Equity markets posted mostly modest gains in April, largely driven by company results reported during the US earnings season to date outpacing expectations. In developed markets, the MSCI World Index climbed 1.65%. Australian equities performed in line with global peers, with the ASX 200 moving 1.85% higher (Chart 1). In the US, the S&P 500 was up 1.56%, while the tech-heavy Nasdaq finished the month largely unchanged.

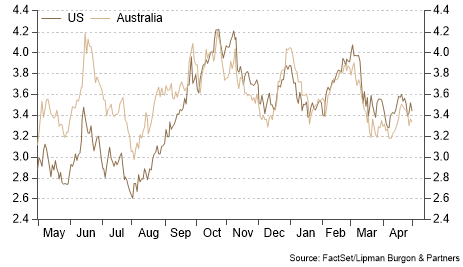

Activity in fixed income markets was muted despite many factors in motion. This is mainly because many market participants are biding their time ahead of additional information or guidance from central banks regarding the direction of monetary policy. Bond yields were largely unchanged, with the Australian 10-Year Government Bond 4bps higher and US 10-Year Treasury yield 5bps lower to 3.34% and 3.45%, respectively (Chart 2).

What are earnings reports telling us?

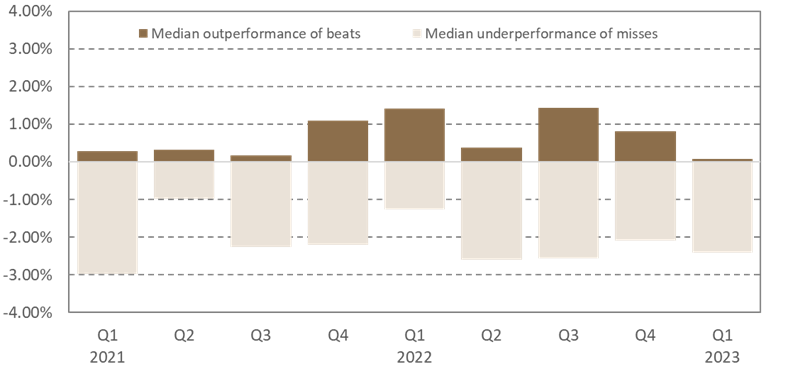

To date, over 50% of S&P 500 companies have reported their Q1 results. At a high level, the blended growth rate is currently -3.7% year-over-year, slightly better than the -6.7% expected decline. Beat rates are also above historic averages, with 79% of reporting companies surpassing consensus EPS estimates. Despite elevated beat rates, the median outperformance of companies is just 0.08% (Chart 3). This likely reflects subdued guidance and concerns of delayed declines in earnings amid the impact of higher inflation and higher interest rates on performance.

Bank earnings have been in the spotlight following the sectors’ recent instability. The major banks reported strong results, with JPMorgan, Citigroup, Wells Fargo and Bank of America all benefiting from the rising interest rate environment. Among the regional banks, the key focus has been on deposit flows as investors parse for further signs of stress. Despite troubling news from First Republic Bank, other regional banks like Truist Financial Corp. and Fifth Third Bancorp. reported largely stable deposits. At the same time, Western Alliance Bancorp announced that deposits had jumped US$2.9bn between March and April, sending the share price 24% higher.

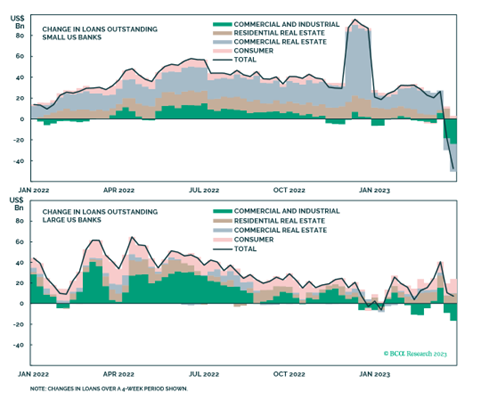

While stabilising deposits have meant that the probability of further bank runs is mitigated, a moderate tightening of credit will create a drag on growth. Large banks have reported that they have not materially tightened lending standards. However, many regional banks are signalling a current or planned reduction in lending. Weekly data from the Federal Reserve through to 29 March is consistent with this commentary, suggesting that while changes in lending within large banks are modestly positive, small banks have experienced a contraction (Chart 4).

Goldman Sachs has estimated the impact of tightening credit will reduce 2023 GDP growth by 0.4%, a moderate but not recessionary drag on growth.

Easing Inflation Cools RBA’s Outlook on Interest Rates

Headline CPI rose 1.38% in Q1 2023, representing a deceleration in the annual rate to 7.0% year-over-year from a peak of 7.8% in December 2022 (Chart 5). Easing inflation momentum was in part driven by softer prices for durable goods and fuel, which offset stickier services inflation driven by higher prices for holiday travel, medical services, rents, and financial services.

Trimmed mean CPI, a measure of underlying inflation and a key metric that the RBA monitors slowed by more than expected in Q1. The data broadly supports the view that the RBA will keep rates on hold when it next meets on Tuesday to further assess the impact of prior tightening.

However, inflation in absolute terms remains far too high. The RBA has emphasised that the April pause did not mean tightening had ended. Still elevated wage growth and persistently sticky services inflation will likely force the RBA to resume hiking later this year.

Portfolio positioning

The US earnings season thus far has alleviated concerns about continued deposit outflows from the banks. The ongoing moderation of inflation could provide further short-term support for equities as central banks get closer to a peak in interest rates. That said, we believe a cautious positioning, with a neutral allocation to equities, is warranted. The outlook on corporate earnings is currently muted, and valuations are not overly cheap, particularly within the US (Chart 6).

Fixed Income markets have undergone structural changes over the past year, leading to a reset of yields at much higher levels. While bond yields may rise from here, mounting evidence suggests that disinflation has begun, increasing the probability that rate hikes will end sooner than later. Given the current favourable yields and elevated economic uncertainty, we feel comfortable allocating to traditional duration in portfolios with a neutral allocation to Fixed Income.

Real Assets such as infrastructure, real estate, and transportation can improve portfolio diversification and provide a degree of inflation protection. Alternative investments, including private markets and hedge funds, can also enhance portfolio diversification.

Private debt markets are still experiencing several structural tailwinds. Positive fundamentals, driven by regulatory changes, have resulted in major banks significantly reducing exposure to these types of financing. Ongoing market volatility has resulted in rising base rates, increased spread, Original Issue Discount (OID), enhanced terms and documentation, and lower leverage levels. Within the asset class, we are aware of an increase in ‘covenant lite’ loans, as competition for capital has increased over the past decade. We aim to invest in high-quality loans with lower LVRs, shorter duration, secured against real assets or sustainable cash flows, and strong covenant protection. We prefer managers with in-depth work-out capabilities that can step in should any loans experience stress.

History has taught us that for well-diversified investors, the greatest threat to real wealth tends not to come from being invested through periods of short-term volatility but from being under-invested over the long term. Thus, we believe it is important to maintain a robust investment framework and remain invested through the cycle.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.