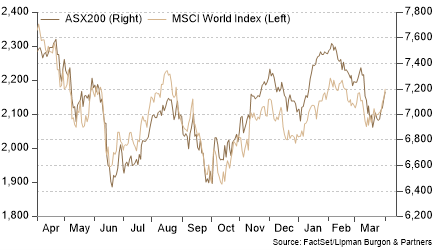

Despite significant intra-month volatility driven by a rapidly evolving banking crisis, equity markets finished mostly higher in March as central banks and regulators acted swiftly to stabilise markets. The MSCI World Index advanced 2.56%, driven by strong gains in US equities, with the NASDAQ rallying 6.79%. The Australian market, however, with a larger concentration of major banks, struggled to keep pace, with the ASX 200 Index modestly lower, down 0.16% for the month (Chart 1).

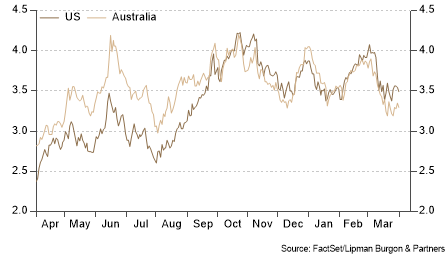

Fixed income markets rallied following a flight to safety amid stress in the banking sector. The yield on the 10-Yr US Treasury Bond declined 42 basis points to 3.49%, while the yield on the 10-Yr Australian Government Bond fell 56 basis points to 3.30% (Chart 2).

Banks in Focus

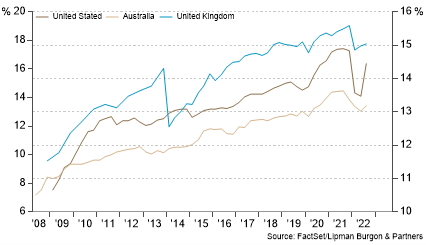

In the space of two weeks, any expectations for a higher terminal rate from the Fed and a ‘no landing scenario’ following stronger-than-expected economic data were disrupted by a rapidly evolving banking crisis. In a note to investors in mid-March, we discussed the fragilities that led to the collapse of Silicon Valley Bank and argued that the range of institutions under scrutiny did not threaten the entire system. Banks are much better capitalised today than they were during the global financial crisis in 2008, the quality of loan books is stronger, and a wider suite of tools for mitigating risk exists (Chart 3).

Since then, stress in the sector has continued with headlines focused on UBS that, under the instruction of the Swiss National Bank, agreed to an emergency takeover of Credit Suisse for a price of CHF 3 billion or roughly a 60% discount to its last closing price. The deal included a CHF 9 billion government guarantee for potential losses from assets UBS is taking over and also involved the write-off of about CHF 17 billion in Credit Suisse AT1 bonds. Shares in Deutsche Bank came under pressure as investors exhibited fear of contagion. However, unlike Credit Suisse, Deutsche is solidly profitable (Chart 4).

The key question on investors’ minds is whether central banks and regulators have averted broader contagion. It would appear that the steps taken thus far by policymakers and central banks acting with speed and precision have stemmed disorderly bank failures, provided short-term stability and boosted investor confidence.

Fed Tightening Cycle is Close to its Peak

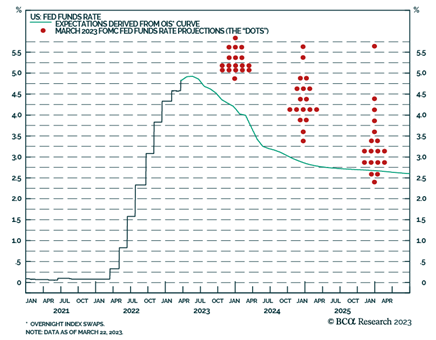

The FOMC meeting on 22 March came amid the banking storm, with the committee opting for a 25-basis point hike and softened statement language about possible future hikes. This signalled that the tightening cycle is close to its peak, with markets currently pricing in 75 basis points of rate cuts by the end of the year (Chart 5).

Indeed, the current turmoil in the banking sector will inevitably weigh on economic activity as banks tighten lending criteria to preserve liquidity, leading to slower credit growth. However, expectations for lower rates will offset some or all of the impact on growth.

The disinflationary momentum appears to be continuing. Incremental data highlighted that personal spending growth in the US cooled in February, with both the headline and core PCE deflators easing and coming in below expectations. Importantly, core services excluding housing PCE inflation – which Powell has highlighted as the component policymakers are watching most closely – receded from 0.5% m/m to 0.2% m/m. As inflation continues to cool, this could give the Fed some room to move lower on rates. While perhaps not as quickly as the market expects, it is likely that rate hikes will end sooner rather than later.

Portfolio positioning

It is still too early to have a confident view of the implications of the current banking turmoil for the US Economy. However, it is likely that the global economy is not on the verge of another financial crisis. That said, we believe adopting a cautious approach to portfolio positioning is warranted with a neutral allocation to both equities and bonds.

There is scope for bond yields to move higher, depending on the speed at which central banks reach peak rates. However, we see a higher probability that rate hikes will end sooner, and bonds are well positioned to act as a defensive ballast in portfolios if further stress in the banking sector occurs.

Equities are fairly valued at the current time, with global equity valuations in-line with long-term averages (Chart 6). Valuations are much more favourable outside the US, with global equities trading at 15.9x forward earnings, compared to 18.2x in the US.

Real Assets such as infrastructure, real estate, and transportation can improve portfolio diversification and provide a degree of inflation protection. Alternative investments, including private markets and hedge funds, can also enhance portfolio diversification.

Private Debt and Direct lending can help achieve income targets within portfolios, where we seek high-quality loans with lower LVRs, relatively shorter duration and secured against real assets or sustainable cash flows.

Throughout history, it has been proven that for investors with a well-diversified portfolio, the most significant risk to long-term wealth creation or preservation does not stem from enduring periods of short-term market turbulence but from remaining underinvested over the long haul. Hence, we emphasize the necessity of upholding a sturdy investment structure and staying invested throughout the market cycle.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.