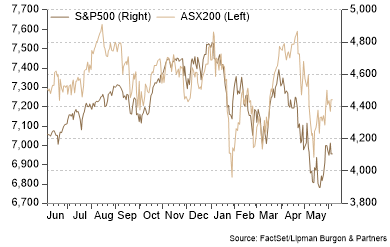

Global Equity markets finished modestly lower in May as investors continue to price in the risks of a recession. Developed and Emerging markets exhibited similar returns, with the MSCI World Index falling 0.16% and MSCI EM Index experiencing a similar 0.14% drop. Australian equities underperformed its global peers as lower manufacturing activity in China weighed on global industrial metal prices. The ASX 200 fell 2.6% during May.

US stocks were mixed, with a rally late in the month helping to offset earlier weakness. The S&P 500 finished 0.18% higher while the NASDAQ fell 1.93%.

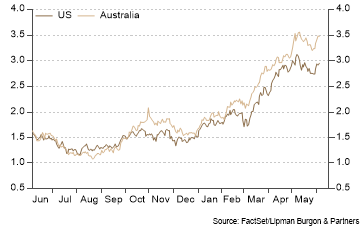

In Fixed Income markets, dampening expectations of the US’s growth prospects and concerns around the Federal Reserve’s over-tightening policy saw the US 10-Year Treasury Bond yield fall 5bps to 2.84%. In stark contrast, Australia’s better than expected Q1 GDP figures helped cement growth expectations, and as a result, bond yields trended higher, with the Australian 10-Year Government Bond Yield up 22bps to 3.34%.

Commodity markets were mixed. Brent Crude rose 15.8% to $125/bbl as the war in Ukraine continued and supply chain risks remained elevated, with the EU agreeing to a partial ban on Russian Oil imports. On the other hand, lower Manufacturing activity in China weighed on the prices of metals, with Iron Ore retreating 11.4% to $133/t.

In May, the stronger relative performance of global financial markets likely reflects easing concerns about inflation and more attractive valuations following the year-to-date selloff. The performance of financial assets going forward will be dependent on the economic outlook, and it is likely that more volatility lies ahead.

Against this uncertain backdrop, we have captured some of the common questions clients have asked us over the past few months. We hope these insights into everything from what’s driving the market selloff to the key takeaways for investors help as you consider your portfolio objectives.

What has been driving market performance over the past few months?

Global equity markets have remained volatile, with increasingly frequent short-term bear rallies followed by selloffs. Most of the market movements can be attributed to several near-term headwinds, including central bank tightening to control inflation, ongoing uncertainty around the conflict in Ukraine and, as a result, higher energy prices, and China’s strict Covid-19 policy and associated supply chain disruptions. Like the forces driving equities, the potential central bank response to persistent inflation has prompted a significant reaction from bond markets. The factors above increased recessionary concerns, which led many investors to pull back from equity markets.

What are economic indicators telling us?

According to BCA Research’s latest Global Asset Allocation research paper, the jury is out on the probability of a recession – and is likely to stay out for a while. However, several warning signs are starting to flash. The US housing market could soon see price declines given its interest rate sensitivity and the 200bps rise in the 30-year mortgage rate since the start of the year. Wages have failed to rise in line with inflation, which has led to retail sales falling year-on-year in real terms. And there are some early reports that companies are slowing their hiring, presumably on worries about the durability of the post-pandemic recovery. The Citigroup Economic Surprise Index, which tracks whether a core set of economic data is below, at or over expectations, has turned down in most regions (Chart); and global industrial production is falling year-on-year (albeit partly because of lingering supply-side bottlenecks).

