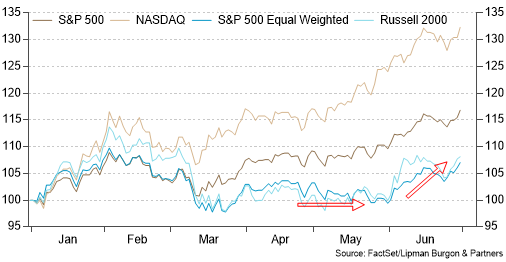

There has been much discussion that a handful of mega-cap tech companies have driven the year-to-date rally in equities. In particular, those that stand to benefit from an AI-induced revolution. While AI-linked and mega-cap tech stocks continued to strengthen, the equity rally is beginning to broaden (Chart 1). The S&P 500 Equal Weighted index gained 7% in June, outperforming the S&P 500 and the Nasdaq composite indexes. According to Bloomberg estimates, the Invesco S&P 500 Equal Weight ETF notched a record US$5bn inflow for June.

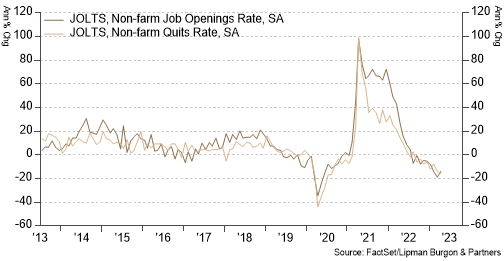

Beneath the broadening rally follows a slew of data pointing toward disinflationary trends while also highlighting economic resilience. May CPI in the US came in softer than expected, with headline CPI decelerating to 4.0% year-over-year, the lowest annual increase in over two years. Personal Consumption Expenditure (PCE) also fell to a two-year low, declining from a peak of 7% year-over-year in June 2022 to 3.8% in May. Forward-looking indicators of inflation also point to lower inflation. For example, the quits and job openings rates, which typically lead to wage growth, have declined meaningfully (Chart 2).

Economic data has also been resilient, contrary to beaten-down expectations and is pushing out forecasts of a US recession. The Citi Economic Surprise Index, measuring the difference between official economic results and forecasts, has increased substantially (Chart 3). US Q1 GDP growth was revised upward to 2% from the prior estimate of 1.3%, reflecting upward revisions to consumer spending and export activity. May durable goods orders rose 1.7% month-over-month, surprising against estimates for a 1.0% monthly decline. May Housing data also surpassed expectations, with builder confidence the highest in nearly a year, housing starts the most elevated in over a year, and multi-unit starts the highest in nearly four decades.

The hope of a soft-landing falling inflation coupled with sturdy growth has caused the equity rally to broaden. While this may fuel continued near-term upside for equities, we would not be in a rush to chase the equity rally. We believe the risks to the economy are symmetric, and as previously discussed, navigating a soft landing requires near-perfect calibration of monetary policy—an incredibly difficult task.

Opportunity Set in Private Debt

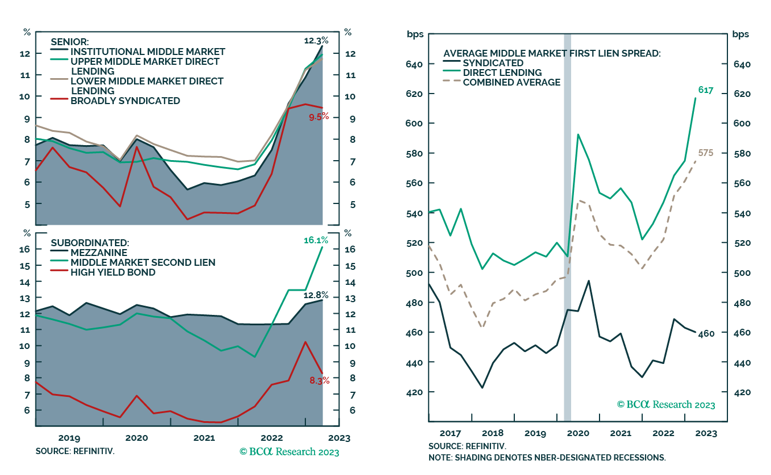

The opportunity in Private Credit has become appealing, particularly on a risk-adjusted basis, compared to other asset classes such as Public Equities or Private Equity. Yields have risen significantly, with those for direct lending increasing from 6-7% in 2022 to upwards of 12% currently (Chart 4). The increase in yields is the corollary of rising base rates, increasing Original Issue Discount (OID), and, particularly in the case of direct lending, increasing spreads.

As banks have become more reluctant to extend credit, particularly in the case of US regional banks following the failures of Silicon Valley Bank, First Republic Bank and Signature Bank, borrowers are increasingly turning direct lenders. These positive supply-demand imbalances have led to greater negotiating leverage, enhanced terms and documentation and lower leverage levels.

The flip side of this market opportunity is increasing stress for portfolio companies as they grapple with the higher cost of debt. When analysing a private debt manager, we pay particular attention to two areas: their history of defaults and their recovery rates in the event of default. The risk of default can be best managed through a detailed and diligent credit underwriting process. This includes focusing on asset-backing, structural protection, and covenant protection. A quality team with the appropriate resourcing and work-out experience is essential to effectively navigate loans that are in distress.

Portfolio positioning

The recent equity rally has broadened on hopes that a soft landing will be achieved. However, this requires near-perfect calibration of monetary policy, a difficult task for the Fed and other global central banks. We are not compelled to chase the equity rally and are positioned modestly underweight equities.

Fixed Income markets have undergone structural changes over the past year, leading to a reset of yields at much higher levels. While bond yields may have scope to rise from here, mounting evidence suggests that disinflation has begun, increasing the probability that rate hikes will end sooner than later. Given the current favourable yields and elevated economic uncertainty, we feel comfortable allocating to traditional duration in portfolios.

Real Assets such as infrastructure, real estate, and transportation can improve portfolio diversification and provide a degree of inflation protection. Alternative investments, including private markets and hedge funds, can also improve portfolio diversification.

Private debt markets are still experiencing several structural tailwinds. Positive supply-demand dynamics, driven by regulatory changes, have resulted in major banks significantly reducing exposure to these types of financing. This has been exacerbated by regional banks becoming more reluctant to extend credit following the collapse of Silicon Valley Bank, First Republic Bank and Signature Bank. The ongoing volatile markets have resulted in rising base rates, increased spread, Original Issue Discount (OID), enhanced terms and documentation, and lower leverage levels. We aim to invest in high-quality loans with lower LVRs, shorter duration, secured against real assets or sustainable cash flows, and strong covenant protection. We prefer managers with in-depth work-out capabilities that can step in should any loans experience stress.

History has taught us that for well-diversified investors, the greatest threat to real wealth tends not to come from being invested through periods of short-term volatility but from being under-invested over the long term. Thus, we continue to stress the importance of maintaining a robust investment framework and remaining invested through the cycle.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.