Our multi-disciplinary expertise allows us to tailor and integrate services to help grow, protect and distribute wealth.

Managing wealth involves much more than simply managing assets.

At Lipman Burgon & Partners, we provide investment and wealth management solutions to high net worth individuals and their families to help them protect, manage and grow their wealth across generations.

Our firm has deep expertise in both planning and investment, and excels at integrating these disciplines to identify problems and find untapped opportunities that may have been overlooked by others.

portfolio construction

& management

INTERGENERATIONAL

WEALTH & FAMILY OFFICE

Tax structuring

& asset

protection

RELATIONSHIP

management

Portfolio Construction & Management

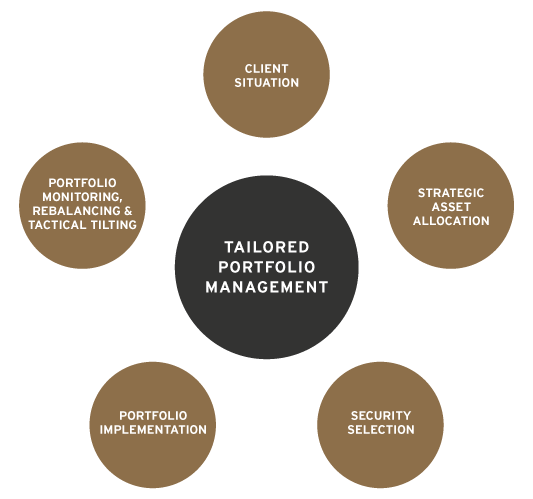

Building a tailored portfolio is a complex and highly personal process. We bring to bear not just our own experience but also the resources and expertise of our research and industry partners.

Diversification is key. So too is having a clear understanding of your tolerance for risk, your liquidity requirements and the optimal tax structures available. Only after extensive consultation with you will we begin the task of constructing a portfolio.

We commission our own research and regularly consult with leading fund managers and market strategists. Our Investment Committee actively monitors a universe of securities and specialist fund managers to ensure our recommendations are targeted to deliver the best possible results within the parameters specified.

Managing a portfolio requires constant attention with an eye for detail, and the experience to take advantage of opportunities when they arise. We keep all of our clients well informed and meet regularly to advise of actions taken and consult on any significant decisions.

Tax Structuring & Asset Protection

Intelligent tax structuring and asset protection can significantly increase after-tax returns while minimising the risk of financial loss and guarding against liability.

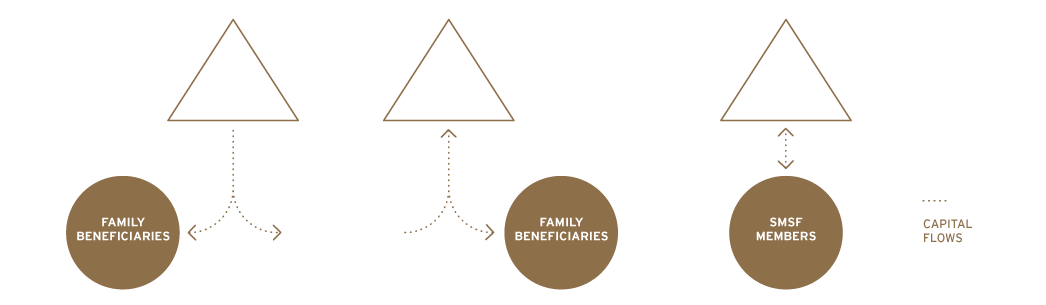

Lipman Burgon & Partners have expertise in allocating assets across a number of different holding structures including discretionary trusts, unit trusts, companies, private ancillary funds and superannuation funds.

We advise on asset separation and business structures to balance security; the cost and ease of operation; insurance and operational requirements; and other asset protection measures. Each solution is designed to be aligned with your personal or organisational criteria.

With specific regard to tax, we focus on maintaining and building wealth through sound investment decisions combined with effective tax planning. Once a strategy is in place, we make asset allocations to arrive at optimal taxation outcomes that are ethical and compliant.

Intergenerational Wealth & Family Office

Managing the transfer of wealth across generations means navigating financial complexity and promoting, where possible, a shared vision for the future.

Lipman Burgon & Partners’ team of experienced professionals can help chart a clear course that can build on, and safeguard, your legacy and provide the security of long-term planning.

Early planning also means all parties can have their opinions heard, and Lipman Burgon & Partners can establish tailored wealth and asset transfer solutions well before they are needed covering the following areas:

- tax planning

- investment structuring

- conflict resolution and governance

- accommodating beneficiaries’ needs

- business succession planning

- estate planning

- philanthropic planning

Relationship Management

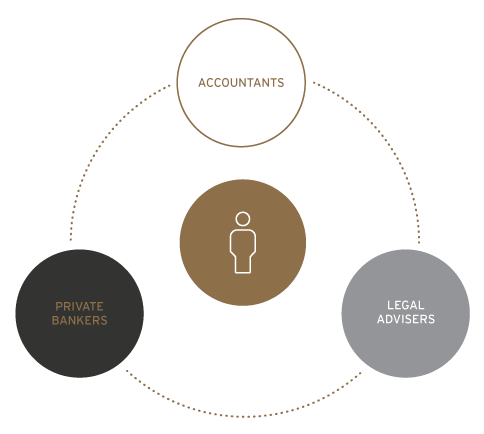

Through the breadth and depth of our service offering, our partners and relationship managers are in a unique position to have full oversight of our clients’ affairs and provide a discreet, personalised and outstanding level of service.

We can manage all third-party relationships with our clients’ professional teams, including private bankers, accountants and legal advisers. This includes tasks such as sourcing and managing term deposits with bankers, collating information for tax returns and working closely with legal and tax advisers to provide value over and above portfolio management.

We also act as a mailing house for some clients and advise on one-off investments and review business opportunities on their behalf.