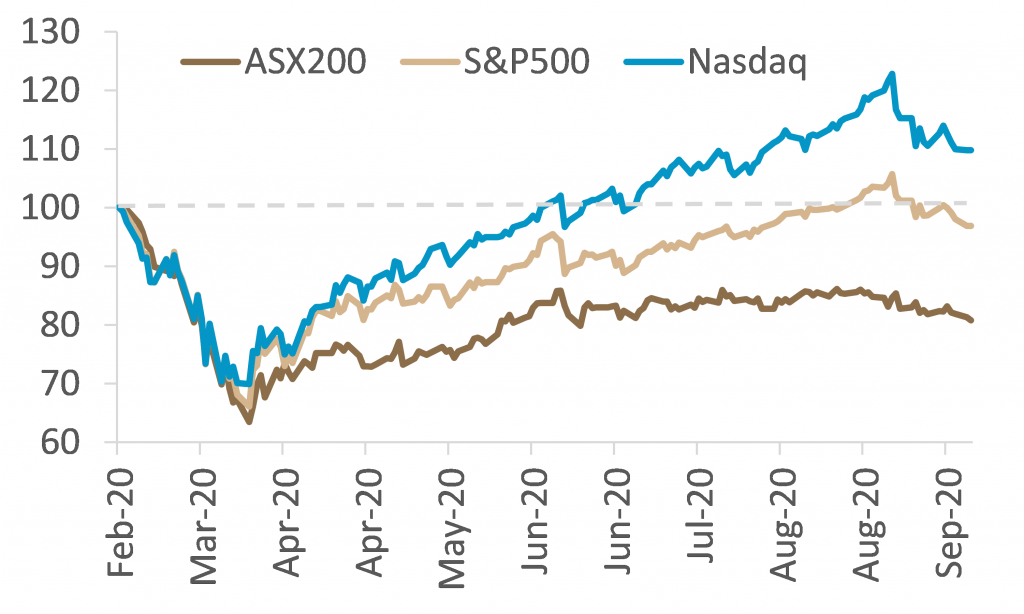

Global equity markets have hit a soft patch in September with the MSCI World Index down 6% from its peak. This follows an extraordinary five month rally of 50% from the COVID-19 driven lows in March. Initially the correction was hardest felt in growth and tech stocks that had led the recovery, however in recent days increasing concerns that economic growth will not meet expectations has seen cyclical stocks underperform. Three key factors are behind the increasing growth concerns:

