The start of the year has ushered in a sudden reversal in market momentum, with most global equity indices recording declines. US equities have been the relative underperformers, with the S&P500 and Nasdaq closing last week 5.7% and 7.6% lower, respectively – the worst weekly performance since March 2020. Locally, domestic equities are also lower, albeit to a lesser extent, with the ASX200 losing 2.9% of its value over the week. So far in 2022, the US market, as represented by the S&P 500, is down 7.7%, while the ASX 200 is down 3.6%.

There are several explanations for the recent market moves. Firstly, persistent inflation pressures in the US and further tightening of the labour market are fuelling the perceptions that the US Federal Reserve may hasten its rate hike cycle. This weighed heavily on the performance of growth stocks and the technology sector, given its tendency to be more sensitive to rising interest rates.

A higher concentration of technology companies in the US market also explains its relative underperformance. Furthermore, expectations of an earlier balance sheet reduction in 2022 created additional uncertainty for investors.

Additional factors include:

- Investors have been exposed to negative market commentary, including a note from a well-respected investment strategist and famed bear, Jeremy Grantham, who speculated that the market could experience a 50% correction.

- Geopolitics came back into the spotlight with the escalation of the conflict between Russia and Ukraine.

- Many short-term technical signals moved into negative territory, causing many quantitative strategies to adopt a short positioning, adding to the selling pressure.

- The start of earnings season has been flat so far, albeit we still have a long way to go and expectations on corporate earnings generally remain upbeat.

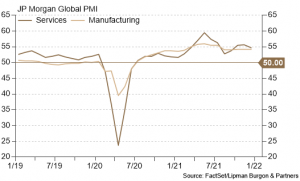

Looking at the economic fundamentals, little has changed over the past few weeks. As highlighted in the most recent Market Insights, we expect strong household balance sheets, re-emergence of corporate CAPEX and productivity, as well as private sector demand to keep the economy growing well above trend. This should continue to provide a positive backdrop for risk assets.

While policy normalisation poses challenges for both equity and bond markets, it is important to note that stocks have historically performed well during periods when the Fed raised rates. In fact, according to Bloomberg, stocks have risen at an average annualised rate of 9% during the 12 Fed rate hike cycles since the 1950s and delivered positive returns in 11 of those instances. Furthermore, current data compiled by Bloomberg shows that, on average, strategists forecast that the S&P 500 will finish 2022 13% above Friday’s closing level.

While our long-term expectations haven’t changed, we anticipate higher volatility and negative investor sentiment to weigh on the performance of shares over the near term. In periods of elevated market volatility, it is important to have a robust investment framework and remain focused on long-term outcomes.

Despite the bumpy start to the new year, we maintain our positive view on growth assets relative to bonds. A hawkish Fed does not equate to tight policy, which is generally the necessary headwind to look out for when investing in growth assets. Government bonds remain expensive and exposures to interest rate duration during the period of rate hikes should be minimised. We continue to advocate for allocation to alternative investments as well as private market opportunities that add some downside protection to portfolios whilst also helping achieve income and growth targets.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.