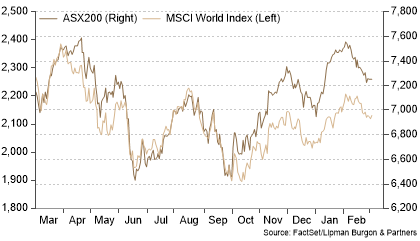

January’s broad-based rally morphed into a sell-off in February, with investors concerned that central banks will keep interest rates ‘higher for longer’ amid signs of resilient demand and lingering price pressure. In developed market equities, the MSCI World Index (in local currency terms) declined 1.53%, weighed down by the US, with the S&P 500 declining 2.44%. In Australia, the S&P/ASX 200 fell 2.45% as technological stock gains were insufficient to offset declines in resources stocks and the major banks (Chart 1).

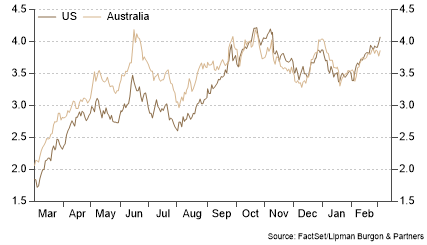

Fixed income markets experienced similar declines, with yields approaching the key resistance levels of ~4%. The yield on the 10-Yr US Treasury Bond rose 30 basis points to 3.92%, while the yield on the 10-Yr Australian Government Bond rose 30 basis points to 3.86% (Chart 2).

‘No Landing’ Scenario Gaining Traction

For some time, investors have bet on global growth softening just enough to cool inflation and persuade hawkish central banks to pause their rate hikes. The notion of the Federal Reserve and other central banks using monetary tightening to engineer a soft landing before pivoting to avoid a deep recession has supported a broad-based rally since October. However, recent data reflecting a persistently tight labour market has investors considering a new scenario. Known as a ‘no landing’ scenario, it’s one where economic growth is robust, inflation is sticky and financial conditions remain tight.

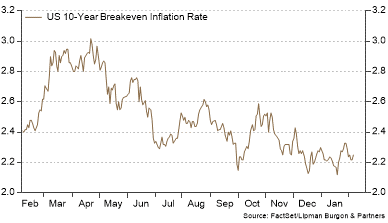

Since the start of February, market estimates of the peak in the Fed funds rate have risen by 50 basis points to 5.50% (Chart 3). Bond yields have risen in line with these expectations, with the US 10-Yr Treasury Yield climbing from a trough of ~3.3% in January to just under 4% today.

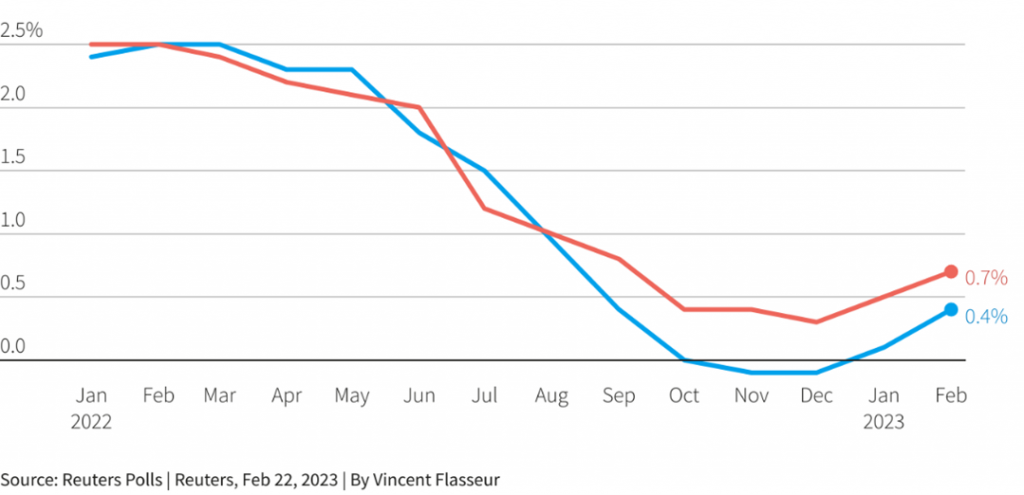

Heading into 2023, the prevailing view was that Europe was already in a recession, the US was on the brink, and that China would struggle to manage its reopening campaign. In December, most economists expected the US economy to contract slightly in 2023, but the consensus now is for 0.7% growth (Chart 4).

Thus, it seems that inflation, rather than a recession, is the key risk on investors’ minds for 2023 and is something that we are monitoring very closely.

Enhanced Index Allocation in a Core-Satellite Framework

For some time, we have discussed the benefits of using a Core-Satellite framework to efficiently allocate active risk within an equity portfolio. To briefly reiterate, combining both Alpha (Satellite) and Beta (Core) building blocks can help create more efficient portfolios that support a more optimal risk-return mix.

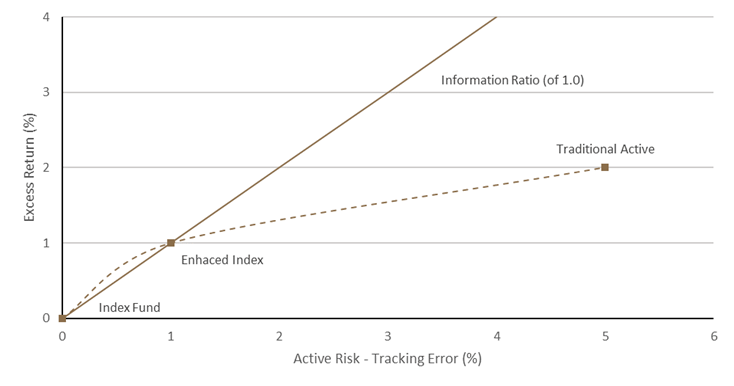

One method to make allocation decisions between Core and Satellite investments is using the Information Ratio, which indicates how much additional return the investment generates for each unit of active risk (tracking error) taken. The Information Ratio is a common metric used to evaluate manager skill, and investments with a higher information ratio should receive higher allocations in portfolios.

However, the relationship between active risk and active return is not linear. Typically, portfolios exhibit diminishing marginal returns to active risk, i.e., as risk increases, the incremental gain in excess return gets smaller and smaller (Chart 5).

An enhanced index strategy is a hybrid between active and passive that attempts to provide modest excess returns consistently over time while closely tracking the characteristics of its reference benchmark. Typically implemented systematically, enhanced index managers strive to limit performance surprises while at the same time taking on a small amount of risk to the benchmark to gain the potential for outperformance. The result is a high information ratio that can be useful for maximising return while efficiently using risk.

Portfolio positioning

Overall, we maintain the view that it is unlikely markets will experience the same negative moves over 2023 that occurred in 2022. That said, risks to the global economy are still present, and we continue to advocate a cautious portfolio positioning with a neutral weight to equities and bonds.

In response to inflationary pressures, bond yields worldwide have increased significantly over the past twelve months. This has made yields on both sovereign and investment-grade corporate bonds more attractive, also creating a buffer to offer some protection in the event of a recession. As such, we are comfortable investing in longer-duration investment-grade securities.

Private debt remains attractive, given that most loans are now tied to a floating rate, benefiting from rising interest rates. We prefer higher quality loans with lower LVRs, relatively shorter duration and secured against real assets or sustainable cash flows.

Real Assets such as infrastructure, real estate, and transportation can improve portfolio diversification and provide inflation protection.

As we anticipate market volatility will persist, it is important to maintain a robust investment framework, focus on long-term objectives and remain invested through the cycle.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.