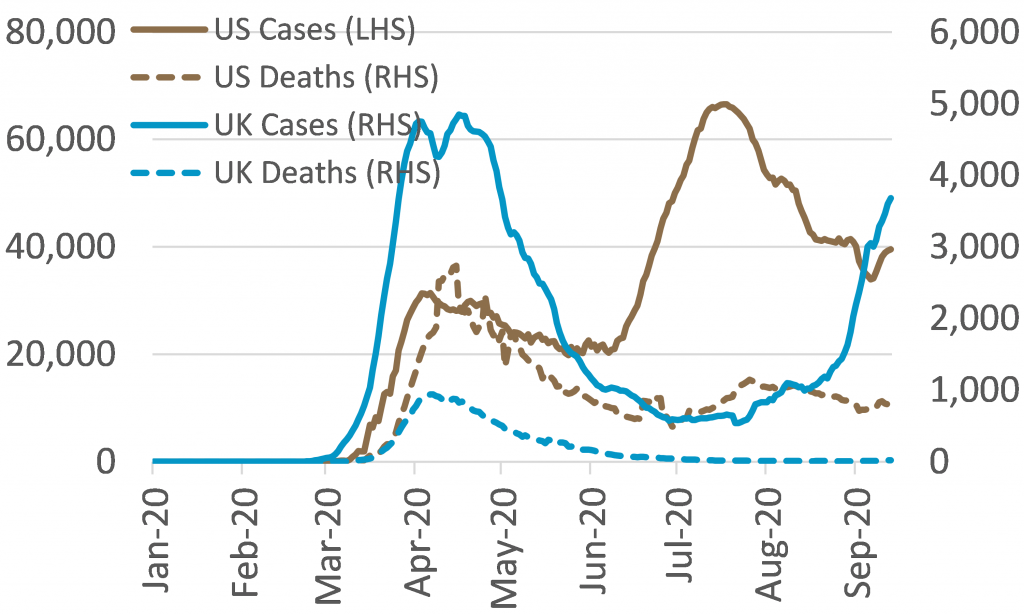

- Rising COVID-19 cases in Europe and a bottoming in US case numbers;

- Declining probability that US Democrats and Republicans will pass further stimulus spending before the November election;

- Confusion over whether the Fed’s changed inflation target will lead to as much policy accommodation as had been expected.

There have been many market risks prevalent throughout the recent recovery, and a number remain as we outline below. However, there are also a number of factors that support optimism including very accommodative fiscal and monetary policy as well as relative valuation support for equities when compared to bonds. On balance we remain constructive towards equities on a long term basis. In the near term a continuation of growth concerns may see equity markets decline further. We would see a further 5-7% fall in the S&P500 as a level at which we would accelerate deployment of capital into equity markets. That level would equate to a PE of 18.5x trend earnings which would be attractive compared to near zero bond yields globally.

Reasons to be cautious

Between the upcoming US election, rising COVID-19 cases and continuing geopolitical tension, there are a number of risks in the current environment exacerbating uncertainty about the future:

- Second wave of COVID-19 cases across Europe – U.K. the most effected, with Boris Johnson announcing new restrictions.

- US election politics – Concerns over the stalemate on much needed further fiscal stimulus package have been inflamed by the passing of Supreme Court Justice Ruth Bader Ginsburg.

- Vaccine vacuum – A lack of positive vaccine updates in recent weeks has led to concerns about delays – Scott Gottlieb (former FDA commissioner) warned that the US may experience one more wave of cases.

Sources of optimism

Amid all the attention-grabbing negative headlines there are some positive signs in the management of the virus, vaccine possibilities, confidence in the economy and ongoing policy support:

- Hospitalisations are much lower in the second wave in Europe. Death rates are also significantly lower (Chart 2)

- Vaccine progress updates – Preliminary results for Pfizer’s stage 3 trials are expected to be available on Sep 27. Other vaccines are advancing and China is also reportedly close.

- Policy support – Despite some short term confusion over Fed inflation targeting more broadly global central bank policy remains very accommodative and central banks remain in whatever it takes mode. With many active QE programs, yields should remain depressed and there is ample liquidity in the system. Similarly, government fiscal support remains active despite near term US political games.

