Global equity markets continued to perform well in August with the MSCI World Index up 6.3%. The US remains the leader of the rebound with the Nasdaq up 9.7% for the month and the S&P500 up 7.2%, the strongest August since 1986. The S&P500 has now followed the Nasdaq’s lead and reached new record highs. Notably, the Nasdaq has corrected by 6% over the last two trading days. The recovery in the ASX200 has stalled with the index trading within a tight range around 6,000 since the beginning of June, and slightly under that level today (Chart 1).

Commodities mostly extended their rebound in August with iron ore, nickel and zinc up strongly (13%, 12% and 10% respectively) and Brent crude oil adding a further 5% to its recovery. The gold price has increased 30% in 2020 but has been unable to continue through the psychological US$2,000/oz barrier that it broke through in early August. Government bond yields have remained remarkably stable at anaemically low levels since March, while credit spreads have narrowed markedly but remain above pre-COVID-19 levels.

The Fed targeting higher inflation

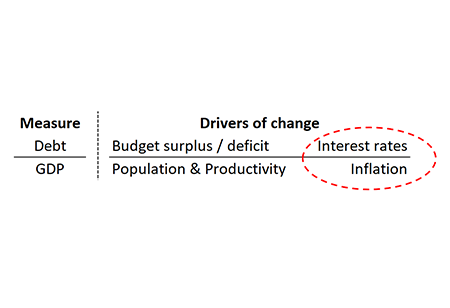

The US Federal Reserve conducted an 18-month review of its monetary policy framework and released revised goals and strategy on 27 August. As was widely expected, the Fed changed its inflation target to an “average” of 2% over time, explicitly stating that “following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time”. This is an important shift that has far reaching implications. A higher inflation target means policy rates will remain lower for longer, even as inflation increases towards 2%. Furthermore, interest rates below the level of inflation (negative real rates) are helpful in reducing highly elevated developed economy government debt/GDP. As such, monetary policy is likely to remain extraordinarily accommodative for some time.

What bubble?

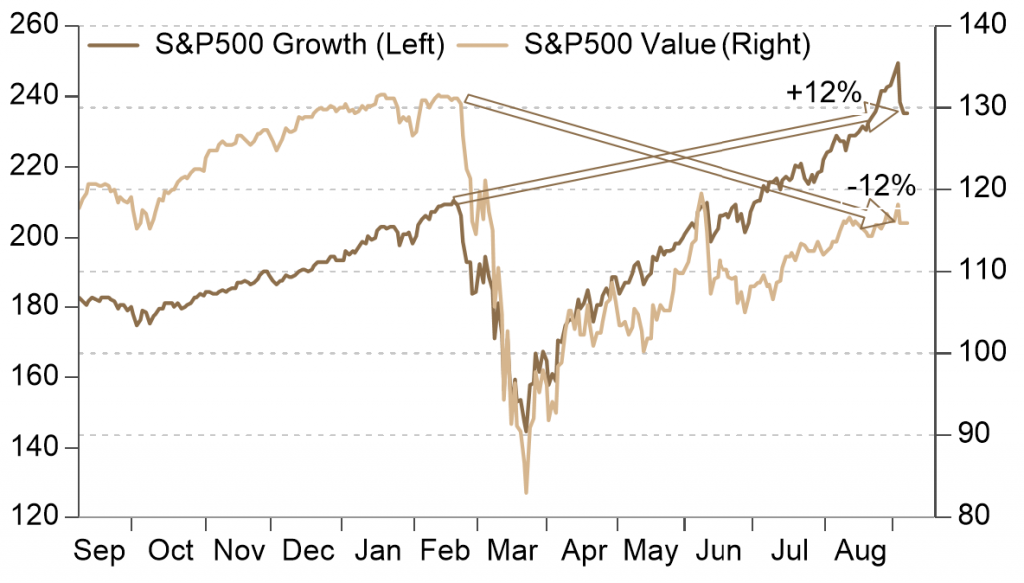

The outperformance of technology and growth companies has led many pundits to question whether that segment of the market has entered bubble territory.

The concentration of large technology companies within the S&P500 index is now extreme, with Apple, Microsoft, Amazon, Alphabet (Google) and Facebook now accounting for ~23% of the index. However, there are two powerful fundamental aspects to the outperformance of technology stocks which run counter to the expectations of a collapse:

- Most of the out-performance has been earnings driven

- Valuations are still below early 2000’s levels despite today’s lower discount rates and proven business models.

As such, we do not expect a collapse in tech stocks. However, we do think cyclical stocks (many of which fit into the value category) are likely to outperform when global economic shutdowns ease and economic growth accelerates (possibly when a vaccine is released).

Outlook

The prospect of sustained policy accommodation (monetary and fiscal) means we remain constructive on equities despite current economic uncertainties and the strong recovery markets have already experienced. Enduring negative real interest rates are also likely to support inflation protected assets like property, infrastructure and gold. We remain positively disposed to various alternative investments to help achieve income and growth targets for portfolios, whilst also adding to portfolio diversification.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.