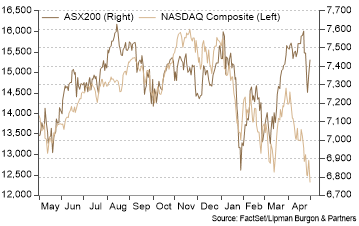

Most major equity indices finished April in the red. This was influenced by several near-term headwinds, including fears of aggressive central bank tightening, the ongoing conflict in Ukraine, rising inflation and the COVID-19 outbreak in China causing investors to re-evaluate the global growth outlook. The result was a re-pricing of equity markets that acutely impacted growth and tech stocks. The US-based NASDAQ led the fall, dropping 13.2% over the month, with the S&P 500 not far behind, falling 8.7%. Australia’s bias towards Materials and Energy companies saw the ASX 200 outperform global markets, declining only a modest 0.9%.

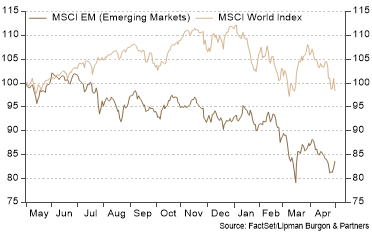

The MSCI World Index was 6.9% lower, and the MSCI Emerging Markets Index dropped 3.5%.

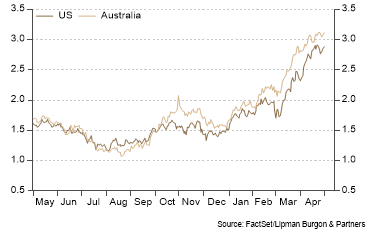

Like the forces driving equities, higher inflation and fears of aggressive central bank tightening to stamp it out also elicited a significant response from bond markets. The yield on the US 10-Year Treasury rose 56bps to 2.89%, while the Australian 10-Year Government Bond yield rose 30bs to 3.12%.

Yields in the front end of the curve rose at a proportional rate, with the US 2-Year Treasury up 41bps to 2.69% and the Australian 2-Year Government bond up 66bps to 2.45%.

Commodity markets were mixed over the month. The ongoing situation in Ukraine poses risks to European energy supplies, with the possibility of a European embargo on Russian oil after Russia cut off supply to Poland and Bulgaria. This has kept oil prices at elevated levels, with the price of Brent Crude rising 1.9% to US$109/bbl. Escalating COVID-19 cases in China and an unrelenting lockdown has weighed on the outlook for Iron Ore, which finished the month flat at US$150/t. Gold finished the month 1.6% lower at US$1911/oz.

Concerns about the global economy and a hawkish Federal Reserve bolstered demand for the US Dollar (USD) while the Australian Dollar (AUD) lagged. The AUD depreciated 5.4% to 71 US Cents relative to the USD.

Spotlight on the Euro Area

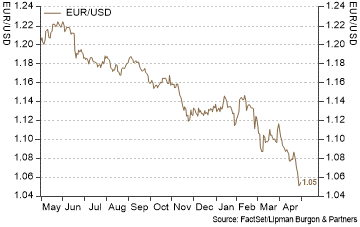

Over the past few months, we have discussed the potential impacts of the war in Ukraine. Amongst other things, we pointed out that overall, Europe was likely to bear most of the economic costs of the war. The recent economic releases now confirm our expectations. Euro area GDP growth declined from 0.3% quarter-on-quarter in Q4 2021 to 0.2% quarter-on-quarter in Q1 2022. At the same time, CPI inflation is currently at the 29-year high, and the headline inflation is at an all-time high of 7.5% as of April.

Stagflation is once again becoming a plausible risk for the Eurozone. This is complicating European Central Bank‘s (“ECB”) task. At the last meeting, the bank reiterated its gradual approach to monetary policy, given the ongoing uncertainty. However, many members are now becoming more hawkish. The ECB’s Chief Economist has recently suggested that more data is needed to decide on the timing of interest-rate normalisation. In the meantime, the German yield curve steepened, and Euro depreciated following these comments and related data releases.

Market participants expect that continued growth underperformance in the Eurozone will hurt the Euro further.

The next few months are likely to be challenging for both the ECB and investors as stagflation fears won’t dissipate until inflationary pressures subside. BCA Research is still forecasting inflation to peak later this year, providing a much-needed reprieve. This will help with the ECB’s policy decisions and provide a more supportive environment for Eurozone equities towards the year-end.

Is the worst over for the Emerging Markets?

Emerging market (“EM”) equities have underperformed their developed counterparts for over a year now.

While valuations are now looking more attractive and sentiment is improving, the corporate earnings outlook for the EM remains a concern for many investors. Along with the global risks that weighed on stock markets in the first quarter, EM equities have felt additional pressure from recent concerns over China, given the country’s concentration within the MSCI EM index. March activity data showed a slowdown in Chinese economic growth amid the worst COVID-19 outbreak since March 2020. Case counts remain high, and growth momentum may soften further in Q2.

Additionally, data shows that the Chinese property sector continues to slow, with many expecting a more persistent property downturn. Facing economic pressures from the Omicron outbreak and weakness in the property sector, we expect Chinese policymakers to step up policy easing to support growth. This, coupled with easing China’s zero-COVID policy, should reduce some of the headwinds in the second half of the year.

Apart from China, other EM economies have also faced several challenges, including slowing global growth expectations, rotation in demand from goods to services, supply-chain disruptions, and higher global energy prices. Additionally, EM markets face headwinds from an increasingly hawkish Federal Reserve (“Fed”) and geopolitical tensions that have, in turn, led to a stronger USD, which is always a net negative for EM equities.

However, the trend-like global growth remains the base case for 2022. Recessionary concerns are expected to fade in the coming months, which could boost export economies. While energy prices are expected to remain high, they aren’t likely to move as they have over the past quarter. Finally, many increasingly see the potential for the dollar to soften modestly in the second half of the year as the Fed rate expectations become fully priced in. This environment could be a potential turning point for EM equities. As JP Morgan points out, EM equities tend to start performing not when the good news begins but when all the bad news is already factored into the price. It is likely that a lot of negative news is already priced into EM stocks, and the second half of 2022 may look better for EM assets.

Portfolio positioning

Unsurprisingly, volatility persisted over the month as markets continued to digest geopolitical, monetary and fiscal challenges. As we highlighted at the end of Q1, we believe that some caution is warranted. However, there is scope for improving returns over the second part of the year. Keeping the above in mind, we make no changes to current portfolio positioning, retaining our relative preference for equities vs. bonds. Certainly, risks remain, but we believe a recession is not imminent. While policy rates are rapidly tightening, overall levels of growth continue to support earnings.

Global equities continue to be more attractively valued today than a year ago, with non-US equities preferred on valuation metrics. However, the recent geopolitical tensions and war in Ukraine continue to moderate our preference for non-US equities over the near term. The latter is likely to outperform in the second half of the year.

Allocations to property, infrastructure, Gold, and other commodities should be maintained for inflation hedging and portfolio diversification. We also remain positive on various alternative investments and private market opportunities for downside protection and diversification of return streams in the portfolios.

In times of market volatility, it is important to have a robust investment framework and focus on long-term objectives while preserving some cash to be invested in opportunities that may present themselves following any further market dissolutions.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.