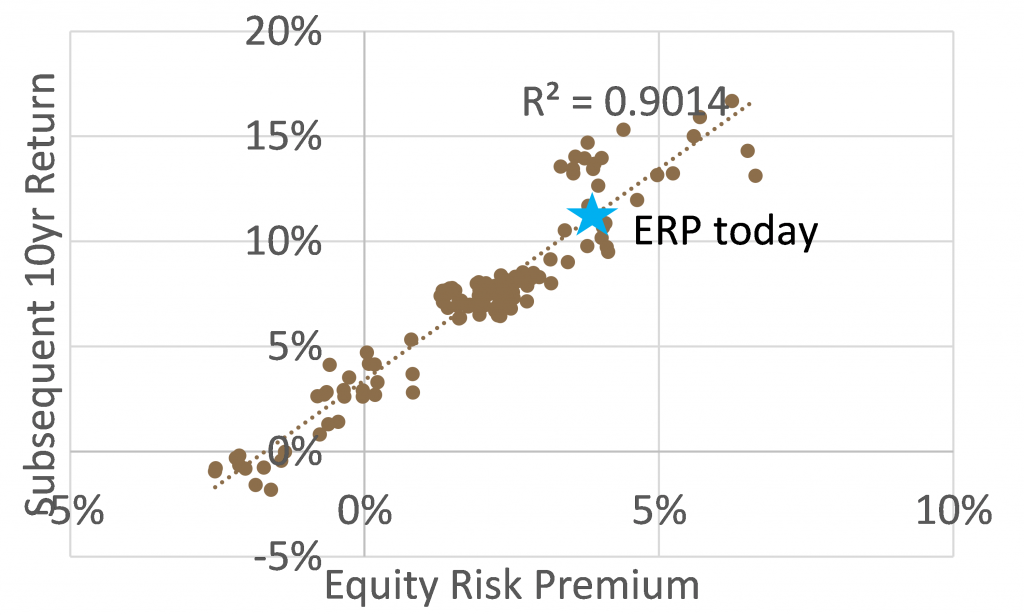

Long term equity valuation support

The relative value of equities versus bonds can be measured as the equity earnings yield (the inverse of the P/E) less government bond yields. This is a proxy for the Equity Risk Premium (ERP). The current equity risk premium is elevated at 4%. Equity Risk Premium is a key factor in explaining the subsequent 10-year per annum equity returns (R squared 0.9). A regression of the historical relationship suggests that equities today, with an ERP of 4%, should offer greater than 10% per annum returns for the next 10 years (Chart 3).

A big driver of the current elevated equity risk premium is the very low prevailing interest rates. Key to our view on long term equity valuation support is our expectation that real interest rates are likely to stay very low or even negative for an extended period of time.

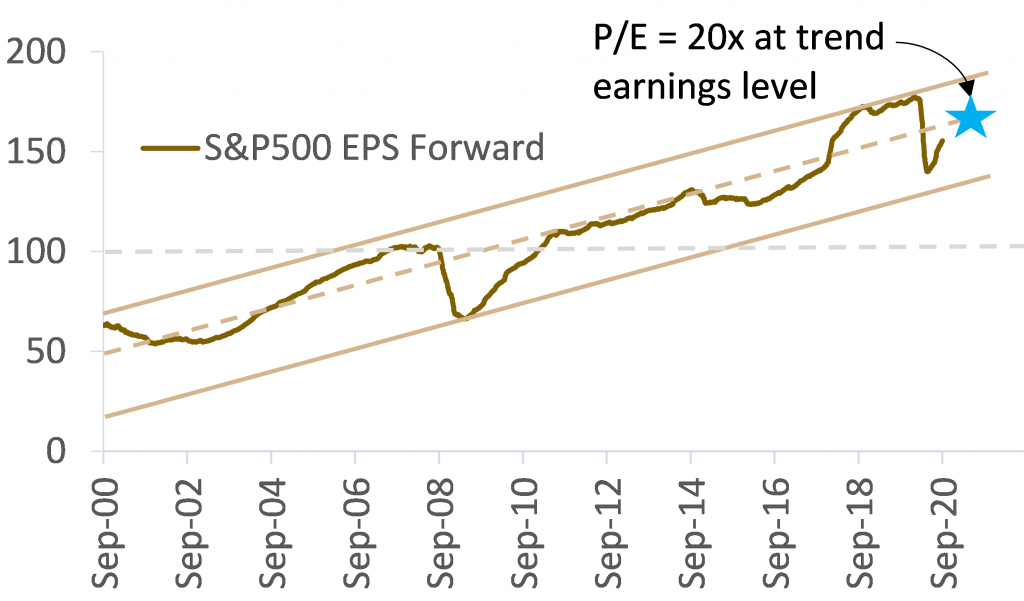

Company earnings today are artificially low because of global economic shutdowns. 20 year trend earnings gives a better sense for underlying earnings power and value. The S&P500 is trading on 20x trend earnings currently (Chart 4). As an absolute PE that is still expensive in a historical context, but would represent an ERP of 4.3%, amongst the cheapest that equities have been relative to bonds outside of the GFC and the depths of the European debt crisis.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.