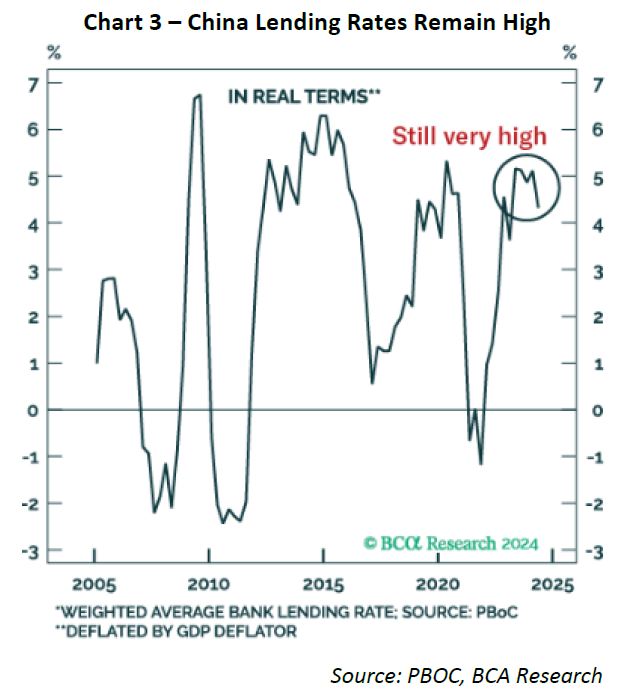

In response to the nation’s deflationary funk, the People’s Bank of China (PBOC) unveiled its biggest stimulus package since the pandemic. Chinese shares surged in response, gaining over 17% in September alone, and given how depressed their prices are; it won’t take much for them to outperform global and emerging market equities for a few months. The PBOC cut interest rates on existing mortgages by 0.5% and supported new lending by reducing the level of reserves banks must set aside before making loans. The bank’s governor, Pan Gongsheng, said he would also ease restrictions on borrowing to invest in stocks and shares on Chinese exchanges and reduce the deposit needed to buy a second home from 25% to 15%. The central bank expects this to help about 50 million households, reducing the total interest bill by about 150bn Yuan (AUD $31bn) a year. Real lending rates remain high in China despite the decline in nominal terms, making it increasingly important to end the persistent deflation and hit their 5% economic growth target (Chart 3).

Furthermore, it was recently announced that there will be a sizeable increase in government debt issuance of 2.3 trillion Yuan (AUD $480bn) worth of special bonds in the next three months. Global commodity markets from iron ore to industrial metals and oil have also been volatile on hopes that monetary support will stoke sluggish demand.

Impact on Australia

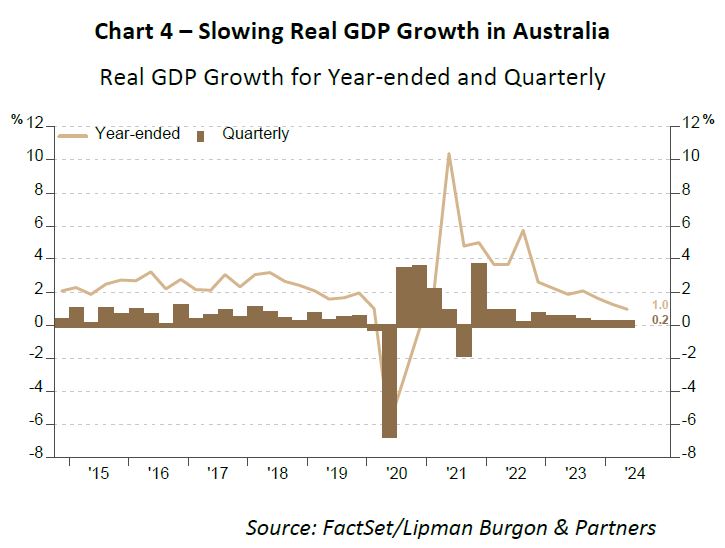

Australia’s largest trading partner has struggled to recover from the pandemic, weighing down commodity prices crucial to the strength of the federal budget. Treasurer Jim Chalmers, who has been in Beijing recently said the steps taken to boost China’s economy were a ‘’very, very good development for Australia’’ particularly as the weakness in the Chinese economy does flow to local conditions. This is particularly important as local real GDP growth has been trending down post the aggressive rate hiking cycle (Chart 4). Some of the key reasons the Australian economy is slowing include China’s slowdown and its impact on iron ore prices, as well as continued inflationary pressures and the impact of higher interest rates. The reduced demand for iron ore is bad news for our budget surplus given Australia’s reliance on iron ore export revenues. On a positive note, though, the budget assumes an iron ore price of $US65 over the medium term and right now, we are still above those assumptions.

