Global equity markets were higher in February, with the MSCI World Index (in local currency) climbing 2.7% over the month. In Australia, the cyclical and value heavy ASX200 rose 1.5%, while in the U.S. the S&P500 was 2.8% higher. Fixed income markets saw a steep sell-off causing yields to rise significantly, with the Australian 10-Year government yield rising by 79bps to 1.88% and the U.S. 10-Year similarly rising 37bps to 1.46%. Higher Inflation expectations drove commodity markets higher, with Brent Crude Oil and Copper rising 19.7% and 16.4% respectively. Iron Ore posted a 1.5% correction following the strong rally over the last several months. Coincident with equities rising, Gold was 6.5% lower to $1,742/oz.

Messy sell-off in government bonds

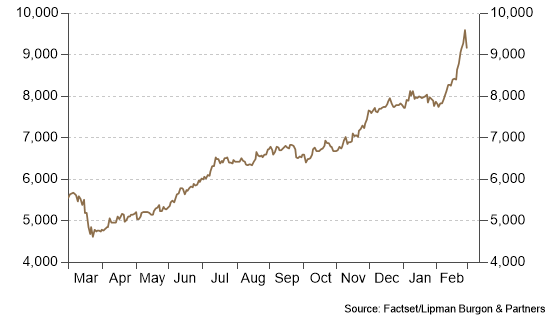

The global reflation theme is gaining momentum and triggered a messy sell-off across global government bond markets in the process. The S&P ASX Government bond index fell 4.4% in February as 10-year yields rose 79bps. Such a sharp rise in yields can’t go unnoticed by equity markets, which also wobbled towards the end of the month with the ASX finishing 3.5% off its high. The vaccine roll-out combined with falling COVID-19 cases and more fiscal stimulus is driving stronger economic growth and inflation expectations. This is forcing longer-term bond yields higher. The market reaction has accelerated in recent weeks as rhetoric from policy makers has continued to be very dovish despite economic data and the outlook improving.

Economic growth outlook remains solid

The increase in bond yields reflects central bank determination to get inflation above 2% and the improved economic growth outlook making the inflation target look more achievable. Ultimately it will be strong economic growth that will lead to the higher inflation outcome. Sustained higher inflation can’t be achieved until the economy is at full employment, which is still a long way off, and as such, means policy is set to remain accommodative for some time. The copper price is often cited as a reliable economic growth signal and looks set to test its all-time high reached in early 2011.

Outlook

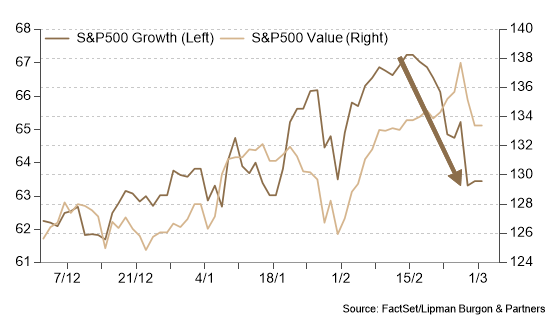

The medium term outlook for equities remains positive, primarily driven by the prospect of economic re-opening and sustained accommodative fiscal and monetary policy. The excess earnings yield of stocks over bonds in the US currently stands at 3.5%, still substantially higher than pre-GFC levels (i.e. equities are cheap compared to bonds). Additional optimism towards the economic growth outlook could compress that spread further towards pre-GFC levels, driving equities higher. As a result of these factors and other variables:

- We are now more positively disposed to cyclical and value stocks than we have been.

- We also like assets providing inflation protection, including property, infrastructure and gold, and various alternative investments that add diversification to portfolios whilst also helping to achieve income and growth targets.

- We continue to see government bonds as un-investable.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.