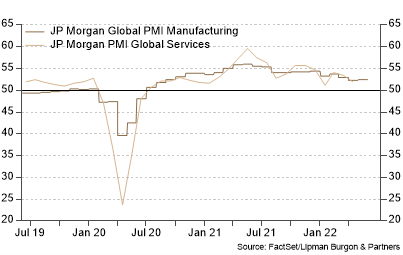

However, even amid ever-present signs that the economy is weakening, evidence of an outright recession isn’t apparent. One of the strongest arguments against a recession is the $2.2 trillion of excess savings held by US households (and $5 trillion among households in all major developed economies). The argument is that, even if interest rates rise and real wage growth is negative, consumers can continue to spend by dipping into these accumulated savings. Additionally, employment remains robust, and manufacturing and services activity hasn’t yet experienced significant declines, albeit it is down from its peaks.

Furthermore, S&P 500 earnings have come in at 7.3% above expectations in Q1, with nearly 80% of S&P 500 companies surprising on the upside. Earnings are up 10.4% year-on-year in Q1, and sales are up 13.6%. Looking to Q4 of 2022, S&P 500 companies are expected to report an average of $60.93 in EPS, up 4.3% from what analysts expected at the start of the year. According to our global economics research provider, BCA Research, the trend-like global growth remains the base case for 2022. Recessionary concerns are expected to fade in the coming months, which could boost equity markets. It is important to note that economic vulnerabilities are greater outside the US. Nevertheless, as some economists point out, there is enough pent-up demand on both the consumer and capital spending side to sustain growth.

All in all, while we don’t anticipate an imminent recession, it is too early to predict with a high degree of certainty whether this will be the case over the next 12-18 months. Therefore, volatility is likely to persist, and equities might move sideways over the near term.

What are the factors in favour of upside in equity markets?

While we remain cautious and continue to monitor economic data closely, there is also a chance that markets will see a near term stabilisation. If BCA’s forecast is correct and inflation will in fact slow down in the second half of the year, we may see an upside for the markets in the near term. Firstly, the forces that pushed down stock prices are starting to abate: the war in Ukraine no longer seems likely to devolve into a broader conflict; the number of new Covid cases in China has fallen, and global inflation has likely peaked. Secondly, global equities are now trading at 15.6-times forward earnings, and only 12.6-times outside the US, offering more attractive buying opportunities. According to BCA Research, the next 18 months of falling inflation fears could see stocks recover much of their losses, provided economic data doesn’t turn outright negative, prompting a sharp increase in recessionary expectations.

What are the takeaways for investors?

Given the current environment, we believe that neutral positioning is warranted until there is more evidence. We remain focused on long-term outcomes and believe that timing markets is challenging and doesn’t tend to lead to material outperformance over the long term. According to Bloomberg, stocks usually rally when the worst doesn’t pan out, with the S&P 500 jumping 12%, on average, over the ensuing 12 months. This may be the case in the second half of the year, especially if geopolitical and inflationary pressures dissipate, in line with BCA’s expectations.

It is also important to remember that stock market volatility is not abnormal. Data shows that despite an average intra-year drop of 14%, the S&P 500 has provided positive returns in 32 of the last 42 years (JP Morgan Research). Lastly, diversification reduces risk, particularly when volatility is high. Rising inflation has prevented bonds from offsetting stock market losses so far this year. However, if the economy was to move into a recessionary period, Treasuries would likely rally, helping provide stability to balanced portfolios. More generally, a broadly diversified portfolio containing stocks, some bonds and alternatives should protect a wide set of economic headwinds and black swan-type events.

Portfolio positioning

We believe that a cautious portfolio positioning with a neutral weight in global equities is currently warranted. Nevertheless, it is important to note that Global equities continue to be more attractively valued today than a year ago, with non-US equities preferred on valuation metrics. However, the recent geopolitical tensions and the ongoing war in Ukraine continue to moderate our preference for non-US equities over the near term. The latter is likely to outperform in the second half of the year.

Allocations to property, infrastructure, Gold, and other commodities should be maintained for inflation hedging and portfolio diversification. We also remain positive on various alternative investments and private market opportunities for downside protection and diversification of return streams in portfolios.

In times of market volatility, it is important to have a robust investment framework and focus on long-term investment objectives.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.