Additionally, Beijing’s pivot to economic stimulus also bodes well for Australian shares, particularly miners like BHP, Rio Tinto and Fortescue Metals. CBA is optimistic, predicting that the stimulus will support iron ore prices between $US100 to $US110 in the fourth quarter. The sentiment boost will be a positive one amid a hawkish central bank tone which is unlikely to change for the time being as core CPI persists above target, and the labour market remains resilient.

Portfolio Positioning

So, how do the above macroeconomic conditions and events inform our portfolio positioning going forward? As always, at LBP, we emphasise a long-term and goal-oriented approach to portfolio construction. Our portfolios focus on diversified sources of return to meet investors’ specific needs and constraints regarding returns, risk, income, and liquidity. This framework guides our asset allocation and fund selection decisions.

As we enter the final quarter of 2024, the LBP Investment Committee observes a mixed outlook for risk assets. While overseas rate cuts and falling inflation are positive signals, they

are counterbalanced by softening US labour markets and a hawkish stance from the RBA. In response, we have decided to maintain our current equity allocation, begin reducing our allocation to debt investments, while increasing our allocation to private infrastructure.

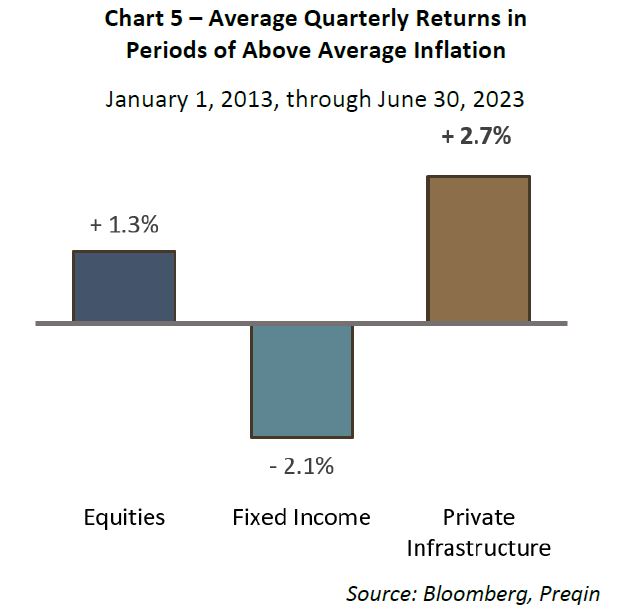

Private infrastructure aligns well with our asset allocation framework for several reasons. Its risk, return, and income profile falls between equities and bonds, allowing for a slightly more bullish portfolio stance. It also improves overall factor diversification and inflation resilience while maintaining consistent income generation.

By diversifying factor exposures, we aim to insulate portfolios from drawdowns in specific asset classes such as bonds, equities or real estate, and improve overall performance consistency. In line with this philosophy, we maintain our focus on alternatives and real assets as portfolio diversifiers with reduced volatility and/or lower correlation to traditional asset classes.

Infrastructure investments offer several key advantages. High barriers to entry, including significant capital requirements, strict regulations, and often monopolistic markets, lead to more stable and predictable returns. For instance, projects like airports, power grids, and data centres require substantial initial investment and operate within strict regulatory frameworks or monopolistic markets, making it challenging for new competitors to enter the market. Infrastructure investments can provide steady income through user fees or long-term government contracts, ensuring reliable cash flow. Many infrastructure investments are linked to inflation, offering a hedge against rising prices and economic uncertainty as illustrated in Chart 5.

Chart 6 highlights the essential nature of infrastructure services, such as electricity, water, and transportation, and how that makes them less susceptible to economic downturns, resulting in more stable returns compared to stocks and bonds.

These characteristics of infrastructure investments align well with our portfolio goals of maintaining consistent income generation, improving overall factor diversification, and enhancing inflation resilience. By incorporating these assets into your portfolios, we aim to bolster the resilience to various economic conditions.

These characteristics of infrastructure investments align well with our portfolio goals of maintaining consistent income generation, improving overall factor diversification, and enhancing inflation resilience. By incorporating these assets into your portfolios, we aim to bolster the resilience to various economic conditions.

Over the next two quarters, the LBP investment team will due diligence a vast range of existing and newly available open-ended private infrastructure options to source then select the few we consider reliably aligned with the portfolio objectives. We continue to maintain that a robust investment framework is integral to preserving wealth, and remaining invested through the cycle will produce the best portfolio outcome.

Recent Comments