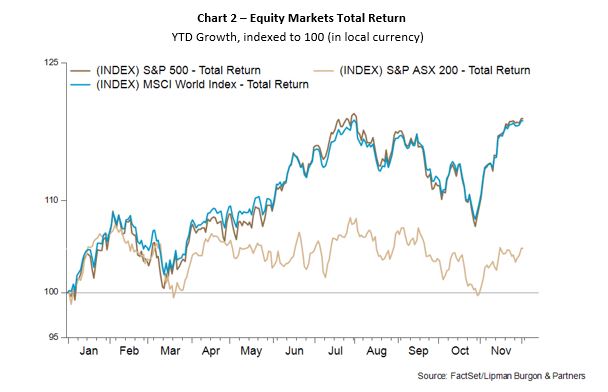

Global and domestic equities staged a rally in the month of November following a meaningful October fall. The S&P/ASX 200 rose 5.03% in November and is now up 4.81% YTD. Turning to global stocks, the MSCI World Index (a benchmark representative of developed market stock performance globally), rose 8.35% in November (up 18.76% YTD) while the S&P 500 and NASDAQ rose 9.13% and 10.83% respectively this month. Finally, despite the ongoing conflict in the Middle east and Russia’s invasion of Ukraine, the price of crude oil continued to abate in November, dropping to $83.0/barrel, and largely flat when compared to its start of year price of $83.3/barrel. This comes in spite of production cut announcements from OPEC Plus. As to what drove this month’s equity market rally, it was seemingly a capitulation of the “higher for longer” thematic amongst investors that had been pervasive throughout the prior month. Several factors were at play here, most notably a softening tone from the US Federal Reserve which appears to be leaning away from further rate hikes (dovish) and lower than expected inflation figures in the US. This resulted in a 54 basis point (bp) fall in the US 10-year bond yield, and a 52bp drop in the Australian 10-year bond yield in November (Chart 1).

However, we caution investors from reading too much into the short-term gyrations of markets when making investment decisions. For example, even with perfect foresight of the starting and ending yields in 2023 so far, investors would have been hard-pressed to benefit from that information alone. Namely, despite the November rout in bond yields, both Australian and US ten-year yields are up in this year (by 36bp and 48bp respectively). Despite the adage that “when yields rise, stocks fall”, most major country equity indices are up meaningfully over the same period (Chart 2). This outcome is more surprising still when considering unexpected events such as the conflict in Gaza which “should” have been negative for risk assets.

No change expected in December RBA Meeting

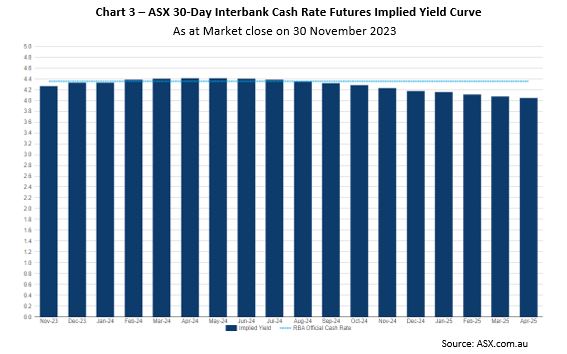

The October inflation figures surprised investors to the downside, rising 4.9% compared to a prior higher-than-expected 5.6% rise in the September quarter. This brings the Australian inflation narrative closer in-line with the US one, with markets now pricing in almost no chance of a December rate hike following the November increase to 4.35%. ASX 30-day Interbank cash rate futures positioning also implies a low chance of rate hikes in 2024, indicating that traders believe the RBA has, or is close to having, finished its rate hiking cycle (Chart 3).

Meanwhile, the Australian Dollar ended November at US66¢, rallying 4.7¢ on the back of the Fed’s more dovish stance on rates and Australia’s comparatively higher inflation situation. Investors expect Australian interest rates to maintain or increase their positive differential above US interest rates. This makes the Australian Dollar relatively more attractive (all other things equal) than the US Dollar, increasing demand for the currency and therefore strengthening the AUD vs USD exchange rate.

Portfolio Positioning

Markets appear to have (for now) capitulated on the “higher for longer” narrative with expectations shifting towards expectations of a softer landing once again. This stark shift further illustrates the importance of applying a robust investment framework and remaining invested through the cycle, as short-term volatility is to be expected. Investors do not always behave rationally, which can cause markets to often overreact to news, both good and bad. This is why it is crucial to emphasise long-term portfolio goals over short-term market movements.

LBP maintains its defensive positioning with a moderate underweighting to equities and other growth assets, and an increased allocation to private debt, fixed income, and cash for dry powder should attractive opportunities arise. LBP will be holding its last Investment Committee meeting of the year in December and will look to review whether this positioning remains appropriate in the current environment. In particular, BCA’s recent research indicates they now expect equities to remain attractive in the short term but remain bearish on the global economy and risk assets, particularly in the latter half of 2024. Underpinning this conservative outlook is BCA’s view that job openings in the US will reduce in the second half of next year, which would result in increasing unemployment – BCA notes that unemployment changes have a certain momentum, and that this rise in US unemployment could lead to lower demand and eventually negative GDP growth leading to a shallow recession.

Fixed income markets have undergone structural changes over the past year, with yields reset at much higher levels. This creates an opportunity to invest in high income assets that have a lower risk relative to equities. In fact, early data from some of our fixed income managers point to a meaningful pay-off from this type of positioning following the November fall in rates. Private debt markets continue to experience structural tailwinds through positive supply-demand dynamics, driven by regulatory changes resulting in major banks significantly reducing exposure to middle market financing.

We continue to maintain an allocation to real assets and alternative investments to diversify portfolios. Given the still-weak Australian Dollar, maintaining exposure to hedging may be appropriate in your portfolio to protect against a rising AUD in your international holdings. LBP reiterates that the main focus should be on long-term objectives and capital preservation as time has shown that the greatest threat to wealth tends to come from being underinvested in the long term rather than remaining invested through short-term volatility.

We encourage you to contact us should you wish to discuss this further or if you have any questions about how these trends are impacting your portfolio.

This article has been prepared by Lipman Burgon & Partners AFSL No. 234972 for information purposes only; is not a recommendation or endorsement to acquire any interest in a financial product and, does not otherwise constitute advice. By its nature, it does not take your personal objectives, financial situation or needs into account. While we use all reasonable attempts to ensure its accuracy and completeness, to the extent permitted by law, we make no warranty regarding this information. The information is subject to change without notice and all content is subject to the website terms of use.