Major market indices rallied in November, with cooling inflation and positive developments in China propelling equities higher. In developed markets, the MSCI World Index climbed 5.7% in local currency terms. Meanwhile, the MSCI Emerging Markets Index rose 11.70%, once the Chinese Government announced a 16-step rescue package for the struggling real estate sector, and speculation of relaxing covid restrictions. The Australian market also posted substantial gains, with the ASX 200 rising 6.58% (Chart 1), mainly driven by strength in the resources sector after Iron Ore rallied amid positive sentiment towards China’s reopening.

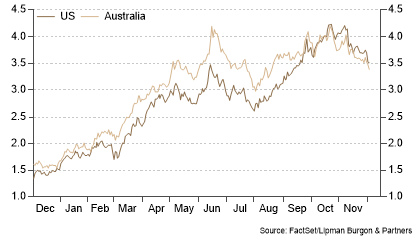

In fixed income markets, bonds rallied, and hence yields fell (Chart 2) as softer inflation data cemented expectations that the Federal Reserve will decelerate the pace of interest rate hikes. The US bond market had the sharpest reaction, with US 10-Year Treasury Bond yields falling 38bps to 3.70% over the month. Similarly, Australian 10-Year Government Bond yields fell 23bps to 3.53%.

Cooling inflation sparks equity rally

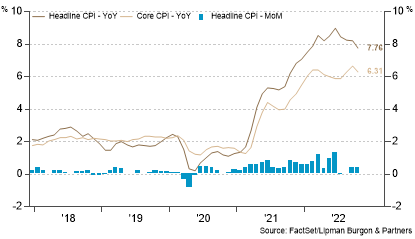

US Headline CPI slowed from 8.2% to 7.7% year-on-year in October (Chart 3). This was below market expectations and highlighted broad-based decreases in core US inflation. Deflationary pressures were most apparent within ex-shelter services which contracted by -0.1% m/m following a 0.9% m/m gain in September, while overall shelter costs were broadly unchanged. Prices of durable goods declined -0.7% m/m following a -0.1% change in September. Markets responded positively, with both equities and bonds rallying on the back of the print.

Minutes from the November FOMC reinforce expectations that the Fed’s pace of tightening will slow. The minutes revealed that “A substantial majority of participants” felt that a step-down in the pace of hikes would be appropriate, with some commenting that “slowing the pace of increase could reduce the risk of instability in the financial system”. In a speech last week, Jerome Powell signalled that smaller interest rate increases are now more likely, noting that “It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring down inflation”.

Is China nearing the end of covid-zero?

The Chinese economy has been plagued by a multitude of issues, sparking downside volatility for equities and broader negative sentiment. Regulatory crackdowns in the private sector have taken a toll on the fundamental and valuation prospects of Chinese equities, while the property market, a key driver of China’s economic growth, has been in a slump since August 2021. This followed a crackdown on indebted property developers and the Evergrande debacle that occurred shortly thereafter. Moreover, lockdowns in response to rising covid cases and the government’s commitment to maintaining a covid zero policy have exacerbated the fragility of the Chinese economy.

Recent developments, however, appear to be positive, which is translating to support for Chinese equities and a sharp 26.8% rally in the Hong Kong Hang Seng Index.

In mid-November, The People’s Bank of China and the China Banking and Insurance Regulatory Commission jointly issued a plan to ensure the “stable and healthy development” of the property sector. The plans include 16 measures that range from addressing the liquidity crisis faced by developers to loosening down-payment requirements for homebuyers. It marks an all-round effort from the administration to bail out the struggling property sector and represents a stark shift in tone from the ‘Three Red Lines Policy’ designed to crack down on developers.

Chinese authorities have also accelerated a shift toward reopening the economy in response to protests against the nation’s stringent policies. Over the last week, Beijing, Shenzhen, Guangzhou and recently Shanghai and Hangzhou, have all begun relaxing covid restrictions. The ‘refinements’ to policy include dropping testing requirements for entry into most public venues and allowing infected individuals with moderate symptoms to isolate at home rather than in government quarantine facilities. In a statement, city officials note that measures will “continue to be optimised and adjusted”.

Portfolio positioning

Across our portfolios, we continue to advocate a cautious positioning with a neutral weight to equities. Although equity valuations have come down, multiples are not overly cheap and are in-line with long-term averages. There is evidence that inflation is peaking. However, the labour market remains tight, posing some upside risks to wage inflation.

Fixed interest investments have seen a stark repricing in the year-to-date in response to tightening monetary policy. With yields considerably higher than they were a year ago, we feel the asset class offers better downside protection and higher income levels, which justify moving from an underweight stance.

Private debt remains attractive, given that most loans are now tied to floating rates, benefiting from rising interest rates. With developers continuing to experience stress from rising input costs, we prefer higher-quality loans that are senior in the capital structure with strong covenant protection.

Core real assets such as real estate, infrastructure, timberland and transportation continue to provide investors with both inflation protection, income and diversification.

We continue to recommend that clients remain invested yet maintain some cash outside their portfolio, giving them dry powder in the event exceptional opportunities present. In times of market volatility, it is important to have a robust investment framework and focus on long-term objectives.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.