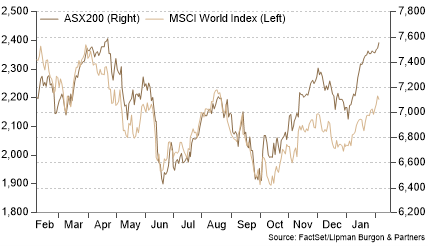

Stocks were higher in January, with investors moderately more optimistic about disinflationary signals in the economic data, expectations for the end of the Fed hiking cycle, and continuing robustness of the labour market. The MSCI World Index rallied 6.53% (Chart 1), with broad-based gains among most major regional indices. In the US, the S&P 500 rose 6.28%; similarly, in Europe, the Euro Stoxx 600 climbed 6.75%. Closer to home, the ASX 200 jumped 6.23% and has outperformed global equities by almost 18% over the last 12 months. China’s continued economic reopening and positive travel tailwinds during the Lunar New Year holiday supported gains in Chinese equities, with the Hong Kong Hang Seng index rising 10.42%.

Fixed income markets continued to stabilise relative to the steep increases in yields seen over 2022. Bond yields steadily declined over the month, with the 10-Yr US Treasury Bond yield falling 35bps to 3.53%. Similarly, the Australian 10-Yr Government Bonds yield fell 50bps to 3.55% (Chart 2). Since peaking in October 2022 at ~4.2%, bond yields have fallen roughly 65bps.

Balancing Act: Inflation, Growth, and Employment

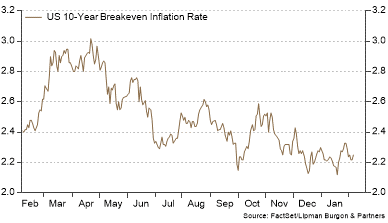

January’s data releases continued to validate the disinflationary thesis. US Headline CPI inflation eased from 7.1% year-on-year to 6.5% year-on-year, driven by lower energy, durable and non-durable goods prices. Core CPI also moderated from 6.0% year-on-year to 5.7%. Furthermore, wholesale prices also contracted much more than expected, with the producer price index (PPI) declining 0.5% in December. Long-term inflation expectations are well-anchored, with the US 10-Year Breakeven inflation rate sustainably below the peak reached in April 2022, suggesting markets have confidence in the Fed’s ability to tame inflation (Chart 3).

However, the ancillary to falling inflation is slowing economic growth and, consequently, leading to higher unemployment. Over the month, the ISM Services PMI slid by 6.9 points to 49.6. This compared to expectations it would ease to 55.0 and marked the first contraction in service activity in 30 months. December retail sales also posted sharper declines than expected, falling 1.9% and behind expectations of a much smaller 0.1% monthly decline.

It is clear that economic indicators are softening; however, the labour market has remained unusually buoyant. The unemployment rate in the US fell to 3.6% in March 2022 and has been broadly stable since then. Similarly, the US jobs report for January showed a 517,000 surge in nonfarm payrolls, nearly triple the anticipated 188,000 (Chart 4).

The combination of low unemployment and low inflation is unlikely to persist, where a positive shock to aggregate demand should push inflation higher, while a negative shock would lift unemployment. Navigating a soft landing requires near-perfect precision from the Fed in its policy calibration, which is an inherently difficult task.

However, households are well-positioned to weather any changes to unemployment. There are currently 1.9 job openings per unemployed worker, so those who lose their job should experience little difficulty securing a new one for now. Furthermore, households still have a buffer of over $1.4 trillion in excess savings accumulated during the pandemic. Moreover, the Fed will be able to cut rates when unemployment starts rising.

Revisiting the Core-Satellite Framework

Taking a step back from the day-to-day market moves, we considered it timely to reiterate our thoughts on the importance of a Core-Satellite framework when building equity portfolios. Many institutional investors at the forefront of best-practice portfolio construction and asset allocation rarely use an “all active” or “all indexed” approach in their equity allocation. This is because investment solutions that incorporate both active and indexed strategies, that is, both Alpha and beta building blocks, typically create more efficient equity portfolios that support a more optimal risk-return mix.

Combining index and active equities through Core-Satellite portfolio construction makes more sense today than ever, given the historically high levels of concentration risk that major indices are experiencing. After all, the top ten names in the MSCI ACWI index make up over 17% of the index’s market cap, surpassing the elevated levels seen during the tech bubble of the early 2000s.

Diversifying from such a high concentration risk can be readily achieved through Core-Satellite portfolio construction, where the core component is a low-cost, broad equity market cap index, and the satellite component is a high conviction, concentrated stock-picking strategy designed to beat the benchmark.

At the core should be a significant allocation to index and/or enhanced index strategies, as they both offer diversified market access and ample liquidity at a lower fee burden. This can then be strengthened with the addition of high-conviction satellite portfolios. Core-Satellite construction allows investors to control tracking error by adjusting the weight of the satellite portfolio relative to the core beta exposure.

We believe that the core-satellite approach results in diversification and the potential to earn alpha and above-average performance, reduced portfolio volatility, efficient implementation, and cost control.

Satellite managers that meet our selection criteria include:

- Active fundamental strategies – high conviction stock selection, stock-specific risk and Alpha. Requires skill, sector expertise, and deep knowledge of companies, competitors, suppliers, and industry trends. Invest through the cycle – can fit any style: value, growth, and quality. Concentrated portfolios with a Tracking Error (TE) range of 4% to 10%.

- Smart beta/factor based – a systematic option that tilts security weightings away from the cap-weighted benchmark and towards a desired factor exposure (e.g. quality, value, low/managed volatility). Return driver is factor-based rather than selection Alpha. Rules-based. TE is usually defined by the portfolio manager.

- Thematic equity managers – within global equities. Improve sector diversification (Alpha aside) due to concentration within global indexes. Examples are megatrends such as generational shifts (health, premium foods, leisure in retirement), climate change (technology innovation, meeting net zero commitments, tailwinds from government investment), infrastructure (digital, smart city, clean energy), and high-tech innovation (digital, robotics, artificial intelligence, security, biotech).

Portfolio positioning

Overall, it is unlikely that in 2023 markets will experience the same negative moves we saw last year. That said, we continue to advocate cautious portfolio positioning with a neutral weight to equities and bonds.

Bond yields worldwide have increased significantly over the last twelve months in response to inflationary pressures. This has made yields on both sovereign and investment-grade corporate bonds more attractive, also creating a protective buffer in the event of a recession. As such, we are comfortable investing in longer-duration investment-grade securities.

Private debt remains attractive, given that most loans are not tied to a floating rate and will benefit from rising interest rates. We prefer higher quality loans with lower LVRs, relatively shorter duration and secured against real assets or sustainable cash flows.

Real Assets such as infrastructure, real estate, and transportation can improve portfolio diversification and provide inflation protection.

As we anticipate market volatility will persist, it is essential to maintain a robust investment framework, focus on long-term objectives and remain invested through the cycle.

“The stock market is designed to transfer money from the active to the patient”

Warren Buffet

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.