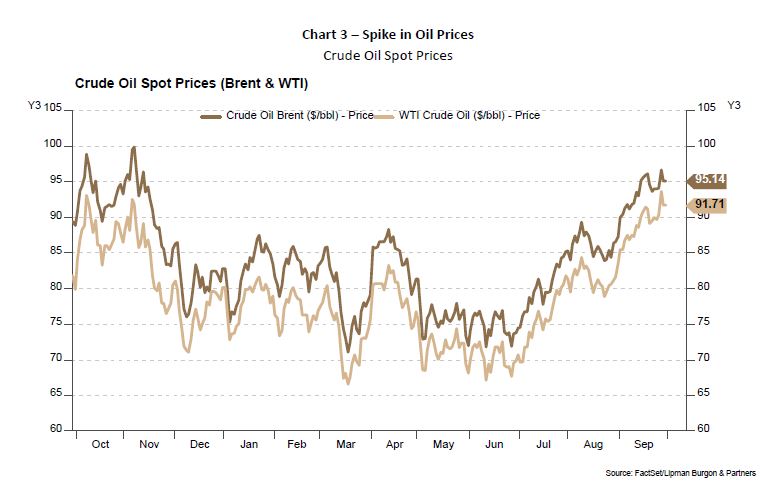

The ninth month of the year is historically the worst for stocks, with the S&P 500 averaging a 1.1% decline since 1928 according to Dow Jones Market Data, and this September was no different. Both domestic and global equity markets saw a sharp sell-off towards the end of the month as US treasury yields climbed alongside the US Dollar, and WTI Oil futures touched $95.03 per barrel, marking its highest point since August last year, before pulling back. The S&P/ASX200 fell 2.84% in September, with the S&P 500 and technology-heavy NASDAQ falling a steeper 4.77% and 5.77%, respectively (Chart 1). NASDAQ is approaching overvalued territory, averaging a 26.6x price-to-earnings ratio indicating it may be time to reduce holdings in technology growth stocks.

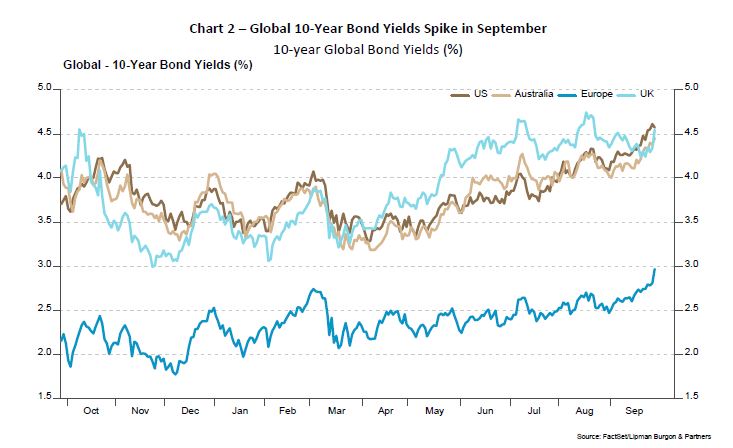

A renewed hawkishness from global central banks has sent bond yields soaring again in recent weeks with Australia’s 10-year bond yield approaching 4.5% and the 10-year US Treasury yield ending the month at a 16-year high of 4.57% (Chart 2). Supported by production cuts, the oil futures price spike intensified concerns about rising gasoline prices and their impact on consumer spending and inflation, reinforcing the higher for longer narrative. Irene Tunkel, chief US strategist at BCA Research, saw the increase in oil prices, bond yields, and the US dollar as a “triple whammy for US equities” in September. With the 10-year Treasury yield at a long-term peak, investors have become less enthusiastic about stocks as high rates should slow growth and impact corporate earnings.

The Australian Dollar hit a low of US63¢ in late September and shows no signs of abating as the US Fed is expected to maintain the funds rate (which is well above Australia’s cash rate) following its decision to hold rates as inflation dropped to 3.7% year-on-year in August. China’s slowed retail spending, low corporate borrowing, and below 50 PMI (Purchasing Managers Index is an index of the prevailing direction of economic trends in the manufacturing and services sectors) point to a weakened economy that may continue affecting the value of the Australian Dollar through lower exports. The Reserve Bank of Australia (RBA) is expected to hold rates at Bullock’s first meeting as governor. This comes as households are under increasing strain from high mortgage repayments and cost of living pressures, evidenced by tepid retail sales data that missed analyst forecasts last month.

Outlook for Australia

The Australian Dollar remains devalued as a result of China’s weak economy and the US Fed’s more aggressive rate hiking cycle. The weaker exchange rate presents a concern for imported inflation and the spike in oil spot and futures (Chart 3) has resulted in petrol prices soaring to $2.20 in Sydney by late September. AMP chief economist Shane Oliver said a 9% climb in petrol prices last month will be a significant driver of the inflation print and September quarter figures due for release on October 25. Oliver, however, believes the RBA will likely brush this off as an anomaly related to a months-long campaign by Saudi Arabia and Russia to cut oil’s global supply and put upward pressure on prices.

“There has been a bit of a reassessment over the past few weeks that inflation’s going to be stickier and central banks will have to keep their policy rates higher for longer to get inflation out of the system” said Paul Bloxham, chief economist for HSBC in Australia and New Zealand. This aligns with Australia’s monthly CPI climbing by 5.2% in the year to August, accelerating from a 4.9% gain in July. Higher housing and transport-related expenses through rising rents and petrol prices were the main contributors to inflation, although the spike in oil prices could prove to be transitory. The CPI rise does not represent an automatic trigger for the RBA to raise rates as it will closely watch September quarter inflation figures with more volatile CPI components stripped out (such as fuel and food) to determine if further rate hikes will be necessary. Most economists expect the cash rate to remain unchanged at the next board meeting and for the RBA to wait for quarterly inflationary data and jobs figures to come through with the possibility of one final hike by mid next year.

Portfolio Positioning

The September Effect this year lived up to its reputation with a substantial fall across global equity markets in conjunction with another hike in global 10-year bond yields. This was spurred by investors bracing for the prospect of “higher for longer” interest rates. It is crucial to stress the importance of remaining invested through the cycle, as short-term volatility is to be expected, and maintaining a robust investment framework can help mitigate the downside risks to portfolios.

Following a quarterly portfolio review, LBP has opted for a more defensive positioning with a moderate underweighting to equities and other growth assets, and an increased allocation to private debt, fixed income, and cash for dry powder should attractive opportunities arise. This is in line with BCA’s third quarter 2023 Strategy Outlook that concluded it expects to downgrade equities to underweight before the end of the year in favour of low risk fixed income assets, as it is no longer worth chasing the rally.

Fixed income markets have undergone structural changes over the past year, with yields reset at much higher levels. This creates an opportunity to invest in high income assets that have a lower risk relative to equities. Private debt markets are also experiencing structural tailwinds through positive supply-demand dynamics, driven by regulatory changes resulting in major banks significantly reducing exposure to middle market financing.

While inflation remains elevated, and markets continue to exhibit volatility, we maintain an allocation to real assets and alternative investments to diversify portfolios. Given that the Australian Dollar is currently undervalued, it may present an opportunity to increase AUD hedging in your portfolio to capture the upside when the currency does strengthen. LBP reiterates that the main focus should be on long-term objectives and capital preservation as time has shown that the greatest threat to wealth tends to come from being underinvested in the long term rather than remaining invested through short-term volatility.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.