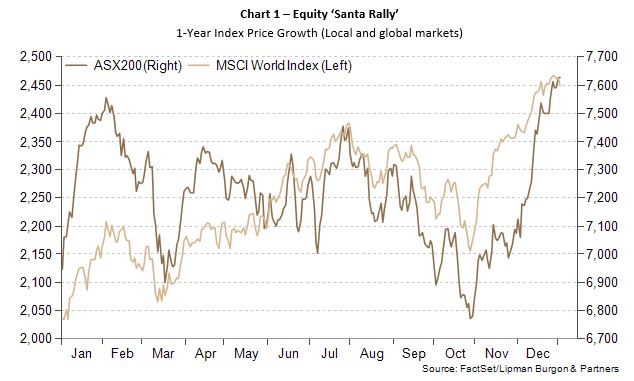

During the fourth quarter of 2023, prevailing market themes revolved around the US Federal Reserve’s (Fed) notable dovish pivot as signs emerged that the aggressive tightening cycle in previous months may end. December saw both global and domestic equities end higher, extending the rally that began in November, as falling inflation encouraged the hope of an interest rate cut in 2024 that would lead to an economic soft landing. The S&P/ASX200 surged 7.26% last month, on the back of a strengthening currency, recouping its earlier losses and ending the year up 12.42%. The MSCI World Index (in AUD terms) also climbed last month, ending the year up 23.75% (Chart 1). Firms with exposure to artificial intelligence soared over 2023, finding strong investor support for the transformative potential of the technology on productivity. This underpinned significant gains for the NASDAQ, rising 5.58% in December, taking its one-year gain to 44.64%.

Since hitting a peak in September this year, oil prices and have now slumped, falling about $20USD over the last quarter despite the prospect of ongoing production cuts in the new year. This comes amid investor concern about the drag of contractionary monetary policy on global oil demand and the potential for oversupply due to record production outside OPEC. Meanwhile, inflation in the United States fell to 3.10% in November from 3.20% in October further supporting the soft landing narrative. The changed outlook has seen fixed income markets rally as long term bond yields have rapidly fallen (Chart 2). This presents a marked turnaround to the “higher for longer” narrative that had been driving sentiment for most of 2023. US treasuries have fallen 69 basis points in the last quarter to 3.88% while Australia’s 10-year yield has fallen to 3.96%.

Signs of a material slowing of inflation meant that global financial markets ended 2023 positively, with investors hopeful of interest rate cuts in 2024. The stock market’s ‘fear gauge’ is at its lowest level since the pandemic (Chart 3) with the VIX (Chicago Board Options Exchange Volatility Index) ending the year at 12.45, renewing investor appetite for stocks. The price of gold has also hit record highs as lower Treasury yields (which are purchased in US Dollars) will result in falling demand for both Treasuries and the USD, which can further boost the price of gold. However, while markets may appear tranquil for now, a black swan event could cause volatility to spike again. The unpredictability of markets and the economic outlook therefore cannot be ignored, with the potential for the volatility seen through 2023 to continue.

The Australian Dollar Strengthens

The Australian Dollar (AUD) has rebounded from lows of US63¢ in October to US68¢ by the end of December on the back of rallying iron ore prices (Chart 4) and market expectations of US rate cuts. Iron ore hit $144.81 USD/Tonne; a 35% gain from October lows that was bolstered by strength in the Chinese economy (the world’s largest importer of iron ore). China’s factory activity expanded at a quicker pace in December with PMI (global manufacturing purchasing managers’ index) rising to 50.8 in December from 50.7 in November and marking the fastest expansion in seven months. Soni Kumari, a commodities’ strategist at ANZ, said that the increase was “momentum driven” by a series of stimulus announcements by Beijing to support its economy. The price rise has seen renewed interest in smaller iron projects across Australia that could also continue to support a strengthened AUD. A risk factor for the local currency is a downturn in the Chinese economy and the possibility that the Fed will not lower interest rates as early as the market believes.

Portfolio Positioning

2023 ended on a positive note for investors with the return of the soft landing narrative and the prospect of rate cuts in 2024. The Reserve Bank of Australia (RBA) kept rates on hold at 4.35% in its December meeting on the back of encouraging signs that past rate hikes were working to curb inflation. This provided relief for variable interest rate mortgage holders in the lead up to Christmas. With the strengthening AUD, we continue to recommend maintaining currency hedging in your international holdings.

LBP is maintaining its defensive positioning for the first quarter of 2024, remaining moderately underweight equities and other growth assets, and a higher allocation to private debt, fixed income, and cash for dry powder should attractive opportunities arise. We see opportunities in alternatives to improve diversification in multi-asset class portfolios, seeking returns from sources with a reduced beta that are typically uncorrelated to traditional asset classes. This is intended to serve as a ballast when risky assets face downward pressure.

Despite a good end to the year, it is important to note that market volatility remains high, supporting the case for portfolio allocation to income-generating assets. LBP maintains its view that private debt is providing a strong source of income through higher yields that will continue to support overall portfolio returns if capital gains fall. In this asset class, prudent manager selection is crucial to ensure underlying loans are written with strong covenants, the portfolio companies have been carefully evaluated on their default risks, and a strong track record of return and minimal losses is evident.

As we move into the new year, it is critical to maintain a robust investment framework and remain invested through the cycle, as short-term volatility is to be expected around the globe. Investors should continue to emphasise long-term goals over short-term market movements as the greatest threat to real wealth comes from being underinvested, in an attempt to “time the market” that even seasoned economists often get wrong.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.