Equities markets experienced a rebound in October following broader weakness in the preceding months. In developed markets, the MSCI World Index bounced 7.17% in local currency terms. In emerging markets, however, a stark reaction to President Xi Jinping’s third term confirmation and commitment to China’s covid-zero policy translated to weakness in Chinese equities. This weighed on the MSCI Emerging Markets Index, which fell 2.61%. Domestically, the impact of higher interest rates drove strong gains for the major banks, which helped the ASX 200 jump 6.04%.

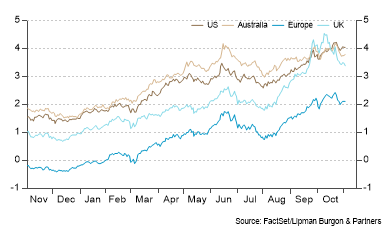

In fixed income markets, commitment from global central banks to do ‘whatever it takes’ to stamp out inflation saw bond yields continue upward (Chart 2). The yield on the 10-Year US Treasury is now 4.07%, 28 basis points higher than when the month began. In Australia, however, the RBA’s decision to slow the pace of rate hikes saw the Australian 10-Year Government Bond yield decline 13 basis points to 3.76%. Amid higher interest rates in the US and widening rates differential with Australia, demand for the US dollar climbed. This kept the AUD relative to the USD subdued at USD$0.64.

Are we at peak macro?

The Ukrainian crisis, hawkish global central banks, and China’s zero-covid policy have been the major forces driving share prices for the better part of a year. Sensitivity to these factors has principally informed market valuations, with fundamentals and earnings largely taking a back seat. These types of global events can broadly be categorised as macro, that is, where investments are influenced by global economic trends.

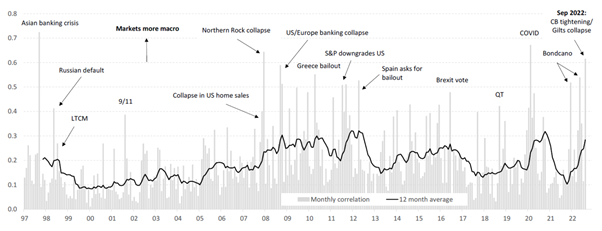

In this type of market, selling patterns tend to be correlated. There is some sector rotation in markets such as oil and commodities (that are also macro-driven), but stocks in those categories also tend to move in tandem. One measure of the impact of macro forces is the correlation between stocks. As Chart 3 highlights, during September, the intra-market correlation of the ASX 200 was the fourth highest in over 25 years.

Source: Refinitiv, Factset, MST Marquee

These market conditions can provide opportunities for macro traders (if they get their calls right) but is generally a difficult environment to invest in as fundamentals are less important and volatility typically prevails. When considering the market drivers, there are some key takeaways to keep in mind.

As options trader and author of The Black Swan, Nassim Taleb, explains, a successful trader has only marginally higher than a 50% probability of getting a trade call correct. It is a difficult and very low-probability game forecasting macro movements. Given this, it makes sense that rational investors should focus less on the macro and short-term outcomes and more on long-term objectives. Strategic asset allocation and sufficient diversification will drive the bulk of portfolio performance outcomes in the long run. A healthy rebalancing discipline will ensure portfolio risks are not overly concentrated.

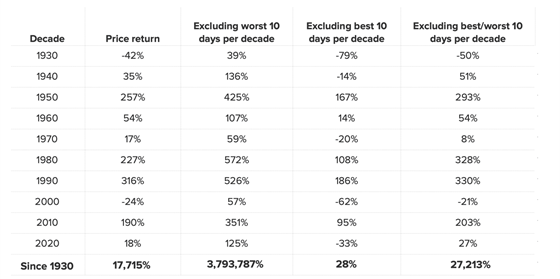

We also know that over the long term, the stock market odds are stacked in investors’ favour. The key is to remain invested. However, this is also the challenge. As table 1 below highlights, missing the 10 best days in the S&P500 would dilute a cumulative 17,715% return since 1930 to a mere 28%. However, it is almost impossible to pick ex-ante when those days will occur. The only way to guarantee you don’t miss them is not to sell into market drawdowns and remain invested.

Source: Bank of America, S&P 500 returns

Building Resilient Portfolios in an Uncertain World

Last week, our investment team attended JP Morgan’s 2022 Global Research Summit in Singapore. The theme of the conference was ‘Building Resilient Portfolios in an Uncertain World’, which was very much alive and well through the keynote presentations. From a markets strategy perspective, geopolitics and the move to a multipolar world, decelerating economic activity and likely contraction in the US, and central banks’ commitment to taming inflation have bifurcated financial markets.

Uncertainty remains; however, investment opportunities that exploit these conditions are evolving, most notably:

- Inflation across the globe is likely to remain elevated for some time. Real Assets across Real Estate, Infrastructure, Transport, Wind and Solar are one avenue to protect against inflation in portfolios. These assets can also help diversify portfolios and produce valuable income streams.

- Given the race to eliminate carbon emissions, with 40% of the world’s largest companies committing to net zero, there is a growing demand for secondary carbon credit markets. Timber and Forestry assets offer an access point with a low correlation to traditional markets. Carbon credits can be earnt, which can be retired to offset existing carbon emissions or sold to increase yield. It is also estimated that $1.8 trillion of annual investment in technology is required to help meet the emissions targets, creating an opportunity in the growth equity space for climate technology businesses.

- Companies are staying private longer. The average age of companies at IPO has increased from 4 to 12 years over the last 30 years, allowing for greater opportunity for financing debt and equity for private businesses.

- Pension funds with historically high allocations to private assets have become heavily overweight, given the sell-off in public markets. These funds also have strict asset allocation policies and will have to approach the secondary market to sell private assets amid portfolio rebalancing. This creates attractive opportunities in the secondary market for private equity and debt.

- In the era of ‘easy money’, a plethora of debt has been financed with light covenants at low interest rates. This debt will need to be refinanced in a slowing economy with reduced liquidity. This will likely provide great opportunities for skilled credit managers and special situations debt managers.

Portfolio positioning

Across our portfolios, we continue to advocate a cautious positioning with a neutral weight to equities. While equity valuations have fallen, now more in line with long-term averages, short-term volatility is expected to persist amid higher rates, decelerating economic activity and negative sentiment.

Fixed interest investments have seen a stark repricing in the year-to-date in response to tightening monetary policy. With yields considerably higher than they were a year ago, we feel the asset class offers better downside protection and higher income levels, which justify greater exposure.

Since most loans are now tied to floating rates, private debt provides an attractive spread and benefits from rising interest rates.

Real assets such as real estate, infrastructure, timberland and transportation continue to provide investors with both inflation protection, income and diversification.

We continue to recommend that clients remain invested yet maintain some cash outside their portfolio, giving them dry powder in the event exceptional opportunities present. In times of market volatility, it is important to have a robust investment framework and focus on long-term objectives.

If you would like to discuss the positioning of your portfolio, we encourage you to reach out to your Adviser.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.