Global equities finished the month lower as investors focused on the Fed’s message from the annual Jackson Hole symposium, where officials reiterated their hawkish stance and commitment to fighting inflation.

In the U.S., nonfarm payrolls grew by a stronger-than-expected 315,000 in August, down from 526,000 in July. Professional and business services, health care, and retail trade drove most of the job gains. Meanwhile, the unemployment rate ticked up from 3.5% to 3.7%. While the report’s details were somewhat mixed, the takeaway is that the labour market is still running hot. Even after accounting for August’s slower pace of growth, payroll employment growth is still running at four times this level. Overall, labour market conditions remain robust and should keep the Fed on its tightening path. Although price pressures have started easing, inflation remains significantly above the Fed’s target.

In developed markets, the MSCI World Index declined 3.42% over the month. European equities led global declines, with the Euro Stoxx 600 falling 5%, as Europe’s worsening energy crisis exacerbated concerns about the economy that is already facing high inflation and a wave of monetary tightening. The local market was a relative outperformer, with the ASX 200 finishing the month up 1.18%.

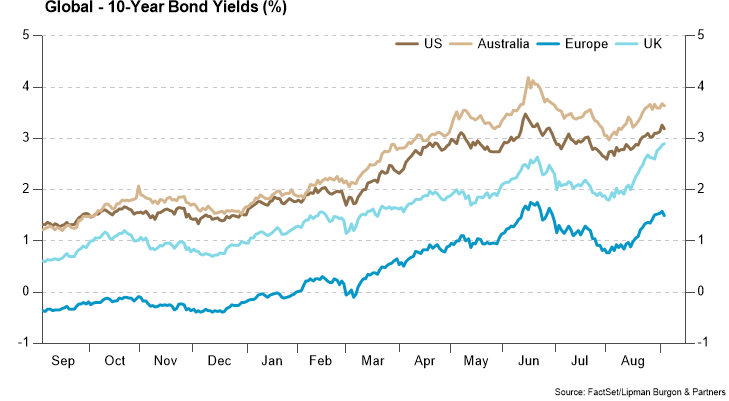

Bond yields increased in August, led by hawkish messaging from global central banks. In the U.S., the 10-Year Treasury Bond yield moved 49bps to 3.13%. The Australian 10-Year Government Bond yield also rose in anticipation of further rate hikes, finishing the month at 3.60%.

The implications of Jackson Hole

Jackson Hole, a valley and wilderness recreation area in western Wyoming, is known for its proximity to Grand Teton National Park and Yellowstone National Park. It is also known for the annual economic policy symposium hosted by the Federal Reserve Bank of Kansas City. Each year dozens of central bankers, policymakers, academics, and economists from around the world convene to discuss economic issues, implications and policy options. The annual address from the Fed’s chair is often watched closely, and this year was no exception. So, what was the market reaction and the likely implications of this year’s speech?

First, despite the big stock market selloff, which gathered strength after the address, the speech didn’t significantly impact the expectations of the Fed’s likely rate path. By the end of the day, the market was pricing in a 64% chance of a 75-basis point rate hike at the September 21st FOMC meeting. The market is still expecting rates to be between 3.50% and 3.75% by the end of the year, then one more rate hike to 3.75%-4.00% in early 2023. The expectation is then for two rate cuts later in 2023 to a range of 3.25% to 3.50%.

Second, on inflation, the August CPI report due out on September 13th should be mild, with a possible month-over-month decline in headline consumer prices. This could reduce the market odds of aggressive Fed action. However, like other communications from Fed officials in recent months, Chairman Powell’s speech suggested that they regret letting inflation get out of hand. Overall, the Fed appears determined to act tough on inflation. Because of this, the easiest path for the Fed could be to maintain some doubt about whether they might raise rates by 50 or 75 basis points in September, then boost rates by 75 basis points on September 21st, thereby bolstering their hawkish credentials. At the same time, in their statement and press conference, note that there is better news on inflation and signal that a smaller move was likely in November (+50 basis points). They could follow this with a 25-basis point move in December. This would take rates from 3.75% to 4.00% by the end of this year. The Fed could then stop hiking rates and hope the economy will avoid recession, allowing them to maintain both higher rates and the current quantitative tightening program.

