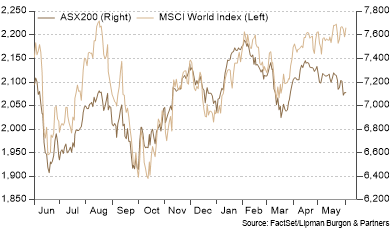

Equity markets posted mixed results in May as concerns regarding the US debt ceiling offset AI-driven optimism in certain pockets of the market. The MSCI World Index finished the month flat, retreating a modest 0.14%. Australian equities underperformed global peers, with the ASX 200 declining 2.53% (Chart 1). In the US, the S&P 500 posted a moderate 0.43% gain, while the Nasdaq surged 5.93%, supported by AI-driven optimism.

Fixed Income markets were heavily influenced by the federal debt crisis in the US, with bond yields increasing over the month. The yield on US 10-Year Treasury bonds rose 19 basis points to 3.64%, and similarly, the yield on Australian 10-Year Government bonds increased 26 basis points to 3.60% (Chart 2). Bond yields are a function of bond prices, and bond prices are a function of supply and demand. As the probability of default on US Government securities increased, there has been less demand from investors (as these securities were perceived as being ‘riskier’). As a result, supply outstripped the demand and bond prices declined while yields increased. As with most markets, what occurs in the US causes reverberations around other markets and geographies, given its size and importance to the global economy.

What Happened with the US Debt Ceiling?

In what can be characterised as political drama for drama’s sake, the federal debt crisis generated an enormous volume of headlines during the month. On 12 May, in an interview with Bloomberg, Treasury Secretary Janet Yellen noted that the federal government would have to renege on some obligations if it didn’t raise the debt ceiling. Concerningly, no plan was outlined at the time on how the department would proceed. Yellen later informed Congress that the Treasury would not be able to pay all of its obligations on time if Congress did not raise the debt limit by June 5. This caused an outsized level of media coverage, stoking fear that the US would default on its financial obligations, impairing its coveted AAA credit rating and likely sending markets into a tailspin.

Fast forward to 28 May, President Biden and House Speaker McCarthy announced an agreement on the “Fiscal Responsibility Act”. This suspends the debt limit until 2025, alleviating political pressure that could have prevented the deal from coming together. The deal has since passed both the House of Representatives and the Senate, confirming that the US has avoided default for now.

AI-Driven Rally

This year, the S&P 500 has returned a positive 9.69%, while the equally weighted Index (removing the market-cap bias in the index construction) is flat. Even more stark, the Nasdaq is 24% higher year-to-date (Chart 3) as investors piled into companies that stand to benefit from the emergence of AI technology.

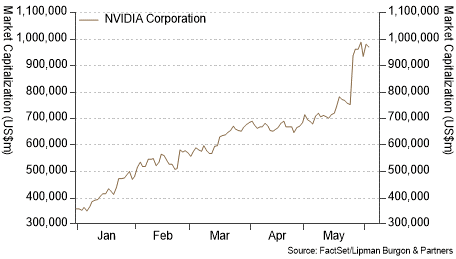

The release of ChatGPT has initiated the modern ‘gold rush’, attracting frenzied investment as companies consider how to integrate AI into their business models and investors seek to capture potential future profits. This culminated with Nvidia Corp.’s (the company that manufactures chips needed for AI computing tasks) extraordinarily bullish forecast for surging revenue of US$11bn in Q2, almost $4bn ahead of wall street’s expectations, propelling the market value of the company to almost US$1 Trillion (Chart 4).

These market movements remind us of the concentration risk currently embedded in market-capitalisation-weighted indices and the need for diversification. Investors can strike the right balance between retaining exposure to the best global companies while minimising the potential risks of index concentration through a targeted core-satellite approach to portfolio construction. This includes combining core building blocks through low-cost, low tracking-error, broad market exposure with high-conviction active satellite strategies with high active share.

Portfolio positioning

We maintain our neutral positioning to stocks and bonds within portfolios as we see symmetric risks to markets. While better-than-expected earnings growth, diminished bank stresses, and the prospects of an AI-driven productivity boom have scope to push stock prices higher over the short term, we feel that risks remain elevated given a sanguine view of global growth driven by rising base rates and tighter bank lending which we expect to translate to higher unemployment.

Real Assets such as infrastructure, real estate, and transportation can improve portfolio diversification and provide a degree of inflation protection. Alternative investments, including private markets and hedge funds, can also improve portfolio diversification.

Private debt markets are still experiencing several structural tailwinds. Positive supply/demand dynamics, driven by regulatory changes, have resulted in major banks significantly reducing exposure to these types of financing. The ongoing volatile markets have resulted in rising base rates, increased spread and Original Issue Discount (OID), enhanced terms and documentation, and lower leverage levels. Within the asset class, we are aware of an increase in ‘covenant lite’ loans, as competition for capital has increased over the past decade. We aim to invest in high-quality loans with lower LVRs, shorter duration, secured against real assets or sustainable cash flows, and strong covenant protection. We prefer managers with in-depth work-out capabilities that can step in should any loans experience stress.

History has taught us that for well-diversified investors, the greatest threat to real wealth tends not to come from being invested through periods of short-term volatility but from being under-investors over the long term. Thus, we believe it is important to maintain a robust investment framework and remain invested through the cycle.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.