Finally, while it is likely that inflation will continue a gradual decline, it is a very close call on whether a recession will occur. The potential for a positive real GDP growth number to be printed for Q3 and a negative number for Q4 may mean the economy teeters on the edge of a recession over the next year until covid-related drags have faded.

For investors, this suggests the potential for volatility in the short term. However, it is also important to consider the economic environment over the next few years. This will be an environment of fading fiscal stimulus that will crimp consumption, higher mortgage rates impacting housing, slow profit growth constraining CAPEX and a high dollar and overseas weakness hurting exports. This will very likely mean slow economic growth and sliding inflation.

In addition, when the public becomes more fearful of recession than inflation, the Fed will likely slowly return to the more accommodative policy it maintained in the decade following the Global Financial Crisis (GFC). This should provide a positive backdrop for both stocks and bonds. However, any surge in volatility between now and then could lead to an even greater investor focus on defensive positioning and valuations. This could favour long-duration bonds, value stocks and income-generating alternatives over more growth-oriented investments.

Australia set for more rate hikes

All but two economists surveyed by Bloomberg predict that the Reserve Bank of Australia (“RBA”) will likely raise its overnight cash rate target by a half-percentage point to 2.35% on the 6th of September.

Like their global counterparts, Australian policymakers are striving to prevent inflation from escalating further. Consumer-price growth in the second quarter was 6.1%, double the upper end of the RBA’s 2-3% target, and is expected to peak at just under 8% late this year. A combination of pandemic-induced stimulus and unemployment of just 3.4% has led to a significant increase in household spending. Retail sales surged 1.3% in July and, together with high export prices are expected to fuel the expansion further.

Economists predict that gross domestic product will rise circa 1% in the three months through June from the prior quarter and 3.5% from a year earlier. On the flip side, the property market is slowing on the back of RBA’s 1.75 points of hikes in the four months since May, when the cash rate stood at 0.1%. House prices fell in August at the fastest pace since 1983. The concern is the downturn will reverberate through the A$2.2 trillion economy, with local households among the world’s most indebted. Generally, RBA rate hikes take about two to three months to flow through to households. That suggests consumers are only now feeling the hit from the initial rate rise. While roughly a third of mortgages are on fixed terms, insulating them from tightening, most market participants expect retail spending and consumption to begin showing signs of weakness by the end of 2022.

Portfolio positioning

We continue to advocate a cautious portfolio positioning with a neutral weight to global equities. However, equities are now fairly valued, with multiples aligned to long-term averages. However, some further weakness on the back of higher rates, lower earnings and ongoing recessionary fears are plausible.

Fixed interest asset classes have seen both government bonds and credit yields increase in response to tightening monetary policy, as well as increasing chances of recession. At these levels, public fixed income is starting to look relatively more attractive and introducing some duration back into portfolios seems reasonable, while corporate credit should remain a resilient source of income.

Core real assets such as real estate, infrastructure, timberland and transportation should continue to provide investors with both inflation protection and income. We also remain positive on various alternative investments and private market opportunities for downside protection and diversification of return streams in portfolios. Although we acknowledge that some private markets investments are yet to see a revaluation of the underlying assets, in line with the public peers. Being selective and investing with high-grade managers remains a priority.

We continue to recommend that clients remain invested yet maintain some cash outside the portfolio, giving them dry powder when a better entry point into risk assets presents itself. In times of market volatility, it is important to have a robust investment framework and focus on long-term investment objectives. If you would like to discuss the positioning of your portfolios, we encourage you to reach out to your Lipman Burgon Adviser.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.